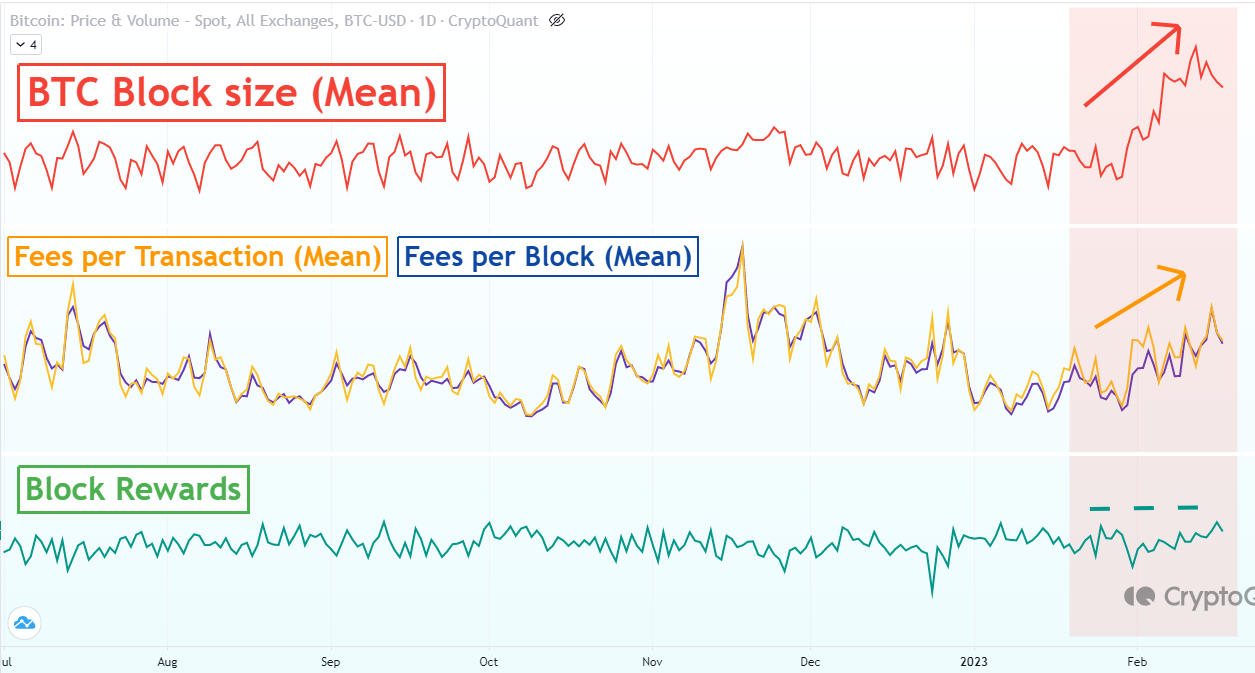

Bitcoin Ordinals: While the Bitcoin halving is taken into account the most important occasion within the cryptocurrency’s life cycle, the onset of Bitcoin primarily based NFTs may doubtlessly go on to change into the following largest improvement. Primarily, Bitcoin was to this point seen as a layer 1 blockchain with its use case being peer to see transactions. With the approaching of Non Fungible Tokens (NFTs) on Bitcoin layer itself, there could possibly be a paradigm shift in the best way miners function, going ahead. On chain information reveals that the imply miner transaction charge per block rose in parallel with the adoption of Ordinals.

Also Read: Polygon (MATIC) Set To Reach New Record, Bullish Ahead Of zkEVM?

As a layer 1 blockchain, Bitcoin had the excellence of sustaining an ordinary peer to see community. However, the blockchain community was disadvantaged of use instances like NFT assist. Hence, contemplating its reliability and stability as a regulator-friendly blockchain, Bitcoin provides extra which means to the Ordinals challenge. The adoption is clearly seen as miners rake beneficial properties from elevated transaction charges because of the NFT exercise on chain.

Bitcoin NFTs With Ordinal Theory

The Ordinals project rose to prominence as NFT transactions on Bitcoin community doesn’t require a separate blockchain layer or adjustments to the Bitcoin community. For the aim of retailer of worth, these transactions additionally don’t go along with some other cryptocurrency however Bitcoin itself. The protocol was powered by two comfortable fork upgrades — Segregated Witness and Taproot.

As per Crypto Quant data, a transparent rise in Bitcoin block dimension and miner charges per transaction was clearly affected by means of Ordinals NFTs. Overall, there’s growing interest in the Bitcoin NFTs.

Also Read: Will Bitcoin Price Rally Above Key 200-WMA Level? Or It’s A “Bull Trap”

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.