Ethereum worth has lastly recorded some pullback after a 40% rally in January, giving buyers a chance to purchase ETH at decrease ranges. The ETH worth hit a excessive of $1,674 final Saturday and fell beneath $1,550 at present because of profit-taking by merchants because the rally had no important pullback.

While buyers speculate whether or not that is the most effective degree to purchase Ethereum, crypto analyst Michael van de Poppe believes there’s extra to it.

Ethereum (ETH) Price Can Fall To $1,450

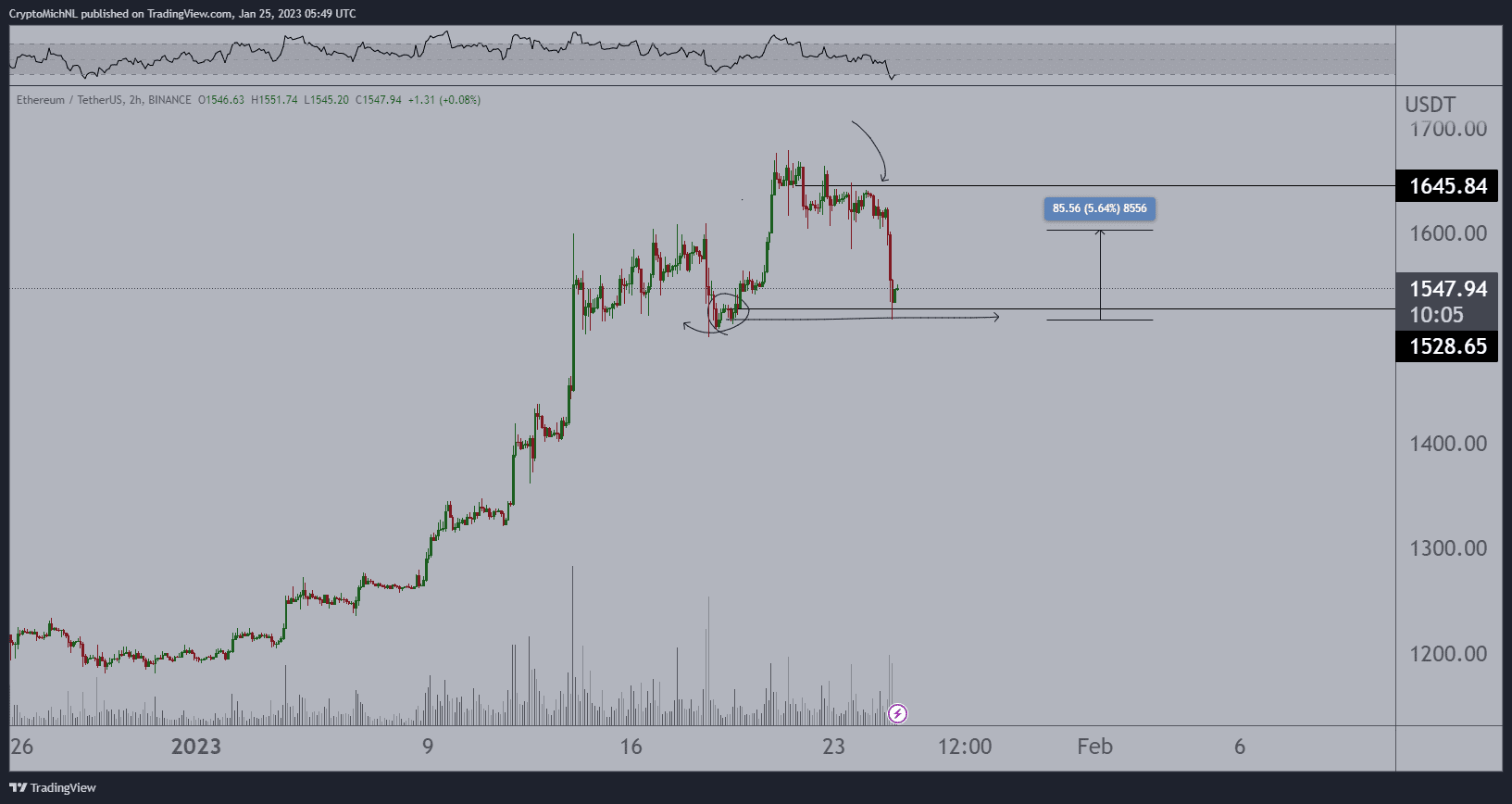

Popular crypto analyst Michael van de Poppe in a tweet on January 25 predicts an extra fall within the Ethereum worth to close $1,450. He believes Ethereum worth could witness some rebound from the essential assist degree of $1,550, however the precise bounce for one more rally will come solely from under the essential assist degree.

“Some slow grind upwards and then one more sweep in the coming days and the correction should be over and we’ll continue the party.”

Ethereum (ETH) worth fell almost 5% within the final 24 hours to hit a low of $1,530. Profit reserving by merchants and selloff by whales have been the first causes behind the latest fall in ETH costs.

According to Whale Alert data, a whale dumped 24,768 ETH value $38 million to crypto exchange Coinbase at present. Whales had transferred ETH value virtually $200 million to crypto exchanges and liquidity swimming pools in the previous few days.

On-chain information by Santiment confirms profit-taking transactions since Ethereum hit a excessive of $1,674. The Ethereum Ratio of Daily On-Chain Transaction Volume in Profit to Loss jumps larger on January 20 indicating an increase in profit-taking transactions.

Moreover, the social dominance of Ethereum has hit its highest worth since July final yr after the worth drop, indicating merchants in search of a “buy the dip” alternative.

Ethereum Price Shows Slight Recovery

Ethereum (ETH) worth fell over 5% within the final 24 hours, with the worth presently buying and selling at $1,553. The 24-hour high and low are $1,530 and $1,637, respectively. Furthermore, the buying and selling quantity elevated by 14% after the autumn, indicating a slight enhance in curiosity amongst merchants.

However, ETH worth will stay beneath strain till the U.S. Federal Reserve‘s fee hike choice on February 1 and the fourth-quarter GDP information due on Thursday.

Also Read: Reasons Why Bitcoin (BTC) Price Rally Is Likely Over

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.