On-chain knowledge exhibits the Binance USD (BUSD) trade reserves have declined lately, an element that could be behind Bitcoin’s slowdown.

Binance USD (BUSD) Exchange Reserves Have Gone Down

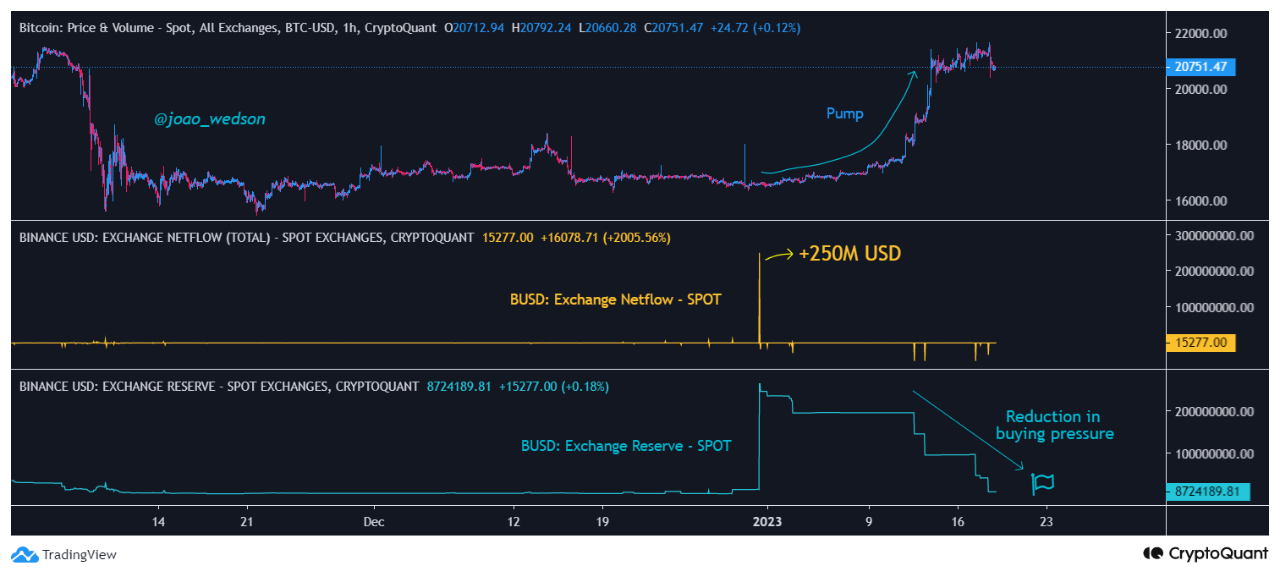

As identified by an analyst in a CryptoQuant post, there was a really massive influx of $250 million BUSD only a whereas in the past. The “exchange reserve” is an indicator that measures the full quantity of a cryptocurrency (which, within the current case, is Binance USD) presently being saved on wallets of centralized exchanges.

Generally, traders swap their cash for stablecoins like BUSD once they need to keep away from the volatility related to different cryptocurrencies like Bitcoin. When these holders really feel that costs are proper to reenter the unstable markets, they shift their stables again into their desired cash. This can act as shopping for stress for the precise crypto that they’re swapping into.

Investors often make use of exchanges to swap these cash, which signifies that every time the trade reserve of a stablecoin like BUSD rises, it presents the likelihood that holders need to purchase again into unstable cryptocurrencies. A big sufficient enhance within the stablecoin reserve can lead to a excessive quantity of shopping for stress for different cash, and may subsequently have a bullish impact on their costs.

Now, here’s a chart that exhibits the pattern within the Binance USD trade reserve (particularly for spot exchanges) over the previous couple of months:

The worth of the metric appears to have been taking place in current days | Source: CryptoQuant

As you may see within the above graph, the Binance USD trade reserve noticed a speedy enhance some time again. Since then, nonetheless, the metric has been steadily declining and has hit considerably decrease values now.

But from the chart, it’s obvious that whereas the BUSD reserve was coming down from excessive values, Bitcoin had been rallying as an alternative. This signifies that holders may need been actively swapping the stablecoin for BTC, thus offering a lift to its worth.

The graph additionally shows knowledge for a metric referred to as the “exchange netflow,” which tells us the online variety of cash coming into or exiting trade wallets. When this metric has a constructive worth, it means traders are depositing a web quantity of the asset to exchanges presently, whereas adverse values counsel web withdrawals are going down.

Some time in the past, there was an enormous constructive spike within the Binance USD trade netflow of round $250 million (which is what brought on the reserve to explode). This influx might have been what helped the current BTC rally.

However, since then, there have solely been outflows, which have taken the reserve again to the identical stage as earlier than this $250 million spike. This suggests that purchasing stress from this influx has now dried up, which might be one of many elements liable for the most recent slowdown in Bitcoin’s rally.

BTC Price

At the time of writing, Bitcoin is buying and selling round $20,700, up 14% within the final week.

Bitcoin plunges down | Source: BTCUSD on TradingView

Featured picture from Nicholas Cappello on Unsplash.com, charts from TradingView.com, CryptoQuant.com