On-chain knowledge reveals Bitcoin miners could possibly be dumping proper now, an indication that would present an impedance to the rally.

Bitcoin Miners’ Position Index Has Shot Up Recently

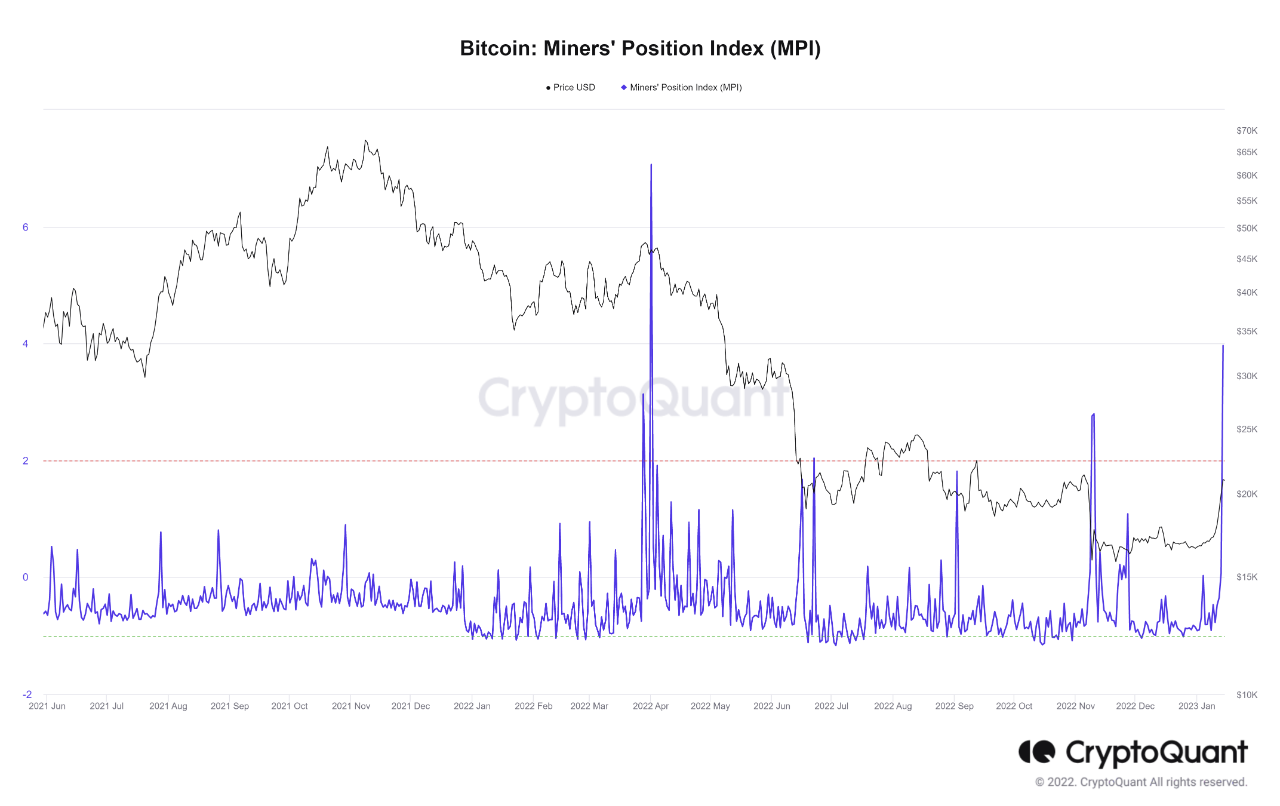

As identified by an analyst in a CryptoQuant post, miners could also be placing promoting stress available on the market at the moment. The related indicator right here is the “Miners’ Position Index” (MPI), which measures the ratio between the miner outflows and the 365-day shifting common of the identical.

The “miner outflows” confer with the whole quantity of Bitcoin that each one these chain validators are transferring out of their wallets in the mean time. Usually, miners withdraw cash from their reserves with the primary objective of promoting them. Thus, a excessive worth of the outflows can counsel that this cohort is dumping giant quantities proper now.

As the MPI compares these outflows with their yearly common, the metric’s worth can inform us how the present miner promoting is in contrast with the imply for the final 12 months.

When this indicator has a excessive worth, it means miners are promoting at a better diploma than standard at the moment, whereas the metric having a low worth might counsel there’s lesser promoting stress coming from these chain validators than the typical for the previous 12 months.

Now, here’s a chart that reveals the pattern within the Bitcoin MPI over the previous 12 months and a half:

The worth of the metric appears to have been fairly excessive in current days | Source: CryptoQuant

As proven within the above graph, the Bitcoin MPI has spiked up not too long ago and has hit a worth of about 4, the best stage that the indicator has noticed since April of final 12 months. The metric having such a big worth would counsel miners are taking out far more cash than standard, and are due to this fact probably placing extraordinary promoting stress available on the market at the moment.

From the chart, it’s obvious that spikes within the metric have often been adopted by declines within the value of the crypto. The most excessive instance was again in April 2022, when the worth noticed a really sharp drawdown not too lengthy after the metric recorded even larger values than now.

The final time the indicator noticed excessive values have been again throughout the collapse of the crypto exchange FTX when the worth as soon as once more noticed a speedy downward transfer.

Bitcoin has been busy rallying throughout the previous week or so, touching as excessive as $21,000 to date, so these elevated withdrawals proper now would counsel miners wish to benefit from this profit-taking alternative whereas they nonetheless can, and dump their cash.

If this cohort certainly intends to promote with these transfers, then the crypto’s rally might probably discover some impedance and briefly halt right here, if not outright reverse its route.

BTC Price

At the time of writing, Bitcoin is buying and selling round $20,800, up 20% within the final week.

The worth of the asset appears to be discovering it arduous to make a major break above $21,000 | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com