On-chain information exhibits the Bitcoin spot and spinoff alternate reserves have each shot up not too long ago, an indication that may very well be bearish for the value.

Bitcoin Spot And Derivative Reserves Register Growth

As identified by an analyst in a CryptoQuant post, the open curiosity and the funding charges are additionally heating up within the BTC market. The “exchange reserve” is an indicator that measures the whole quantity of Bitcoin that buyers are depositing into wallets of centralized exchanges proper now.

This metric has two variations; one is for the spot exchanges, whereas the opposite is for the spinoff platforms. Usually, buyers deposit to identify exchanges for promoting functions, so a rise within the reserves of those platforms can recommend promoting strain is rising available in the market.

And as holders use spinoff exchanges for opening positions on the futures market, an increase on this reserve can result in greater volatility (the impact on the value will be in both route).

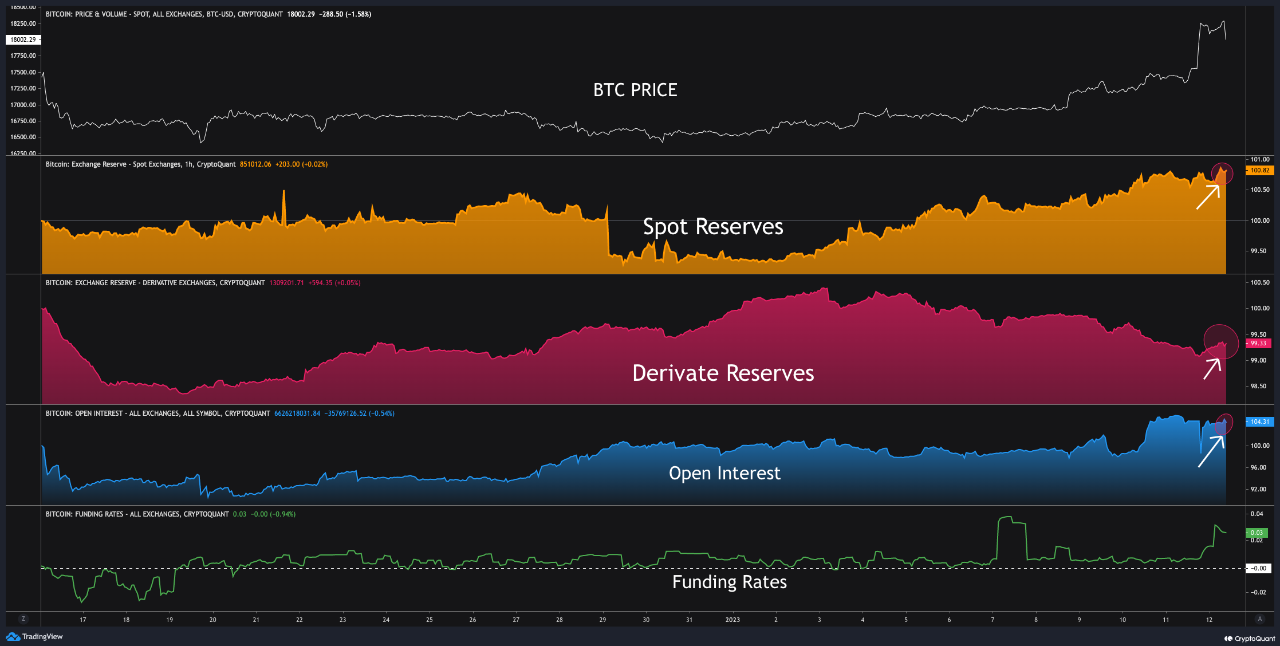

Now, here’s a chart that exhibits the pattern in these Bitcoin alternate reserves over the past month:

The values of all of the metrics appear to have seen an increase in latest days | Source: CryptoQuant

As displayed within the above graph, each the spot and spinoff alternate reserves have elevated in worth not too long ago, suggesting that buyers have been making deposits to those platforms. The elevated spot reserves recommend an elevated promoting strain available in the market, whereas the spinoff reserves suggest an overheated futures sector.

The chart additionally consists of information for 2 different metrics, the open curiosity, and the funding charges. The “open interest” is an indicator that measures the whole quantity of futures positions presently open on spinoff exchanges. This metric takes under consideration each quick and lengthy contracts.

The graph exhibits that this metric has additionally trended up not too long ago, additional suggesting that the futures market is presently overheated. The different indicator, the “funding rates,” tells us whether or not there are extra shorts or longs available in the market.

The Bitcoin funding charges are favorable now, implying that the longs are overwhelming the shorts. Generally, whichever approach this metric swing tells us which of those contract holders is extra prone to a liquidation squeeze.

So far, there hasn’t been any lengthy squeeze available in the market, however moderately a brief squeeze as the value has been capable of sustain the momentum. There have been some high liquidations through the previous day which will have helped calm the overheated futures marketplace for now, however since there may be elevated promoting strain on the spot exchanges, BTC continues to be in danger for a short-term pullback.

BTC Price

At the time of writing, BTC is buying and selling round $19,100, up 14% within the final week.

Looks like the worth of the crypto has surged in the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Thought Catalog on Unsplash.com, charts from TradingView.com, CryptoQuant.com