On-chain knowledge reveals Bitcoin is now retesting the price of manufacturing worth for miners, suggesting that this cohort could quickly lastly discover some reduction.

Bitcoin Miners Might Find Relief After A Period Of Immense Pressure

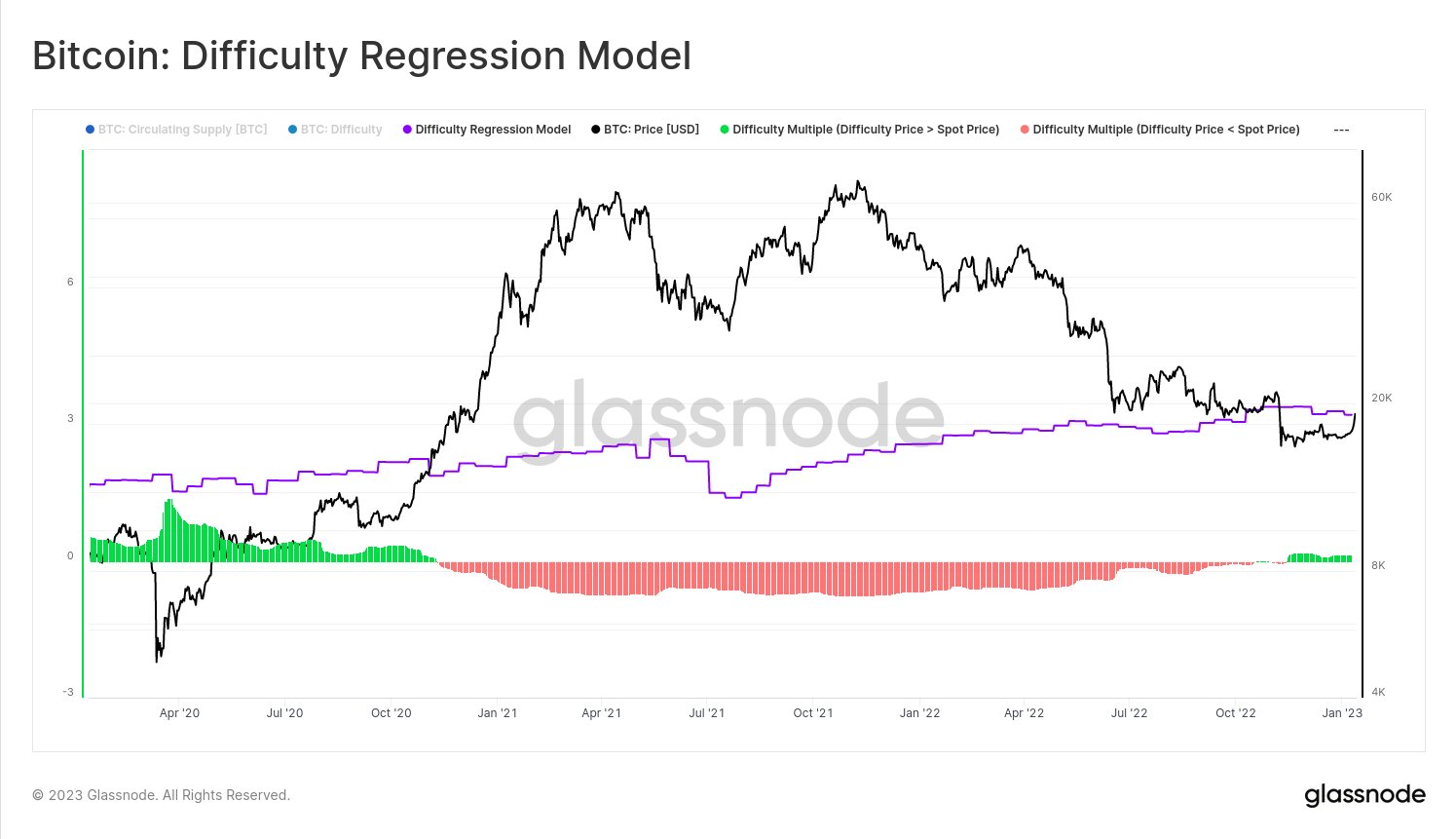

According to knowledge from the on-chain analytics agency Glassnode, the typical value of manufacturing for miners is now across the present worth ranges. The related indicator right here is the “difficulty regression model,” which is an estimation of the price of Bitcoin manufacturing that the typical miner incurs.

As the title already implies, this mannequin is predicated on the idea of “mining difficulty,” which is a built-in function on the BTC blockchain that decides how arduous miners might want to work with a purpose to efficiently mine a block on the community.

For this mannequin, Glassnode has made the idea that the problem is “the ultimate distillation of mining cost, accounting for all the mining variables into one number.”

To relate the problem with the market cap (so {that a} value of manufacturing “price” might be obtained from the metric), the mannequin makes use of a log-log regression evaluation.

Now, here’s a chart that reveals the pattern within the Bitcoin problem regression mannequin over the previous few years:

Looks like the value of the crypto has been approaching the metric in current days | Source: Glassnode on Twitter

As the above graph shows, the Bitcoin problem regression mannequin has a worth simply across the present BTC worth ranges proper now. This signifies that the price of mining 1 BTC that the typical miner has to pay in response to this mannequin is now about what the crypto itself is valued at.

The chart additionally consists of knowledge for the “difficulty multiple,” which is a metric that merely highlights the hole between the present worth of the coin and the problem regression mannequin. Negative values of the indicator recommend the value is larger than the price of manufacturing for miners proper now, whereas it’s decrease within the case of optimistic values.

From the graph, it’s obvious that the problem a number of has been optimistic since across the time of the FTX crash, which suggests that in this era of the final couple of months or so, the typical miner has been producing Bitcoin at a loss.

Miners had already been coming beneath immense strain earlier within the bear market resulting from a mess of things like the value plummeting and the electrical energy prices changing into larger, however this era because the downfall of FTX made their incomes even worse, resulting in a number of bankruptcies of main names within the sector corresponding to Core Scientific.

However, if the present worth retest of the problem regression mannequin stage is profitable and BTC breaks larger, miners would lastly be capable to get some reduction after what has been a very horrible run.

BTC Price

At the time of writing, Bitcoin is buying and selling round $18,900, up 13% within the final week.

The worth of the asset appears to have sharply surged in the previous few days | Source: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Glassnode.com