Data reveals Bitcoin whales have been inactive not too long ago as transactions of greater than $10 million now account for less than 19% of the full quantity.

Bitcoin Volume Dominance Of $10M+ Transfers Declines To 19%

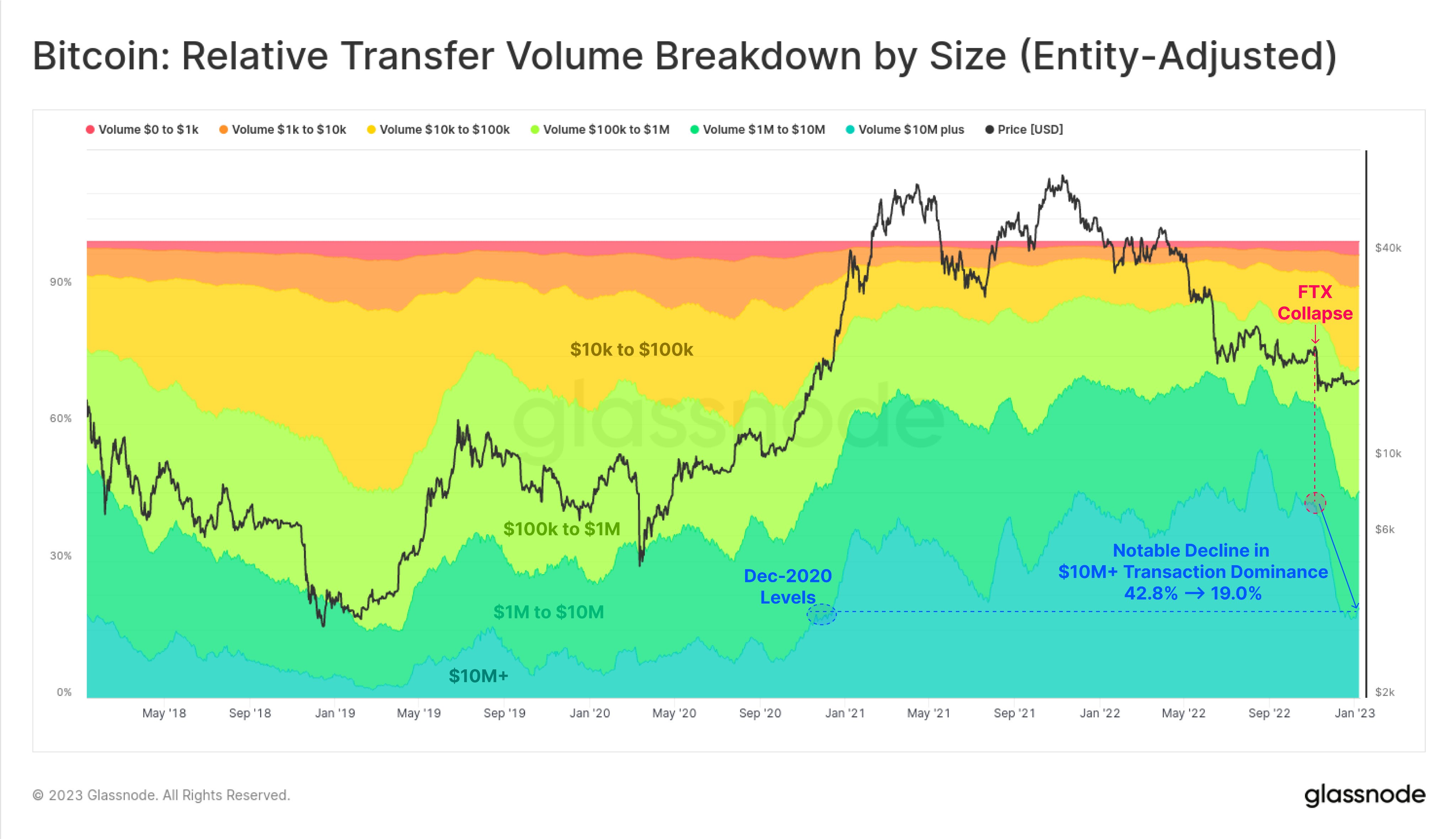

According to the on-chain analytics agency Glassnode, these giant transactions made up 42.8% of the complete BTC quantity again at first of November 2022. The “volume” right here refers back to the complete quantity of Bitcoin being transacted on the community on any given day.

The “relative transfer volume breakdown by size” (the indicator of relevance right here) tells us what a part of this BTC quantity is being contributed by the different-sized transaction teams available in the market.

These teams outline ranges between which the values of the transfers belonging to a given group lie. For instance, the $10,000-$100,000 group contains all transactions which are not less than $10,000 and at most $100,000 in worth.

Now, under is a chart that reveals the development within the Bitcoin relative switch quantity breakdown by measurement throughout the previous few years:

The dominance of every transaction group within the BTC market | Source: Glassnode on Twitter

As the above graph shows, the shares of the completely different transaction teams have shifted within the Bitcoin market not too long ago. More particularly, the dominance of the transaction group with transfers valued greater than $10 million (with no higher sure) has considerably fallen in current weeks.

Since solely the whales take care of transfers carrying such excessive quantities, this transaction group could also be used to trace the exercise of those humongous holders. Back through the begin of November final yr, the transaction dominance of this cohort was about 42.8%. However, since then, the proportion of the quantity being contributed by this group has fallen to simply 19%.

The indicator’s worth is now the identical as in December 2020, which suggests the metric has reset to pre-2021 bull run ranges now. Interestingly, this dramatic plunge within the dominance of the transactions of those whales got here proper after the collapse of the crypto exchange FTX came about. There could possibly be a few implications for this development.

The first could possibly be that these whales already exhausted their promoting urge for food through the FTX crash and are actually not occupied with promoting the coin. This would counsel that the current lows might have been the underside for this bear market. Back within the 2018-2019 bear market as nicely, this cohort’s dominance declined to low values because the cyclical lows had been attained.

However, one other factor this development implies is that these whales haven’t been shopping for not too long ago both. If they had been shopping for across the present lows, then there would nonetheless be important transaction exercise from them.

In the previous, bull runs have been fueled by these whales as their dominances have spiked throughout such durations. So, if the metric reveals any important enhancements within the quantity of those transactions, then Bitcoin might see a return of some bullish development. But for now, the exercise of this cohort continues to be muted.

BTC Price

At the time of writing, Bitcoin is buying and selling round $17,200, up 3% within the final week.

BTC surges up | Source: BTCUSD on TradingView

Featured picture from Gabriel Dizzi on Unsplash.com, charts from TradingView.com, Glassnode.com