On-chain knowledge exhibits a considerable amount of outdated Bitcoin provide has moved in the previous few days, one thing that might be bearish for the crypto’s value.

Bitcoin Supply Older Than 2 Years Showed Movement In The Past Week

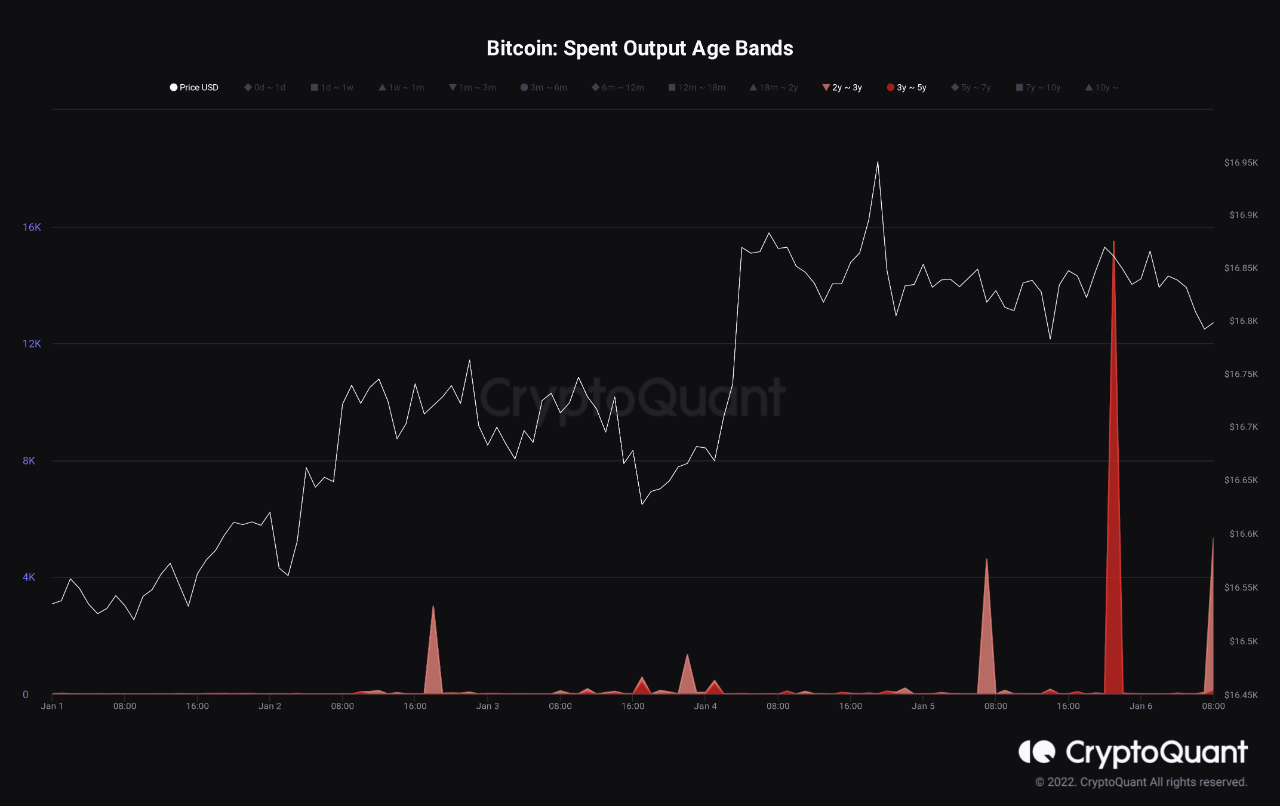

As identified by an analyst in a CryptoQuant post, a complete of 4 massive transfers with outdated provide have taken place within the final week. The related indicator right here is the “Spent Output Age Bands” (SOAB), which tells us the full variety of cash that every age band is shifting on the chain proper now.

The age bands refer to provide teams divided primarily based on the factors of the age of the cash (or extra exactly, of the UTXOs). For instance, the 1m-3m age band consists of all cash which were sitting dormant inside the identical addresses since at the very least 1 month in the past and at most 3 months in the past. The SOAB metric for this group would then measure the full variety of these cash which were transferred to a different pockets.

Now, the age bands of curiosity listed here are the 2y-3y and 3y-5y teams. Typically, traders which were holding their cash since greater than 155 days in the past are stated to be the “long-term holders” (LTHs), so each these bands embrace cash belonging to 2 completely different segments of the LTHs.

Also, it’s a statistical indisputable fact that the longer traders maintain onto their BTC, the much less possible they change into to promote at any level. This implies that the holders with such aged provide as in these bands can be a number of the most resolute HODLers available in the market.

Here is a chart that exhibits the SOAB knowledge for these two Bitcoin age bands over the previous week:

Looks like there have been a number of spikes on this metric in latest days | Source: CryptoQuant

As the above graph shows, there have been 4 massive actions of cash belonging to those cohorts in the previous few days. Three of those transfers have been from the 2y-3y age band, whereas one was from the 3y-5y group.

The spike from the latter cohort was considerably bigger than the others, amounting to greater than 15,000 BTC being moved. All the transfers from the 2y-3y age band mixed got here to virtually 13,000 BTC, which continues to be lower than the 3y-5y group’s transactions.

Generally, massive actions of such outdated Bitcoin provide is an indication of dumping from the LTHs, and if it’s the case right here as effectively, then it will imply that the present market broke these so-called diamond hands into promoting.

The quant notes that these transfers have been at the very least not headed in direction of exchanges, which does cut back the chance of those transactions being for promoting functions (however clearly doesn’t remove the probabilities, as these traders might simply have been promoting by way of OTC offers).

Regardless of that, nevertheless, the analyst cautions, “it is very surprising to see FOUR of these transactions in one week. It is definitely worth watching in the next period.”

BTC Price

At the time of writing, Bitcoin is buying and selling round $16,700, up 1% within the final week.

BTC appears to be persevering with its sideways pattern | Source: BTCUSD on TradingView

Featured picture from Janko Ferlič on Unsplash.com, charts from TradingView.com, CryptoQuant.com