Key Takeaways

- Crypto change Huobi is reportedly shedding 20% of its workforce and has requested staff take their salaries in stablecoins

- Internal communication has reportedly been suspended in an effort to quell discontent

- Customers are pulling their funds from the change, whereas quantity is down 23%

- Its native token has fallen 10%. Reports had beforehand singled out Huobi because the change which depends probably the most on its native token to denominate its reserves

- While there is no such thing as a concrete proof of something untoward occurring with buyer reserves, traders would be sensible to withdraw the funds till the mud settles, given what else has transpired within the crypto trade during the last yr

It’s groundhog day in crypto. Yet one other centralised crypto exchange is coming one other hearth, this time Huobi.

What is occurring Huobi?

Chinese crypto entrepreneur Justin Sun, who’s the founding father of cryptocurrency Tron and likewise sits on Huobi’s board, introduced that the change was to put off about 20% of its workforce.

Further experiences claimed that along with a dramatic discount of the workforce, staff had been required to take their salaries in stablecoins, whereas inside communication channels had been shut in an effort to quell discontent.

While the story continues to be rising, that is clearly…not good. Many ominous screenshots of staff making an attempt to get into techniques and talk with each other had been being shared throughout Twitter. Reports emerged, understandably, that staff had been enraged that should they refuse to just accept their salaries in stablecoins, they’d be dismissed.

Justin Sun’s HR is speaking with all Huobi staff to vary the wage type from fiat forex to USDT/USDC; staff who can’t settle for it could be dismissed. The transfer sparked protests from some staff. Exclusive https://t.co/QB4sjDyHc7

— Wu Blockchain (@WuBlockchain) January 4, 2023

Funds go away Huobi swiftly

The market waited no time in reacting. While there is no such thing as a confirmed proof of something mistaken with Huobi’s reserves or solvency, it has been a tough yr for crypto traders and the demise of FTX and Sam Bankman-Fried is all-too-raw for therefore many.

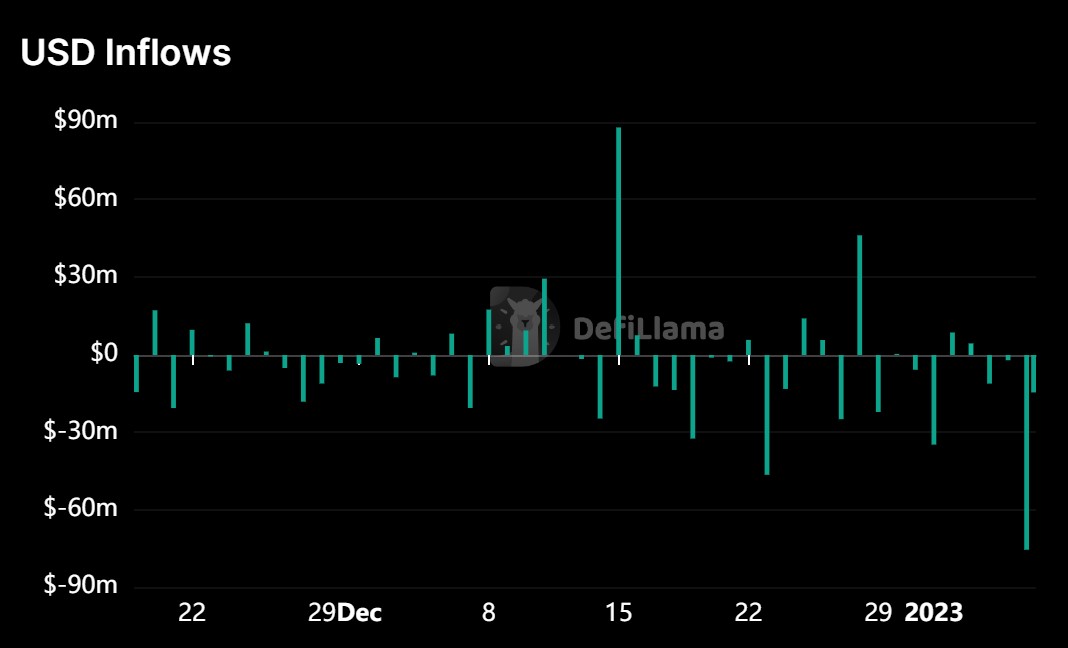

As a consequence, funds had been pulled swiftly from Huobi. The beneath chart from DefiLlama exhibits the USD outflows selecting up. Since December 15th, when it obtained $87.9 million in USD inflows, there was over $200 million of outflows. $75.1 million of those outflows has been I the final 24 hours.

During the final 24 hours, quantity on the change can also be down 23% to $295 million from $510 million.

Huobi’s change token can also be feeling the ache. Crypto traders will be significantly delicate to those native tokens, given FTT’s function within the FTX collapse and the truth that it has change into more and more apparent that so many merely serve minimal function.

The Huobi token has halved since late October. It is down over 10% within the final 24 hours or so for the reason that story of Huobi layoffs emerged.

Is Huobi secure to carry property on?

While drama about layoffs, worker discontent and falls in quantity is regarding, this should not have any impact on the protection of Huobi. At least, in idea it shouldn’t. But that is crypto, and if this yr has taught us something, it’s that issues are sometimes not as they seem.

As I’ve written about repeatedly, transparency is abhorrent in relation to these centralised crypto gamers. There is just no option to know for certain what’s going on behind the scenes at any of them.

The presence of an change token additionally muddies the water. Is this token being accepted as collateral for liabilities? Again, there is no such thing as a proof to recommend it’s, however there may be additionally no proof to recommend it isn’t.

Looking at knowledge from blockchain analytics platform Nansen, Huobi’s native token makes up 32% of its complete allocation, whereas Justin Sun’s TRX token includes a further 17%. A report from CryptoQuant additionally exhibits that of all of the exchanges, Huobi depends probably the most by itself token to denominate its reserves.

Again, whereas there is no such thing as a proof to recommend something untoward is occurring right here, the affect of a local token positively muddies the water.

Customers making proper name in withdrawing funds

With the doubt on the platform and the latest chaos within the crypto trade final yr, it makes excellent sense that customers are pulling their funds. Similar to how such a big chunk of funds were pulled from exchanges within the wake of the FTX collapse, that is merely sound danger administration.

If Huobi is completely secure and all returns to regular – and once more, there may be nothing concrete to recommend it gained’t – then customers can merely deposit their funds again onto the platform. But that is an unregulated, opaque entity that’s inconceivable to make any form of monetary evaluation on. That means it’s a danger, and with all of the insanity of the final 24 hours, it could be a questionable transfer from a danger administration perspective to not no less than quickly pull funds and wait till the mud settles.