The prime crypto predictions for January are that the Ethereum (ETH) worth will outperform Bitcoin (BTC), the Bitcoin Dominance Rate (BTCD) will fall, and Solana (SOL) shall be one of many largest losers.

Ethereum Price Will Outperform Bitcoin

The ETH/BTC pair broke out from a descending resistance line (white) on July 27 and reached a excessive of ₿0.086 on Sept. 7. Afterward, it returned to validate it as help on Sept. 22 (inexperienced icon).

Since the validation, the Ethereum price has traded inside a symmetrical triangle, thought-about a impartial sample. However, because it transpires after an upward motion, a breakout from it might be the more than likely situation. A breakout touring the complete triangle’s top would result in a excessive close to ₿0.094.

There are two different readings that help the opportunity of a breakout.

Firstly, the ETH worth bounced on the 0.5 Fib retracement help stage at ₿0.067, creating an extended decrease wick within the course of (inexperienced circle). As lengthy as it’s buying and selling above the 0.5 Fib retracement help stage, the development might be thought-about bullish.

Secondly, the motion contained in the triangle resembles a accomplished, complicated W-X-Y correction (black). If so, a breakout from the triangle can be the more than likely situation.

However, the each day RSI continues to be bearish because it failed to interrupt out from a descending resistance line and was rejected by the 50 line.

As a end result, whether or not the ETH worth breaks out from the triangle or closes under the ₿0.057 space will decide the ETH crypto prediction for January.

The Bitcoin Dominance Rate Will Fall

The BTCD is closely affected by the actions of ETH, for the reason that latter is the most important altcoin primarily based on its market cap. However, it additionally strikes by adjustments in the remainder of the crypto market.

The BTCD worth motion is presently contained inside an ascending parallel channel. Such channels normally include corrective actions, that means {that a} breakdown from it might be the more than likely situation.

Next, the channel’s resistance line coincides with the 0.382 Fib retracement resistance stage, growing its legitimacy. Then, the motion contained in the channel resembles an A-B-C corrective construction.

Finally, the each day RSI is overbought (crimson circle). The earlier time this occurred, a pointy downward motion adopted.

If the BTCD breaks down from the channel, it might fall towards its all-time low at 36%. Conversely, a breakout above the channel’s resistance line would point out that the development is bullish as a substitute.

Therefore, if the motion transpires, this crypto prediction can be bullish for many of the crypto market aside from Bitcoin. Since the Bitcoin worth is mired in a bear market, it’s also doable for the BTC worth to fall whereas altcoins fell by a smaller share.

SOL Price Will Be a Massive Loser

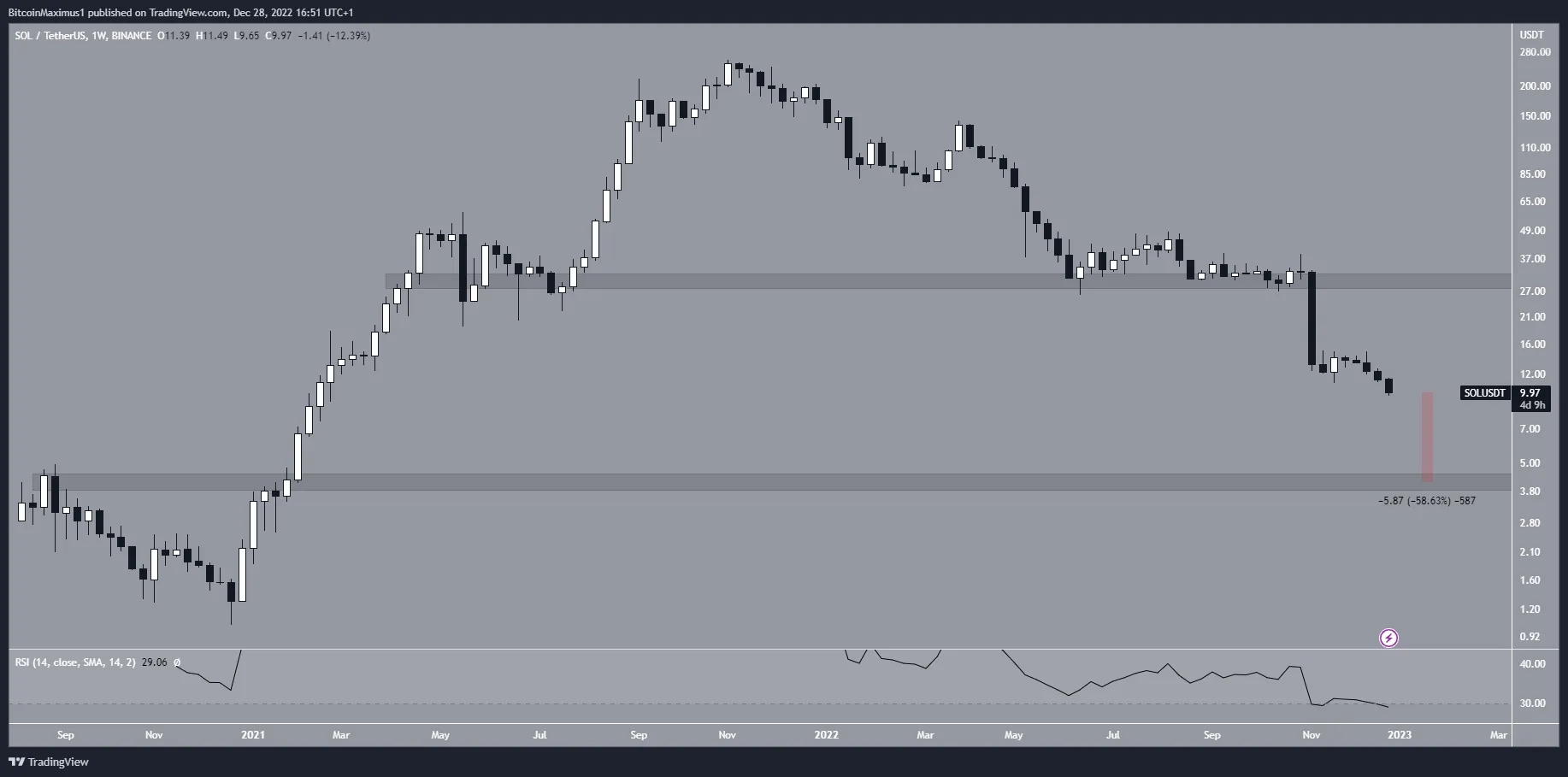

The SOL token worth has fallen since reaching an all-time excessive of $259.90 in Nov. 2021. The downward motion led to a low of $9.65 in Dec. 28. During the downward development, the Solana price fell under the long-term $29 help space and the short-term $12 help space. The lower additional accelerated over the previous 24 hours.

The first decisive bearish signal is that the closest help space is at $4.30, a lower of 58.6% from the present signal. Because there is no such thing as a help in any respect between the present worth and the $4.30 help space, it might be doable for the SOL price to achieve it by the tip of January.

The second decisive bearish signal is that the weekly RSI has fallen under 30 and is lowering, with out producing a hint of bullish divergence.

As a end result, the more than likely SOL crypto prediction is a downward motion towards this space. In order for the long-term development to be bullish, the Solana worth must reclaim the $29 resistance space.

For BeInCrypto’s newest crypto market evaluation, click here.

Disclaimer

BeInCrypto strives to offer correct and up-to-date info, but it surely is not going to be chargeable for any lacking details or inaccurate info. You comply and perceive that you need to use any of this info at your personal threat. Cryptocurrencies are extremely risky monetary property, so analysis and make your personal monetary selections.