On-chain knowledge reveals the buying and selling curiosity of whales in Bitcoin is now at its lowest level in round two years.

Bitcoin Whale Transaction Count Has Declined Recently

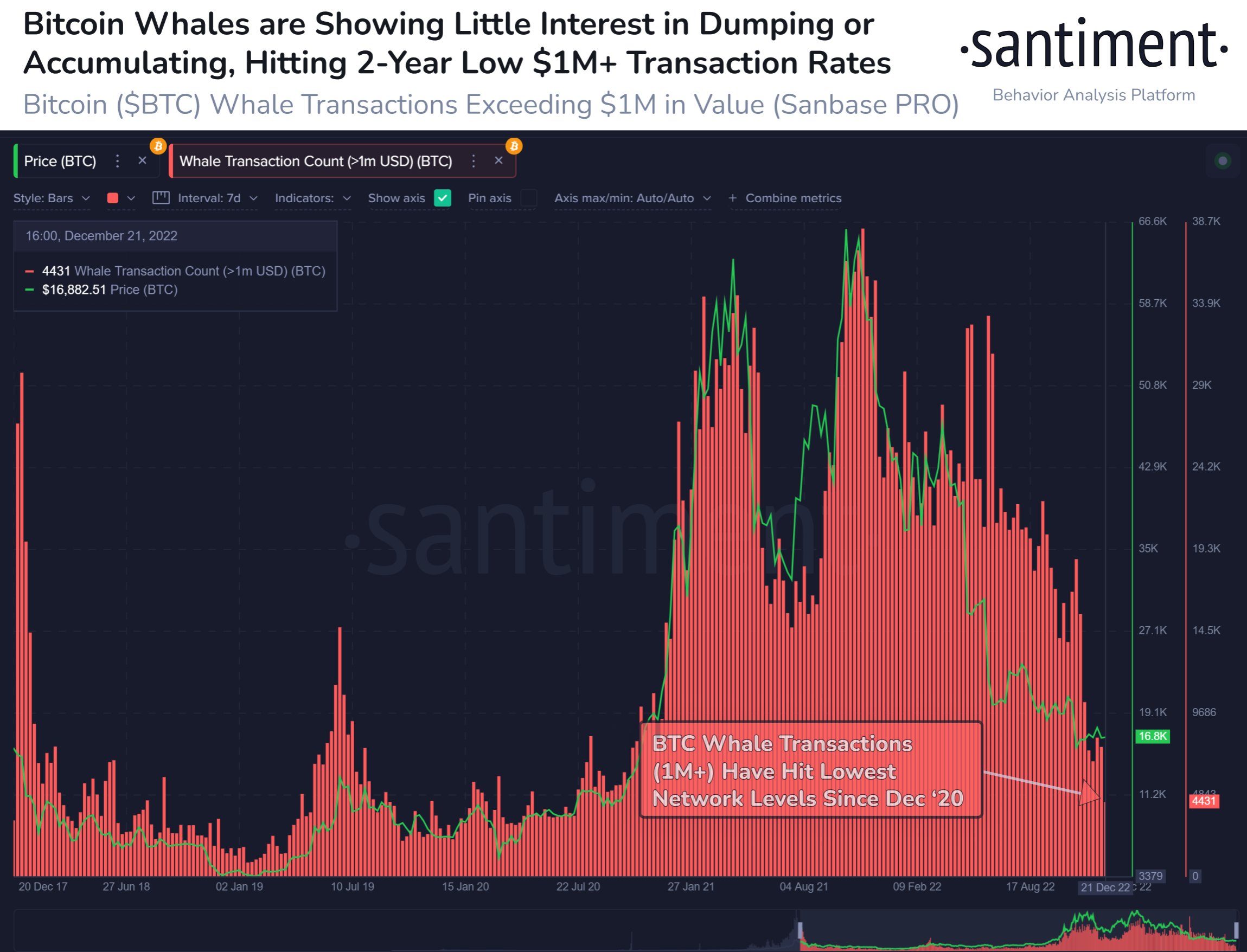

According to knowledge from on-chain analytics agency Santiment, the transactions being performed on the community by whales have slowed down not too long ago. The related indicator right here is the “whale transaction count,” which measures the entire variety of Bitcoin transfers going down on the chain on any given day, which can be valued at $1 million or extra.

When the worth of this indicator is excessive, it means there are numerous large actions taking place out there proper now, suggesting that whales are actively buying and selling. On the opposite hand, low values counsel these humongous holders aren’t making many strikes in the mean time.

Now, here’s a chart that reveals the development within the Bitcoin whale transaction depend over the past 5 years or so:

Looks like the worth of the metric has hit fairly low factors in current days | Source: Santiment

As the above graph shows, the Bitcoin whale transaction depend has trended down because the bear market has develop into longer. The indicator has now reached fairly low ranges relative to the common for 2021 and 2022, and actually, the present values are the bottom since December 2020.

This signifies that whales are exhibiting little curiosity in buying and selling BTC in the mean time. While which means that these buyers aren’t including any vital promoting strain proper now, it additionally implies that they haven’t been accumulating a lot both. This is the explanation why the cryptocurrency’s value has been caught in countless consolidation recently.

Santiment factors out {that a} sturdy correlation between the whale transaction depend and the Bitcoin worth has traditionally existed, as is seen within the chart. Bull runs have usually seen very excessive exercise from this cohort, whereas bears have seen a slowdown just like the one being noticed at the moment.

Interestingly, durations of bearish traits have usually reversed when the whale transaction depend has spiked up at factors when the value has been happening. Such exercise suggests curiosity is again from this cohort to commerce the crypto, and the ensuing accumulation takes the value up.

There have been some spikes within the metric not too long ago as properly, however they’ve usually coincided with uplifts within the value. Thus, they had been doubtless due to distribution (and never accumulation). Now it stays to be seen when the whales return to buying and selling the coin in full pressure and trigger a bullish reversal within the value.

BTC Price

At the time of writing, Bitcoin’s price floats round $16,600, down 1% within the final week. Over the previous month, the crypto has gained 1% in worth.

The beneath chart reveals the development within the value of the coin over the past 5 days.

The worth of the crypto appears to have noticed some decline prior to now day | Source: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, Santiment.web