MATIC has had a rollercoaster of a 12 months. Its value has fluctuated between cycle peaks and cycle lows year-to-date however has seen some good recoveries as properly. However, because the week attracts to an in depth, MATIC dove off its $0.9 cliff, and investor profitability has plummeted proper together with it.

MATIC Loses 5.6% In 24 Hours

Over the final 24 hours, the worth of MATIC is already down greater than 5.6%, based on knowledge from TradingView. The digital asset which had been capable of keep its $0.9 stage for the previous couple of weeks had finally succumbed and drifted down.

By the time the markets opened for buying and selling on Friday, MATIC had already touched its 24-hour low of $0.84 earlier than marking a small restoration again above $0.85. Its 5.6% decline coincided with a broader decline within the crypto market, which implies it wasn’t an remoted incident for the token.

It adopted the likes of Ethereum (ETH) and Binance Coin (BNB), each of which had recorded greater than 5% losses in the identical time interval. Volume was additionally down throughout the area with MATIC seeing an 18% decline in quantity.

Price trending at $0.85 | Source: MATICUSD on TradingView.com

The digital asset additionally misplaced about $300 million from its market cap. Nevertheless, it retains its place because the tenth largest cryptocurrency within the area, sitting proper behind Cardano (ADA) which was down virtually 5% in the identical 24-hour interval.

Profitability Drops Drastically

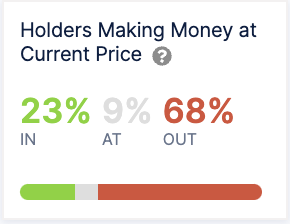

An offshoot of the current decline in MATIC value has been the drop in profitability for buyers who maintain the token. Data from IntoTheBlock exhibits that presently, solely 23% of all wallets holding the cryptocurrency are recording a revenue.

The overwhelming majority of holders, accounting for 68% of all wallets, are seeing losses. The remaining 9% are sitting within the impartial territory, placing them proper on the value that they bought their cash for.

Only 23% of holders in revenue | Source: IntoTheBlock

Interestingly, not like Bitcoin and Dogecoin, MATIC has a decrease composition of long-term holders which might present a cause for such low-profit percentages. Only 33% have held their cash for a couple of 12 months, whereas 57% have held them between one and 12 months, and 10% have solely had their cash for lower than one month. However, additionally it is necessary to notice that MATIC’s 70% decline from its all-time excessive value of $2.90 in December 2021 performs an enormous position on this.

MATIC was exchanging arms at $5.11 on the time of this writing, down virtually 8% during the last seven days.

Featured picture from Capital.com, chart from TradingView.com