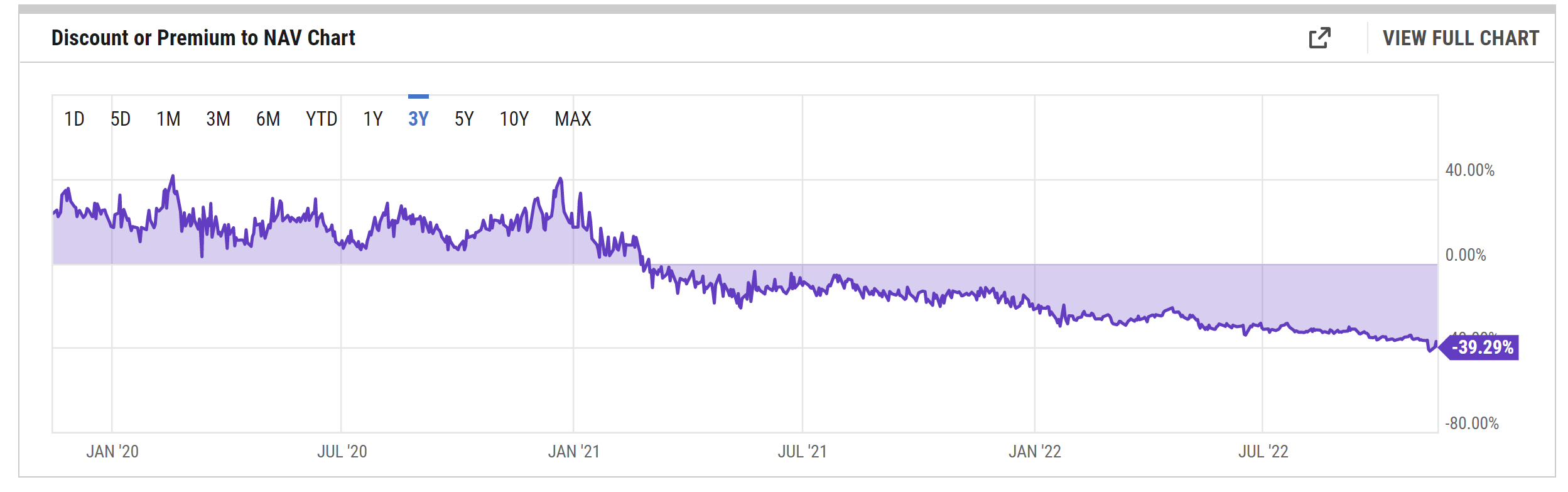

The FTX Contagion results don’t even cease on the largest institutional Bitcoin product available on the market, the Grayscale Bitcoin Trust (GBTC). As a results of the chapter of Sam Bankman-Fried’s crypto alternate, the low cost to the NAV of Grayscale’s GBTC fund has fallen to round -40%.

As not too long ago as the top of 2020, GBTC was buying and selling at a premium of +40%. However, in January 2021, the pattern reversal occurred when Grayscale’s Bitcoin fund traded at a reduction for the primary time. Since then, GBTC has been on a downward slide.

GBTC’s largest house owners embrace Cathie Wood’s ARK Invest (0.85%), Horizon Kinetics (0.34%), Simplify Asset Management (0.06%) Systelligence (0.04%), Parkwood (0.04%), Emerald Mutual Fund (0.03%) and Rothschild Investment (0.01%), in keeping with CNN Business.

Doomsday for Bitcoin

Recent occasions have led Grayscale Bitcoin Trust to turn out to be doubtlessly the only largest danger to the Bitcoin market. As NewsBTC reported, Genesis Global needed to pause all withdrawals for its lending enterprise on Wednesday attributable to “unprecedented market turmoil.”

This is regarding for the Grayscale Bitcoin Trust in that Genesis Global served because the liquidity supplier for the belief. Genesis Global’s mum or dad firm is Digital Currency Group (DCG). This in flip can also be the mum or dad firm of Grayscale.

Shortly after the Genesis announcement, Digital Currency Group clarified that the matter would don’t have any influence by itself enterprise. DCG acknowledged that Genesis isn’t a service supplier “for any” Grayscale product.

Furthermore, the corporate asserted that it doesn’t lend, borrow, or pledge Bitcoin, and that its custodian – Coinbase – is prohibited from participating in such actions. In addition, SEC and OTC markets experiences and audited monetary statements are filed.

Grayscale merchandise proceed to function enterprise as common, and up to date occasions have had no influence on product operations.

The belongings underlying $GBTC and all Grayscale merchandise stay protected and safe, held in segregated wallets in deep chilly storage by our custodian Coinbase .

Still, the neighborhood is bellyaching. A dissolution of GBTC may imply Armageddon for Bitcoin. The collapse of Terra Luna, then again, would have been enjoyable.

The Grayscale Bitcoin Trust at the moment holds 634,000 BTC. The Terra Luna Foundation “only” liquidated 80,000 Bitcoins, and nonetheless managed to crash the BTC worth from $40,000 to $20,000.

As Ryan Selkis reported, DCG is in a liquidity squeeze. “Appears holding company’s (DCG) liquid assets are below liabilities. As a result, it looks like DCG is looking to raise outside funding”. However, this tweet is now deleted.

The Bitcoin neighborhood is now demanding proof that Grayscale really holds roughly 634,000 BTC in reserve at Brian Armstrong’s Coinbase. However, neither Grayscale nor Coinbase have proven any response to date.

All that’s at the moment out there is a CSV file that’s up to date day by day. As analyst Dylan LeClair defined, it must be comparatively possible to provide a proof of reserves if all BTCs are held at Coinbase.

Does anybody know of the addresses for the 630k BTC in $GBTC? Are there some type of proof of reserves and if no, why?

We have a completely clear public ledger so we are able to audit these things.

All I can discover is a CSV file that updates day by day. Why not publish the addresses?

— Dylan LeClair ???? (@DylanLeClair_) November 17, 2022

But criticism additionally heads in the direction of the U.S. Securities and Exchange Commission. If chairman Gary Gensler had authorised the conversion of GBTC into an ETF, the Armageddon state of affairs wouldn’t even exist.

Instead, Gensler most well-liked to reject spot Bitcoin ETFs and flood the market with paper BTC. The FTX fiasco may additionally contribute to the shortage of approval for a spot ETF within the close to future.

Meanwhile, Chris Burniske, accomplice at Placeholder and former crypto chief at ARKinvest, tweeted that fears surrounding the unwinding of GBTC and ETHE are unfounded, an instance of hysteria.

He retweeted Bob Loukas who wrote that the belief won’t go away as it’s a cash printing machine.

They generate like $700m in charges and traders can’t cease it. […] They may borrow billions in opposition to that money circulate.

Also, You’re not killing the goose to save lots of Genesis. They’re fire-walled.

At press time, Bitcoin traders appeared to agree with Chris Burniske. BTC stays in a wait-and-see mode.