On-chain knowledge exhibits massive quantities of stablecoins have entered exchanges just lately, one thing that would present shopping for stress for Bitcoin.

Around $111 Million Stablecoins Flowed Into Exchanges In Last Couple Of Days

As identified by an analyst in a CryptoQuant post, the newest stablecoin influx is the biggest noticed on this month to this point.

The related indicator right here is the “exchange netflow,” which measures the web quantity of stablecoins (of any sort) shifting into or out of wallets of all centralized spot exchanges. The metric’s worth is solely calculated by taking the distinction between the inflows and the outflows.

Positive values of the indicator imply a internet variety of stables are being deposited into exchanges proper now, whereas unfavourable ones suggest traders are withdrawing their cash in the meanwhile.

Since stablecoins have a comparatively secure worth as a consequence of them being tied to fiat (as their identify already suggests), crypto market members like to make use of them each time they need to keep away from the volatility related to cash comparable to Bitcoin.

Once they really feel that costs are proper to leap again into the unstable cryptos, these traders change their stables again for them, thus offering a bullish impact to their costs.

Because of this, a development of traders depositing their stablecoins into spot exchanges (that’s, optimistic netflows) can suggest shopping for stress for BTC and different cryptos.

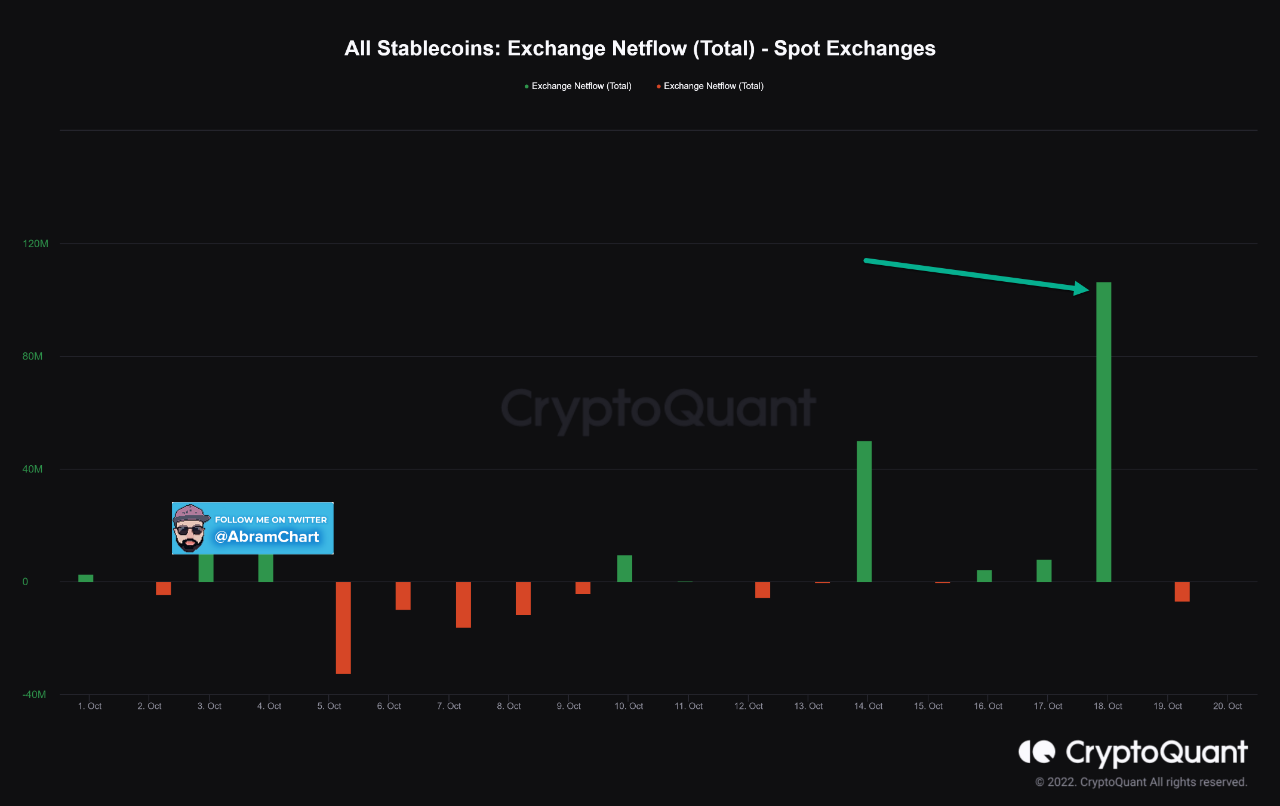

Now, here’s a chart that exhibits the development within the stablecoins change netflow over the month of October to this point:

Looks like the worth of the metric has spiked up throughout latest days | Source: CryptoQuant

As you possibly can see within the above graph, the stablecoin spot change netflows have registered a excessive worth within the final couple of days.

This spike amounted to round $111 million value of stables shifting into spot change wallets. While this isn’t a particularly massive worth, it’s nonetheless the most important deposit by traders within the month to this point.

If these inflows have certainly been made with the purpose of shopping for up cryptos like Bitcoin, then this may increasingly have a optimistic influence on the costs of the unstable cryptos within the close to future.

Bitcoin Price

At the time of writing, Bitcoin’s price floats round $19.2k, up 3% within the final seven days. Over the previous month, the crypto has misplaced 1% in worth.

Below is a chart that exhibits the development within the worth of the coin during the last 5 days.

The worth of the crypto has continued to point out stale worth motion in the previous few days | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, CryptoQuant.com