Bitcoin, the most important cryptocurrency when it comes to market capitalization, will more than likely enter subsequent month having a buying and selling worth that’s considerably decrease than its $69,044 all-time excessive attained on November 10, 2021.

Moreover, its common worth for October 2022, which presently stands at $19,443, is nowhere close to the $58,051 common it tallied in the identical month final yr.

To say the extremely touted “digital gold” was hit laborious by the unpredictable volatility that’s identified to have an effect on the crypto area is an understatement as Bitcoin continues to bleed.

But even with decrease costs and dangerous efficiency during the last couple of months, the chief of all digital currencies managed to outrank even the largest banks within the U.S. together with the frontrunner on the checklist, JPMorgan Chase.

Such a feat is de facto spectacular, contemplating these monetary establishments, as a rule, stay skeptical about Bitcoin and its fellow cryptocurrencies.

Bitcoin Dominates In Terms Of Market Cap

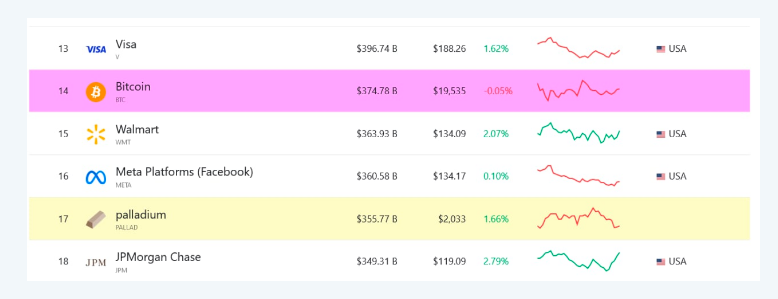

Yesterday, the overall market capitalization of Bitcoin reached $374.78 billion, making it the 14th most precious asset class, in response to CompaniesMarketCap.

JPMorgan Chase, a nicely established monetary establishment within the U.S. that has efficiently earned international status, solely managed to place itself on the 18th spot with its $349.31 billion market cap.

Source: FirmsMarketCap

As spectacular as that’s already, Bitcoin additionally managed to outperform different U.S. banks in the identical class.

Bank of America ($280.26 billion market cap), Wells Fargo ($169.54 billion), Morgan Stanley ($134.57 billion) and Charles Schwab ($130.15 billion) are all included within the high 10 checklist of largest banks and financial institution holding corporations when it comes to market capitalization.

But not even one in all them was in shut competitors to Bitcoin, which additionally managed to surpass Walmart ($363.93 billion) and Meta Platform (Facebook) ($360.58 billion).

Not A First For Bitcoin

This isn’t a fluke for the digital asset because it managed to tug this sort of efficiency final yr at a fair bigger scale.

When Bitcoin was buying and selling at $48,481 in February final yr, its market cap surged all the way in which as much as $900 billion.

The cryptocurrency managed to surpass the mixed market capitalization of JPMorgan Chase, Bank of America and Citigroup Inc. throughout that point.

All of that occurred earlier than the digital asset hit its all-time excessive later that yr, catapulting its total worth to even higher heights, peaking at $1.28 trillion.

Source: FirmsMarketCap

While Bitcoin stays on the mercy of the risky nature of crypto area, it has confirmed as soon as once more that it has large potential. That, nevertheless, is being overshadowed by its dismal efficiency of late.

At press time, in response to monitoring from Coingecko, the maiden crypto is altering fingers at $19,282, down by 1.1% during the last 24 hours however is up by 1.2% for the previous seven days.

Meanwhile, the United States presently has the very best quantity of Bitcoin buying and selling on this planet, at roughly $1.5 billion. Slightly over 23 million folks within the US presently possess Bitcoin, in response to Bankless Times, citing data by PEW.

Around 15% of US adults have bought or traded cryptocurrency in the previous few months. During the transition from 2018 to 2019, the variety of Americans who owned cryptocurrency surged, the PEW analysis exhibits.

BTC complete market cap at $370 billion on the day by day chart | Featured picture from Game of Life, Chart: TradingView.com