Someone get up Green Day, as a result of September is about to finish.

So, what occurred this month in crypto? And how do we glance as we flip the web page to October?

Bitcoin and Ethereum lag

Nothing too main, however Bitcoin and Ethereum trended down over the month. Interestingly, Bitcoin drew down greater than Ethereum, which is uncommon in comparison with the sample we’ve seen traditionally, the place Ethereum is mostly the extra risky of the 2.

The Merge was the large information, after all, as Ethereum accomplished the most important blockchain improve in historical past on September 15th. The occasion got here and went and not using a hitch, though pricing didn’t do a lot – suggesting it was priced in forward of time, as many suspected.

In the short-term, there’s not a lot the Merge has affected concerning value, however it will likely be fascinating to trace going forwards now that the pipeline underworking the Ethereum ecosystem has been utterly reworked.

I’ve written earlier than about my ideas that the staking yield might even act as a “risk-free” proxy for the world of De-Fi, serving to present a framework for valuations and laying the groundwork for ETH to mature much more.

The groundwork must also enable Ethereum to decouple from Bitcoin. I’ve lengthy considered Bitcoin as cash and Ethereum as tech, and I believe this transfer additional accentuates the dichotomy – cash wants proof of labor, however the base of a DeFi system does not.

But these are long-term concerns and within the medium-term, we’re nonetheless very a lot correlated.

On-chain

Let’s bounce on-chain to see any notable indicators that jumped out to me over the month.

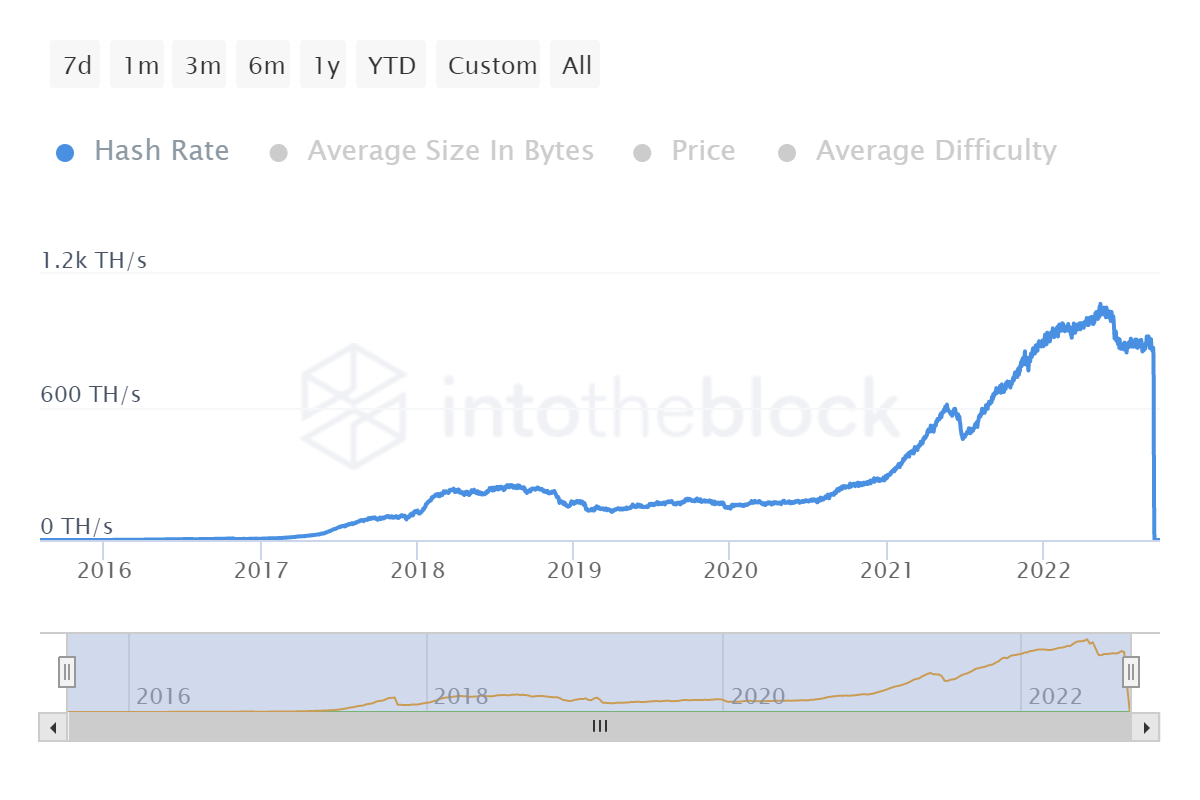

Firstly, given Ethereum accomplished the aforementioned Merge, there’s clearly no extra want for miners on the community. This is the precise reverse of ground-breaking information, however it’s nonetheless cool to see the hash price drop to zero within the beneath chart.

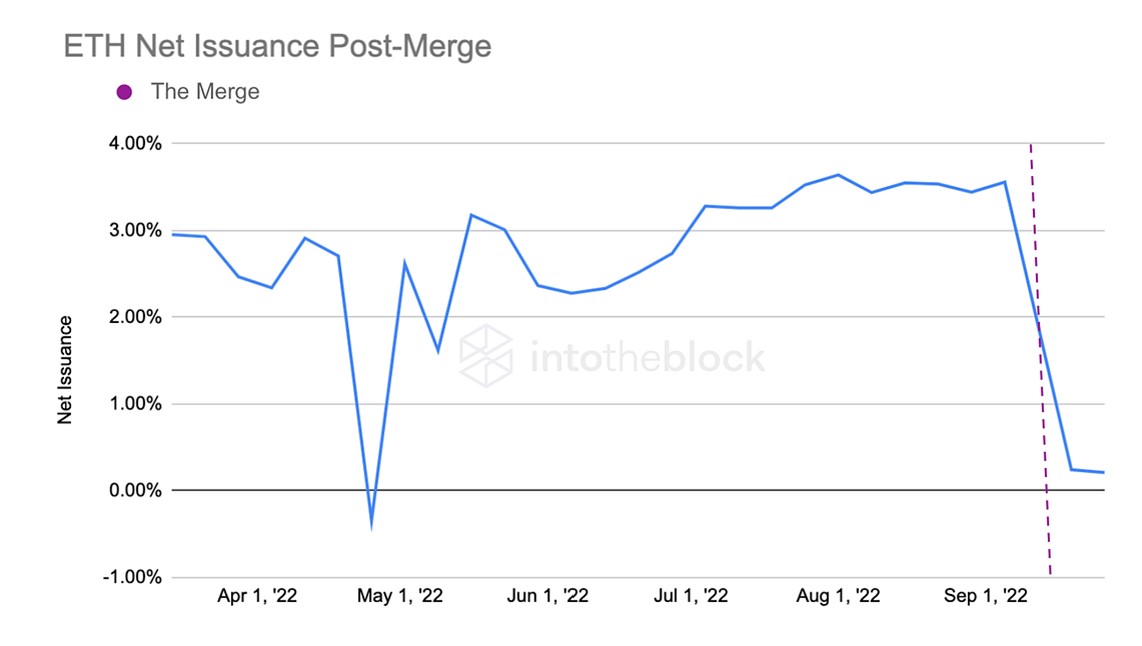

IntoTheBlock reveals a neat graph beneath of the web issuance of ETH dropping after the Merge. It has not fallen to deflationary, which was a story many had pushed within the leadup to the Merge.

As I stated in earlier analyses, I consider this was extra a case of naively following a “deflationary means price go up and I want price to go up so I will say ETH will be deflationary” sort of logic. But once more, Merge went completely and it’s cool seeing the issuance price drop so drastically.

However, maybe extra sombrely is Ethereum charges dropping 80% quarter over quarter. This is for no different cause than a great old school fall in demand. The macro scenario stays completely abhorrent and it follows that demand for the community is down (I’m probably being somewhat harsh as Layer 2’s are partially exacerbating this fall in charges however it’s largely because of an total fall in demand).

However, maybe extra sombrely is Ethereum charges dropping 80% quarter over quarter. This is for no different cause than a great old school fall in demand. The macro scenario stays completely abhorrent and it follows that demand for the community is down (I’m probably being somewhat harsh as Layer 2’s are partially exacerbating this fall in charges however it’s largely because of an total fall in demand).

Flicking over to Bitcoin, the share of long-term holders – aka diamond handers – continues to creep again up in the direction of its all-time excessive of near 64%, set this time final 12 months. The knowledge reveals that this demographic – defines as these holding Bitcoin for longer than a 12 months – stay unmoved, and this newest bearish month is not any completely different.

Mining

I used to be curious as as to if there can be a rise within the hash price on Bitcoin following the Ethereum merge.

Looking on the graph beneath, exhibiting the final three months, there does not seem like a lot motion. This is sensible, I suppose – there are different cash which miners are capable of flick over to simpler with their tools somewhat than Bitcoin.

Top of that checklist is sweet outdated Ethereum Classic – a coin which I had largely forgotten about till I seen its hash price had ballooned to an all-time excessive on the date of the Merge, almost 4Xing in a single day.

Top of that checklist is sweet outdated Ethereum Classic – a coin which I had largely forgotten about till I seen its hash price had ballooned to an all-time excessive on the date of the Merge, almost 4Xing in a single day.

Conclusion

In reality, this month was concerning the Merge and nothing extra. We can discuss on-chain indicators all we like, and as a blockchain junkie myself, I’m very happy to take action.

But the fact is that within the quick time period, the one thing that issues for crypto is the macro scenario. The lack of exercise on value across the Merge proves this.

Crypto has been, and will proceed to, commerce like leveraged bets on the S&P 500 going ahead. So strap in and tune in to the phrases of Jerome Powell, as a result of that’s all that basically issues till we get some macro momentum once more and issues can begin to transfer.

Welcome again, Green Day.