On-chain information exhibits some previous Bitcoin provide has just lately been moved into exchanges, one thing that might be bearish for the crypto’s worth.

Bitcoin Exchange Inflow CDD Has Spiked Up Over The Past Day

As identified by an analyst in a CryptoQuant post, the long-term holders have deposited some cash to exchanges over the past day.

There are two related indicators right here; first is the “exchange inflow,” which measures the overall quantity of Bitcoin being despatched into wallets of all centralized exchanges.

For the second, there’s a idea referred to as “coin days,” which is used as a measure of the dormant provide on the community. Whenever 1 BTC sits nonetheless on the chain for 1 day, it accumulates 1 coin day. The complete coin days, subsequently, inform us what number of days the availability has been left unmoved for.

However, when any coin that has gathered some coin days exhibits some motion, these coin days reset again to zero, or are “destroyed.” The “Coin Days Destroyed” (CDD) is a metric that retains monitor of the variety of such coin days being reset throughout the community.

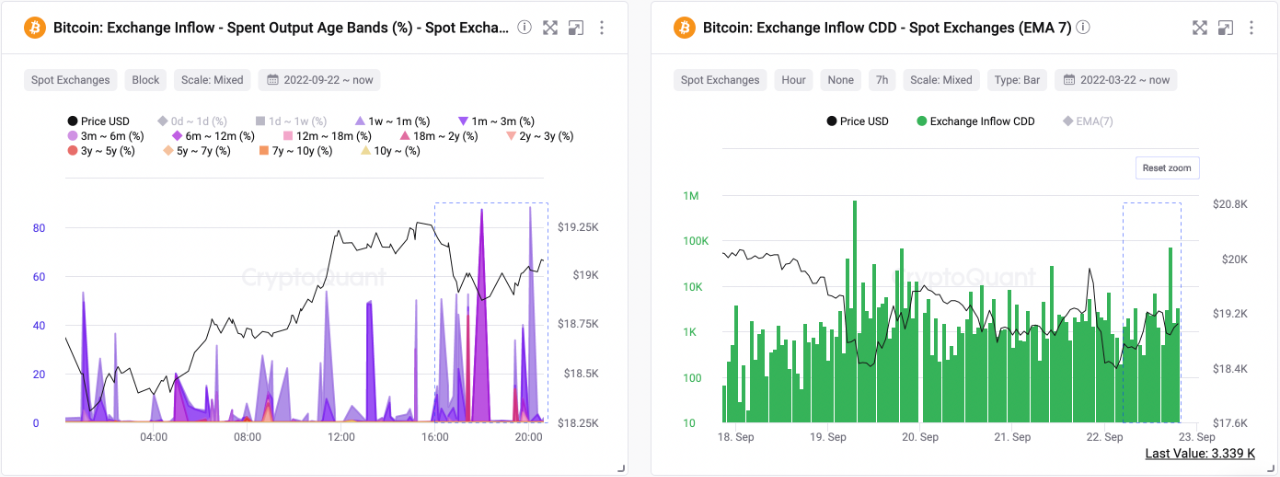

Now, here’s a chart that exhibits the pattern within the Bitcoin CDD particularly for alternate influx transactions:

Looks just like the 7-day EMA worth of the metric has been elevated just lately | Source: CryptoQuant

As you possibly can see within the above graph, the Bitcoin alternate influx CDD has noticed a spike over the past day.

Since the indicator proven is only for the spot exchanges, these transactions have been probably carried out for promoting functions as that’s what traders typically use these exchanges for.

Long-term holder group is a sort of cohort within the BTC market which incorporates all these traders who maintain onto their cash for a protracted whereas with out promoting or transferring them, therefore accumulating a considerable amount of coin days within the course of.

As such, spikes in CDD typically counsel previous provide (that’s, the availability owned by long-term holders) is on the transfer. LTH promoting has traditionally been bearish for the worth of Bitcoin.

The final spike of an analogous scale was seen just some days in the past, round which the coin’s worth noticed a short-term plunge down.

The chart additionally exhibits the pattern within the Inflow Spent Output Age Bands, which is an indicator that highlights the person contributions to the inflows coming from the completely different holder teams available in the market.

It appears like a wide range of cohorts have confirmed motion just lately, with the long-term holders with 6 months to 12 months previous cash transferring an particularly great amount.

BTC Price

At the time of writing, Bitcoin’s price floats round $18.6k, down 5% previously week.

BTC continues to be rangebound | Source: BTCUSD on TradingView

Featured picture from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, CryptoQuant.com