On-chain knowledge exhibits the Bitcoin MVRV triple ribbon has as soon as once more shaped a sign that has result in a median of 30% decline throughout earlier situations this yr.

Bitcoin MVRV Triple Ribbon Shows Bearish Signal Formation

As identified by an analyst in a CryptoQuant post, the most recent pattern within the BTC MVRV triple ribbon might recommend the crypto will observe one other native drawdown quickly.

Before what “MVRV” is, it’s finest to first check out the 2 main sorts of capitalization strategies for Bitcoin.

The first cap, the same old market cap, is calculated by multiplying every coin in circulation with the present BTC worth (or extra merely, it’s simply the whole variety of cash in circulation, multiplied by the value).

Where the opposite capitalization mannequin, the “realized cap” differs is that as an alternative of all of the cash being weighted towards the most recent worth of the crypto, every coin is multiplied by the BTC worth that was there on the time of the coin’s final motion.

Now, MVRV is simply the ratio between these two Bitcoin caps (market divided by realized). Historically, this metric has indicated when the worth of BTC has been undervalued, and when it has been overvalued.

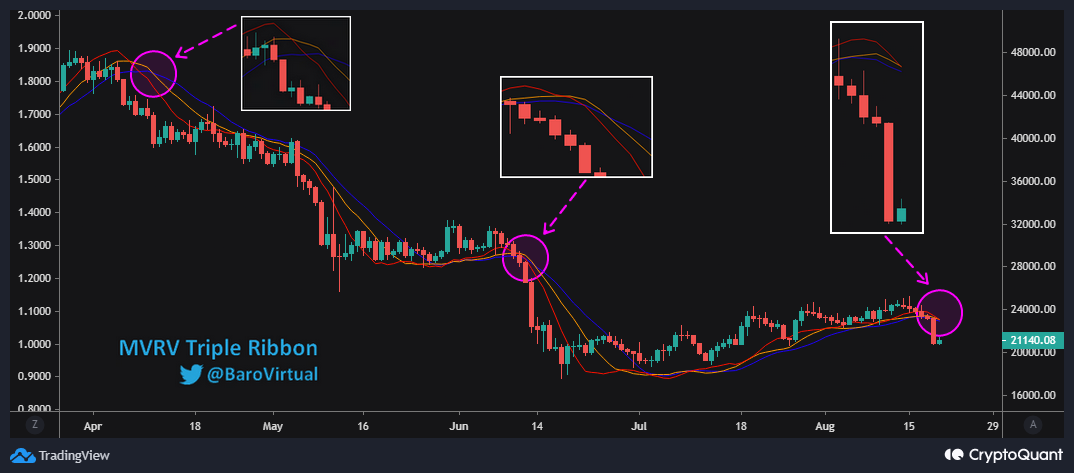

Here is a chart that exhibits the pattern in three totally different MVRV transferring averages (10-day, 15-day, and 20-day) throughout the previous couple of months:

Looks just like the 10-day MA curve is passing beneath the 15-day MA line | Source: CryptoQuant

These three transferring averages of the indicator collectively kind the “MVRV triple ribbon.” And as you’ll be able to see within the above graph, the pattern on this triple ribbon has had some fascinating implications on the Bitcoin worth throughout the previous couple of months.

Whenever the 10-day MA has crossed under the opposite two MAs, the value of the crypto has noticed a pointy decline within the close to time period.

In this yr to date, every of those MVRV triple ribbon crossovers has resulted in a 30% common drawdown for the worth of BTC.

From the chart, it’s obvious that this sample as soon as once more appears to be forming for the indicator. If that is certainly the identical sign because the earlier occurrences, then Bitcoin might face extra fall within the close to future.

BTC Price

At the time of writing, Bitcoin’s price floats round $21.2k, down 12% up to now week. Over the final month, the crypto has misplaced 9% in worth.

The under chart exhibits the pattern within the worth of the coin over the previous 5 days.

The worth of the crypto appears to have plunged down a couple of days again | Source: BTCUSD on TradingView

Featured picture from Thomas Bonometti on Unsplash.com, charts from TradingView.com, CryptoQuant.com