Data exhibits a considerable amount of leverage has been piling up within the Ethereum futures market as the value of the crypto breaks above $2k.

Ethereum Open Interest Surges To Highest Value In Last 4 Months

As identified by an analyst in a CryptoQuant post, the ETH futures market has seen the leverage sharply going up just lately.

The “open interest” is an indicator that measures the entire variety of Ethereum futures contracts presently open in all derivatives exchanges.

When the worth of this metric rises up, it means traders are opening up extra positions available on the market proper now. Since extra futures positions suggest that leverage can also be going up out there, such a development can result in increased volatility within the value of the coin.

On the opposite hand, reducing values of the indicator recommend holders are closing up their positions in the meanwhile. This sort of development can lead to a much less unstable worth of ETH.

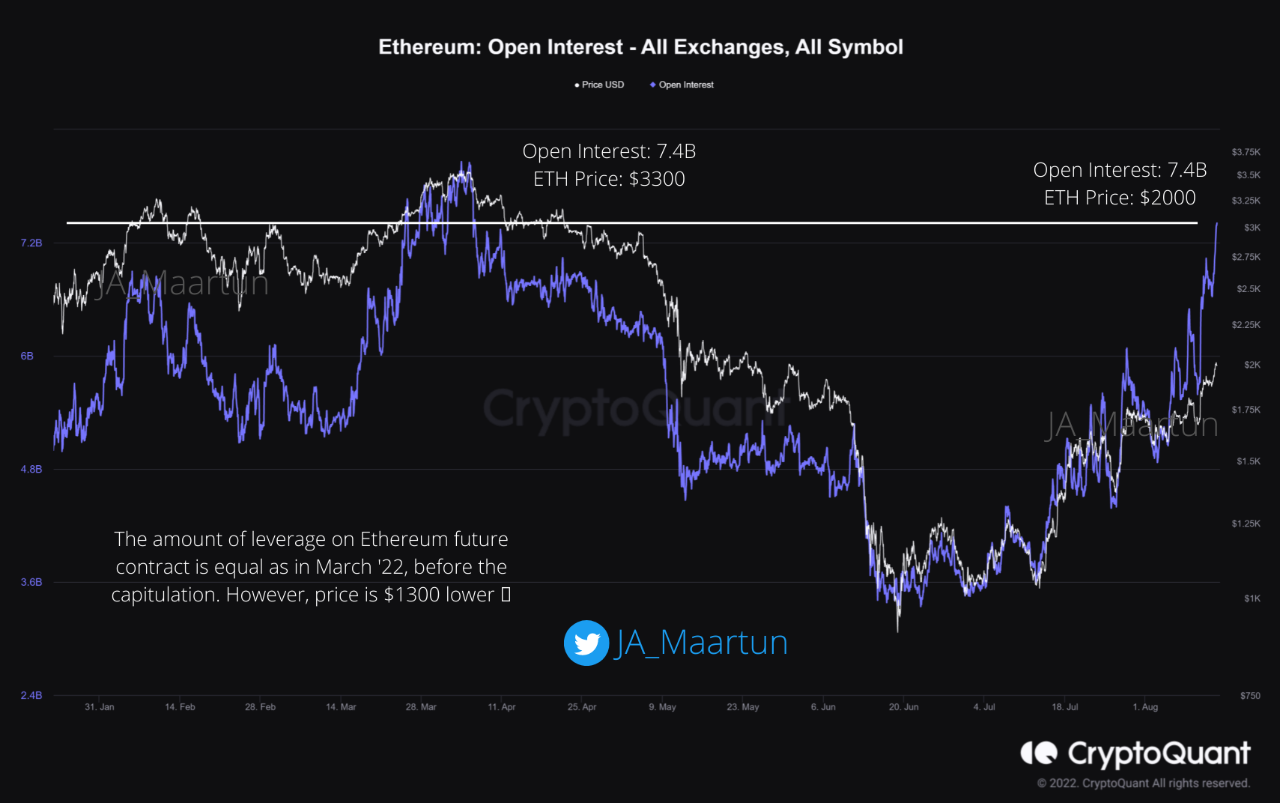

Now, here’s a chart that exhibits the development within the Ethereum open curiosity over the course of 2022 thus far:

Looks like the worth of the metric has shot up in current days | Source: CryptoQuant

As you’ll be able to see within the above graph, the Ethereum open curiosity has noticed some sharp uptrend through the previous couple of weeks.

The indicator has now reached a price of seven.4 billion, the best it has seen over the last 4 months. However, there’s an fascinating comparability right here.

Around 4 months in the past, when such values had been beforehand noticed, the value of ETH was about $3.3k. But immediately the value is simply $2k, round $1.3k lower than it was again then.

And but, the open curiosity is on the similar degree, that means the Ethereum market is likely to be having the identical diploma of leverage this time as properly, whereas the value is far decrease.

When particularly excessive leverage accumulates within the futures market, any sharp swing within the value can liquidate numerous positions directly. These liquidations then additional amplify this value transfer, which liquidates extra positions.

In this fashion, liquidations can cascade collectively, and the occasion known as a “liquidation squeeze.” This is the explanation behind the volatility of an overleveraged market.

If an extended squeeze does find yourself going down this time, then the most recent rally within the worth of ETH could hit the breaks.

ETH Price

At the time of writing, Ethereum’s price floats round $1.9k, up 5% previously week.

The worth of ETH appears to have gone up throughout the previous couple of days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com