Ethereum is transferring increased over right this moment’s buying and selling session and appears to be focusing on earlier ranges in regards to the $2,000 mark. The cryptocurrency soars as “The Merge” turns into imminent and backs the bullish sentiment throughout the market.

At the time of writing, ETH’s worth trades at $1,900 with a 3% revenue within the final 24 hours and a 17% revenue over the previous week. Ethereum is the most effective performing asset within the crypto prime 10 by market cap recording greater positive aspects than Solana (14%), Polkadot (16%), and Bitcoin (7%).

The bullish momentum for Ethereum appears poised to increase. In a current ETH core builders calls, “The Merge” mainnet launch was tentatively scheduled for September 15 to 16 at epoch 144896.

This announcement comes on the heels of a profitable implementation of “The Merge” on one other important Ethereum testnet, Goerli. Called the ultimate “dress rehearsal” for this main upcoming occasion that can mix Ethereum’s execution layer with its consensus layer.

In different phrases, Ethereum will lastly full its transition from a Proof-of-Work consensus to a Proof-of-Stake. This course of will present the blockchain will higher efficiency, a lot decrease transaction charges, scalability, and fewer power consumption.

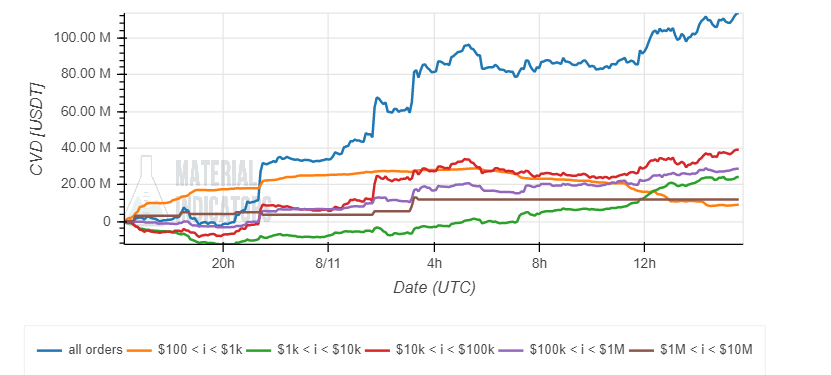

The potential for “The Merge” to draw new customers and capital into the Ethereum ecosystem is without doubt one of the explanation why it’s perceived as bullish by the market. Data from Material Indicators (MI) signifies that just about each investor class has been shopping for into ETH’s worth present worth motion.

This shopping for strain is trending upwards and seems to be selecting up momentum, over the previous 12 hours as information in regards to the tentative date for the mainnet launch broke.

Further knowledge from Material Indicators data necessary ask liquidity above ETH’s worth present ranges. There are over $40 million in promoting orders stack from $1,920 to $2,000. These orders will function as important resistance.

What “The Merge” Could Spell For The Price Of Ethereum

If Ethereum is ready to break above these ranges, the orderbook document nearly no resistance to the upside. Thus, ETH’s worth might reclaim beforehand misplaced territory and lengthen its climb.

However, MI data low shopping for strain for ETH’s worth on increased timeframes from giant buyers. Over the previous two months, retail buyers look like leaping into Ethereum’s worth motion.

Additional knowledge offered by Jarvis Labs coincides that retail buyers having been accumulating ETH. Larger buyers want to start accumulating to offer ETH’s worth with an prolonged pattern.

Jarvis Labs believes that this sustainable bullish worth motion may solely be triggered if Bitcoin picks up momentum and follows the bullish pattern. The worth of the primary cryptocurrency has additionally been supported primarily by retail, however the analysis “would like to see a Q4 2020 repeat”.

At that point, retail was shopping for BTC and ETH and in This autumn, whales took over and costs have been in a position to attain new highs.