On-chain information reveals the Bitcoin short-term holder SOPR is approaching the “breakeven” worth, a degree that has acted as resistance for the crypto’s worth prior to now.

Bitcoin Short-Term Holder SOPR Surges Up And Approaches A Value Of “1”

As identified by an analyst in a CryptoQuant post, the promoting stress from the short-term holders might even see a rise if their SOPR retains rising up.

The “Spent Output Profit Ratio” (or SOPR briefly) is an indicator that tells us whether or not the Bitcoin market as an entire is presently promoting at a revenue or at a loss.

The metric works by going via the on-chain historical past of every coin being offered to see what worth it offered at earlier than this. If the earlier worth of any coin was lower than the present worth, than that coin moved at a revenue simply now.

While the final promoting worth being lesser than the most recent one would suggest the sale of the coin result in a realization of loss.

When the SOPR’s worth is larger than one, it means the general market is promoting at a revenue for the time being. On the opposite hand, values under the brink recommend the common investor is shifting BTC at a loss.

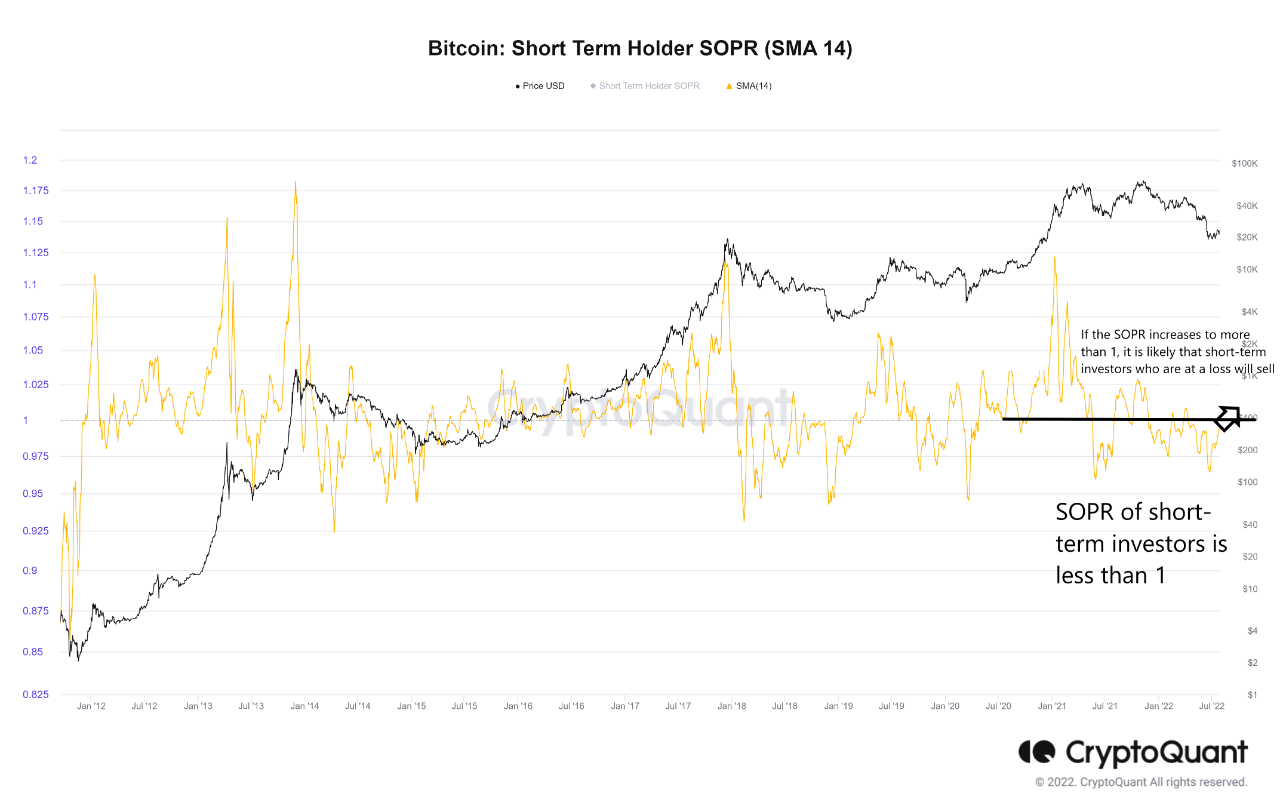

Now, the “short-term holders” (STHs) embrace all Bitcoin buyers who promote their cash after holding them for lower than 155 days. The under chart reveals the pattern within the SOPR particularly for this cohort.

The worth of the metric appears to have noticed some rise in latest days | Source: CryptoQuant

As you possibly can see within the above graph, the Bitcoin STH SOPR sunk down under “1” just a few months again, suggesting that these holders had been promoting at a loss.

During these previous few months, the indicator has tried to flee this zone twice, however each occasions it failed and the value additionally concurrently went down.

The cause behind this pattern is that the “SOPR = 1” line represents the “breakeven” level for the market. As the metric hits this degree, buyers who had beforehand been at loss suppose they’ve now received their cash “back” and thus promote their cash right here.

This results in the next than traditional promoting stress from the STHs at this mark, which offers resistance to the value of Bitcoin.

Recently, the SOPR for this holder group surged up and is now approaching the brink as soon as once more. If previous pattern is something to go by, as soon as it assessments the worth, BTC might even see some downtrend this time as effectively.

BTC Price

At the time of writing, Bitcoin’s price floats round $23.7k, up 5% within the final seven days.

Looks like the value of the coin has been consolidating sideways throughout the previous few days | Source: BTCUSD on TradingView

Featured picture from Amjith S on Unsplash.com, charts from TradingView.com, CryptoQuant.com