A quant has recommended that the rationale behind the latest adverse Coinbase Premium may have been resulting from Tesla’s Bitcoin promoting.

Tesla Dumping 75% Of Its Bitcoin Holdings Might Be Behind Negative Coinbase Premium Gap

As defined by an analyst in a CryptoQuant post, the information about Tesla promoting off 75% of its BTC stash seems to be behind the latest adverse premium hole on Coinbase.

The “Coinbase premium gap” is an indicator that measures the value distinction between the Bitcoin listings on crypto exchanges Coinbase and Binance.

Since Coinbase is popularly utilized by US traders (particularly giant institutionals) whereas Binance has a extra international userbase, this indicator can inform us in regards to the shopping for or promoting conduct from the US-based holders.

When the worth of the metric is adverse, it means the worth of BTC listed on Coinbase is presently lower than on Binance. This suggests there was some promoting happening from American traders.

Related Reading | Bitcoin Hashrate Downtrend Leads To Largest Negative Difficulty Adjustment In A Year

On the opposite hand, the premium hole’s worth being larger than zero implies there may be shopping for taking place on Coinbase a the second.

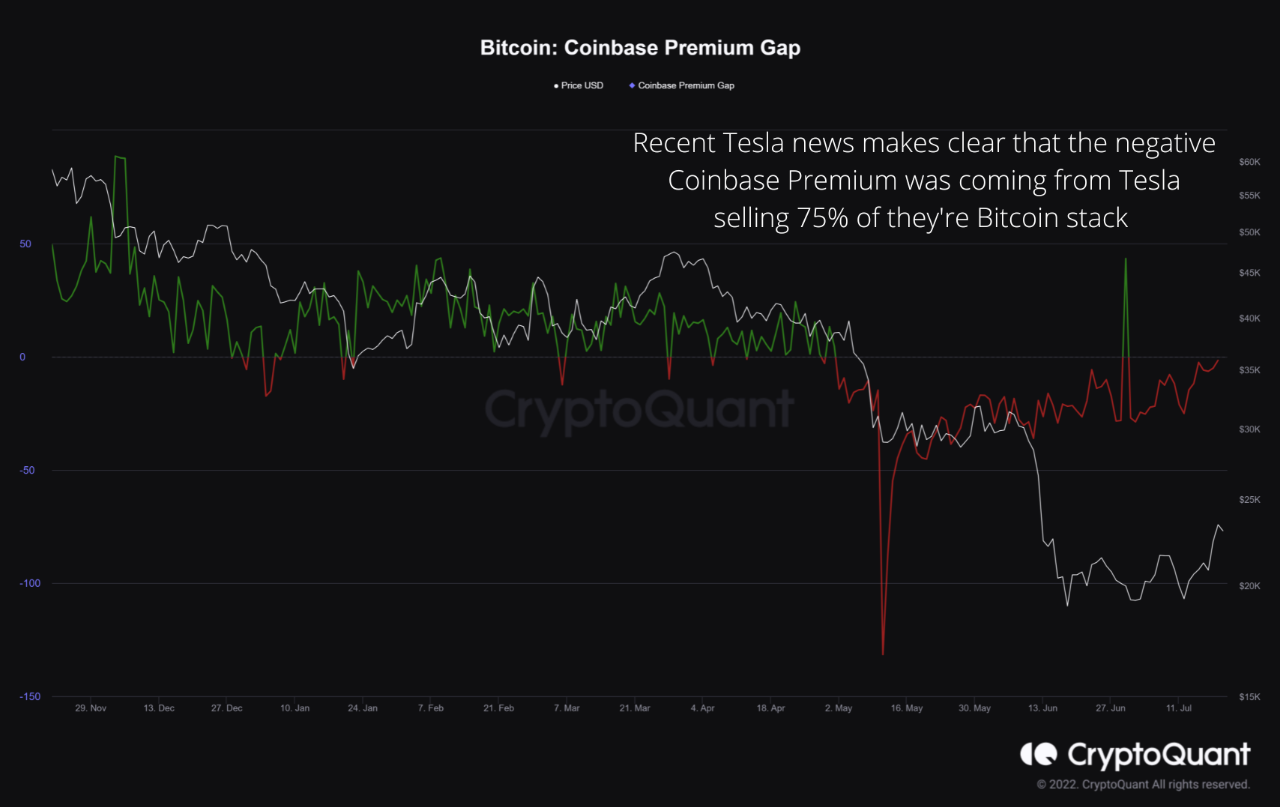

Now, here’s a chart that reveals the development within the Bitcoin Coinbase premium hole over the previous couple of months:

The worth of the metric appears to have been purple in the course of the previous couple of months | Source: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin Coinbase premium hole has been adverse for a very good whereas now, in addition to one transient spike to inexperienced values.

The quant notes that this was a sign that heavy promoting was continually occurring from excessive internet value traders or institutionals primarily based within the US.

Related Reading | Uniglo (GLO) Brings Forth Fractionalized Asset Ownership, Overshadowing Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)

The newest information about Tesla having dumped 75% of its complete BTC holdings makes it obvious that the promoting supply was Elon Musk’s firm.

Also, as is seen within the chart, the Coinbase premium hole has improved in latest days because the promoting strain from Tesla has dropped off.

BTC Price

At the time of writing, Bitcoin’s price floats round $22.6k, up 15% within the final seven days. Over the previous month, the crypto has gained 10% in worth.

The under chart reveals the development within the worth of the coin over the past 5 days.

Looks like the worth of the crypto has proven some decline over the past 24 hours | Source: BTCUSD on TradingView

A few days again, Bitcoin had been observing some sharp uptrend, however over the previous day the coin has dropped down as a response to the information about Tesla’s dump.

Featured picture from Shubham Dhage on Unsplash.com, charts from TradingView.com, CryptoQuant.com