The second-largest cryptocurrency by market cap, Ethereum, has soared 45 % throughout the previous week, outperforming the majority of different betable belongings. There might be a easy rationalization for this:

As Ethereum’s workforce of builders approaches the conclusion of a multiyear, extraordinarily troublesome improve, merchants are shifting constructive.

Ethereum Surge

The second-largest cryptocurrency by market cap, Ethereum, has surged by about 45% over the previous week, outperforming the majority of the prime 100 crypto belongings. While there are numerous theories surrounding ETH’s bullish pattern, one in every of the predominant drivers of worth actions is the impending Ethereum merger.

Trading in ETH has modified from bearish to bullish as builders get nearer to ending a multi-year, extraordinarily troublesome improve. The total ETH provide in revenue has now risen to 56% with the intense social expectation of the Merge, from lows of 41% simply previous to the present worth spike.

ETH/USD trades in new bullish momentum.

According to statistics from Glassnode, a big clearing out of brief positions in the futures market was the motive for Ethereum’s 22 % achieve this week.

Glassnode tweeted:

“Over $98M in short futures positions were liquidated in one hour, pushing $ETH prices up by 12.5%.”

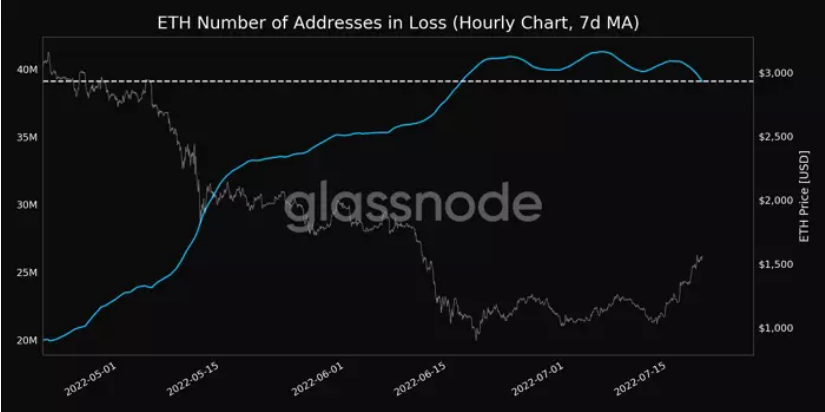

The Number of ETH Addresses in Loss (7d MA) reached a 1-month low of 39,112,029 at press time, additional demonstrating ETH’s latest bullish pattern.

Source: Glassnode

Since the final actions that can actually switch Ethereum exercise to the Beacon Chain are scheduled for September, there may be nonetheless loads of time for The Merge. Superphiz.eth, an Ethereum educator, added in a Tweet that Goerli would bear the merging switch as the final public testnet round August 11.

The mainnet merge is anticipated to drift throughout the week of September 19 if all the pieces with Goerli goes in response to plan.

Related Reading | Ethereum Classic (ETC) Reclaims $3 Billion Market Cap, More Upside To Follow?

Experts Opinion

Youwei Yang, director of economic analytics at StoneX, says that two “certainties” are the reason for this upward rise for EthereumThe first is the just lately introduced time for the Ethereum “merge” replace, which ought to make the community considerably extra energy-efficient. Yang claims that the “calming” of macroeconomic anxieties is the second.

“Actually if you see the price movement tick by tick, this time it’s more like ETH leading BTC [or Bitcoin] instead of the other way around in usual times, so it’s a strong indication of ETH-led bear market rally with the confirmation and sentiment of ETH2.0,” mentioned Yang, referring to post-merge Ethereum.

In his most up-to-date episode of “The Breakdown,” well-known podcaster and devoted trade watcher Nathaniel Whittemore made this assertion. There is a rising understanding that “the Merge” may affect markets on Twitter, Discord, and all over the place else folks debate cryptocurrencies.

After months of low costs, the occasion suggests, as Whittemore put it, a “return of optimism” in the cryptocurrency markets. The Merge additionally fills a “narrative void,” permitting crypto lovers to inform others tales about how this expertise is altering the world.

Others consider that the Merge might be inflicting ETH worth to spike as a result of structural causes. The improve represents a basic change in the potential functions of Ethereum by rewarding traders who stake their belongings in the community. Even Bitcoin-like deflationary forces that additional profit holders might outcome from the transfer. People who’re buying ETH now in preparation could view it extra as an funding than a transaction on this situation.

Related Reading | Liquidations Cross $230 Million As Ethereum Barrels Past $1,400

Featured picture from The Shutterstock, chart from TradingView.com