Following sturdy weekly double-digit features from Bitcoin and quite a few big-cap altcoins, the cryptocurrency market capitalization surpassed $1 trillion.

$1 Trillion Market Crossed Again

For the primary time since June 13, a big achieve on Monday in each bitcoin and ether helped raise the market price of cryptocurrencies again past the $1 trillion degree.

The largest cryptocurrency has reached its highest costs since a selloff in mid-June introduced the value of bitcoin down from $30,000 to as little as $18,000, rising 5% within the final 24 hours to $22,300.

During the late 2017 bull market surge for bitcoin, that very same degree served as a powerful area of resistance, and in technical evaluation, outdated resistance sometimes turns into new assist (and vice versa).

Crypto market cap above $1 trillion threshold. Source: TradingView

For cryptocurrency traders, Monday’s income ought to come as a aid after the previous 9 months have seen them endure a horrible bear market. As a results of the extended bear market in cryptocurrencies, $2 trillion in market worth has been misplaced, and a number of other crypto firms, together with Celsius, Voyager Digital, and Three Arrows Capital, have gone bankrupt.

Despite analyst predictions that the Federal Reserve would improve rates of interest by at the very least 75 foundation factors on the Federal Open Market Committee assembly on July 27, the normal markets are mildly larger on the day that cryptocurrencies are usually within the black.

While merchants could just like the uptick in worth on July 18, a number of analysts warn that it’s merely a bear market pump.

Related Reading | Bitcoin Bearish Signal: Exchange Netflows Spike Up

Bitcoin Poised For Rebound

According to TradingView knowledge, Bitcoin has made appreciable features over the previous week. At the time of writing, BTC had risen by 16 p.c from its most up-to-date low of $18,907.

The most precious cryptocurrency is at present bumping up into resistance on the 200-week shifting common, which additionally occurs to be the highest of the buying and selling vary that BTC has been caught in because the center of June.

Over the previous 5 weeks, makes an attempt to interrupt above this degree have been repeatedly rejected, proving it to be a tough nut to crack. It is but unclear whether or not Bitcoin will have the ability to overcome this barrier and climb larger or if it should proceed to fluctuate between $19,000 and $22,000.

$BTC battling that 200 Week MA once more. Rejected 3 instances within the final 5 weeks right here.

Decision time imo.

We both have a fats breakout or fats breakdown. $ETH has been main the market to date, together with many different altcoins. Breakouts occurring all over the place.

Can $BTC comply with swimsuit? pic.twitter.com/6Cz49po8CH

— Taner ⚡️ (@Taner_Crypto) July 18, 2022

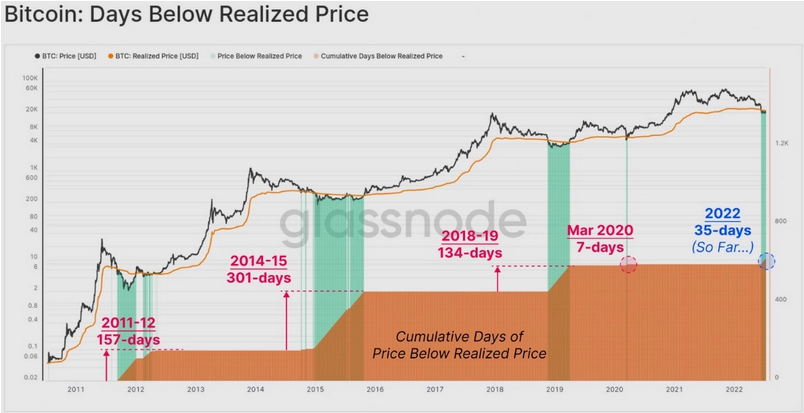

The main distinction between the current bear market and former cycles, in accordance with Glassnode’s most up-to-date e-newsletter, is “duration” and lots of on-chain measures are actually comparable to those historic drawdowns.

Realized worth, which is calculated as the worth of all Bitcoin divided by the amount of BTC in circulation, has proven to be a very good indicator of bear market bottoms.

Number of days Bitcoin worth traded under the realized worth. Source: Glassnode

With the exception of the flash crash in March 2020, which is depicted on the above chart, Bitcoin has constantly traded under its realized worth for a protracted time period all through bear markets.

Glassnode defined:

“The average time spent below the Realized Price is 197-days, compared to the current market with just 35-days on the clock.”

Related Reading | Bitcoin Breaks Above Realized Price Again, Bottom Finally In?

Featured picture from Getty Images, charts from TradingView.com