On-chain knowledge reveals Bitcoin miners withdrew a considerable amount of cash from their wallets yesterday, suggesting they could be planning to promote them.

Bitcoin Miners Transferred 14k BTC Out Of Reserve Yesterday

As identified by an analyst in a CryptoQuant post, the BTC miner reserve noticed a plunge in the course of the previous day.

The “miner reserve” is an indicator that measures the entire quantity of Bitcoin presently saved within the wallets of all miners.

When the worth of the metric rises up, it means a internet variety of cash are coming into into miner wallets in the meanwhile.

Such a pattern, when extended, can recommend these chain validators are accumulating proper now, and thus may be bullish for the crypto’s worth.

On the opposite hand, a reducing worth of the reserve signifies that miners are withdrawing a internet quantity of BTC presently.

Related Reading | Bitcoin Volume Saw False Spike Due To Binance’s Fee Removal

Since they often switch out their cash for promoting on exchanges, this type of pattern may be bearish for the worth of BTC.

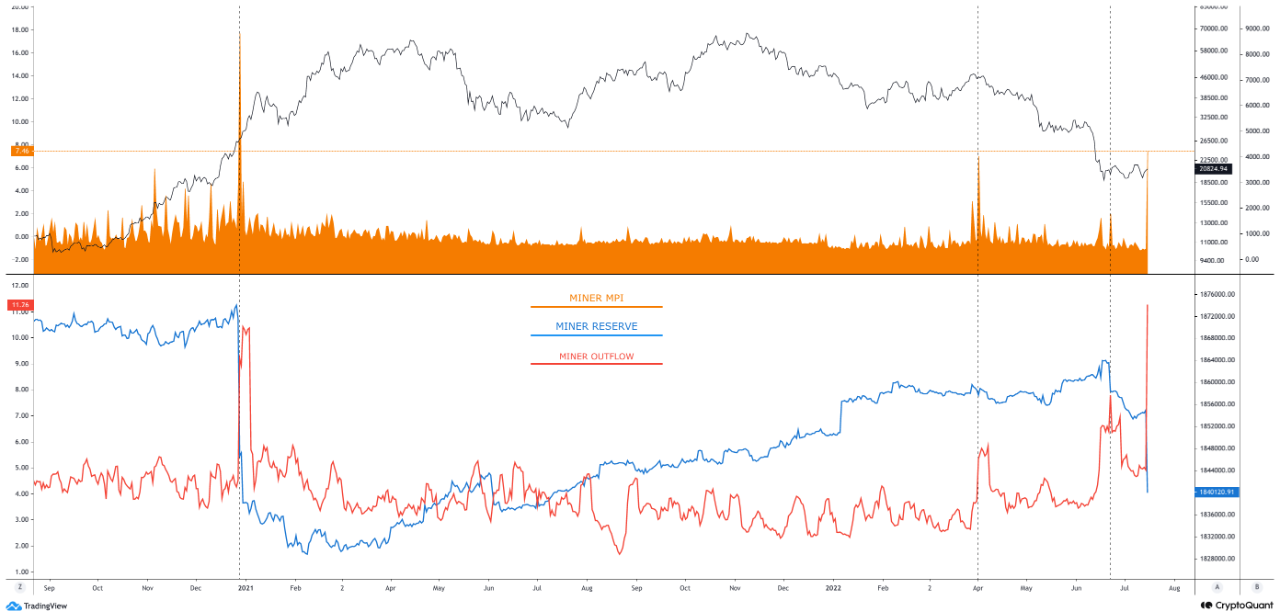

Now, here’s a chart that reveals the pattern within the Bitcoin miner reserve over the previous couple of years:

Looks like the worth of the indicator has sharply declined lately | Source: CryptoQuant

As you may see within the above graph, the Bitcoin miner reserve has noticed a major lower over the previous day.

The chart additionally consists of the info for 2 different indicators: the BTC miners’ place index and the BTC miner outflows.

Related Reading | Here’s Who Was Behind Bitcoin’s Recovery To $22,000 According To Open Interest

The outflow is simply the entire quantity of cash exiting miner wallets. As anticipated from the plunge within the reserve, this metric has additionally sharply decreased in worth.

What the “miners’ position index” (MPI) does is that it compares this present outflow worth to the 365-day shifting common of the identical.

This tells us about how the present miner promoting could evaluate with that noticed in the course of the interval of the final yr.

This indicator registered a giant spike yesterday. The final two instances such massive spikes had been seen, Bitcoin began happening some time later (or instantly in case of the spike in April).

If the previous pattern is something to go by, this may occasionally probably develop into bearish for the worth of the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.7k, down 4% within the final seven days. Over the previous month, the crypto has misplaced 8% in worth.

The worth of the coin appears to have stagnated in the course of the previous couple of days after a transfer up | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com