After the official US inflation numbers had been launched, bitcoin costs began to rise. However, in the course of the earlier month, the BTC miners have elevated their outflow.

A brand new set of tax insurance policies focused at stopping home cryptocurrency mining had been unveiled by Kazakhstan, which continues to be a big nation on this planet of Bitcoin mining.

During a halt in worldwide exercise and fireplace gross sales related to latest bankruptcy-related information, costs for Bitcoin mining rigs are additionally mentioned to have fallen to epidemic lows for 2020.

Most considerably, Texas energy grid operators have requested all Bitcoin miners to stop operations with the intention to reduce the pressure on an influence grid that’s already overloaded.

Bitcoin Miners Inflow Reach New ATH

IT Tech experiences that Bitcoin miners transferred over 14,000 BTC to an alternate in a single block. The switch from the miner pockets to the alternate was famous as being unfavorable for the market. According to their definition of mining pool wallets of their stats, all pool members—together with the precise miner—are included.

One person did level out that these Bitcoin weren’t mirrored within the spot market or derivatives, although. Glassnode reported that the BTC Miners’ Netflow Volume on a 7-day transferring common (MA) foundation hit an all-time excessive (ATH) of $1,779,953. In the primary week of January 2022, an ATH of $1,700,940 was registered.

This outflow didn’t cease on the alternate pockets, in accordance with Ki Young Ju, CEO of CryptoQuant. It will in all probability find yourself in a custodial chilly pockets. This might be utilized as an OTC deal or as a custodial service. In his opinion, the information is both bullish or impartial.

Miner simply moved 14k $BTC:

Poolin individuals → Unknown pocketsIt didn’t go to an alternate pockets however extra like a custodial chilly pockets. It might be for utilizing a custodian service or an OTC deal. It’s impartial or bullish information.

Nice catch @IT_Tech_PL https://t.co/G25DsK2nR6 https://t.co/rYmqVaoTAR

— Ki Young Ju (@ki_young_ju) July 15, 2022

Related Reading | Mid Cap Crypto Coins Lead In July, Best Way To Weather The Winter?

Price May Surge?

Additionally, open curiosity is rising, in accordance with IT Tech, and the market could quickly expertise progress. The Bitcoin miner reserves have decreased over the past two weeks, in accordance with the examine. This, nonetheless, could also be a big signal of waning confidence in a worth turnaround.

Within the previous 24 hours, the worth of bitcoin has elevated by greater than 6%. BTC is presently buying and selling for $20,953 on common. Its 24 hour buying and selling quantity is up by 2% to face at $32.8 billion.

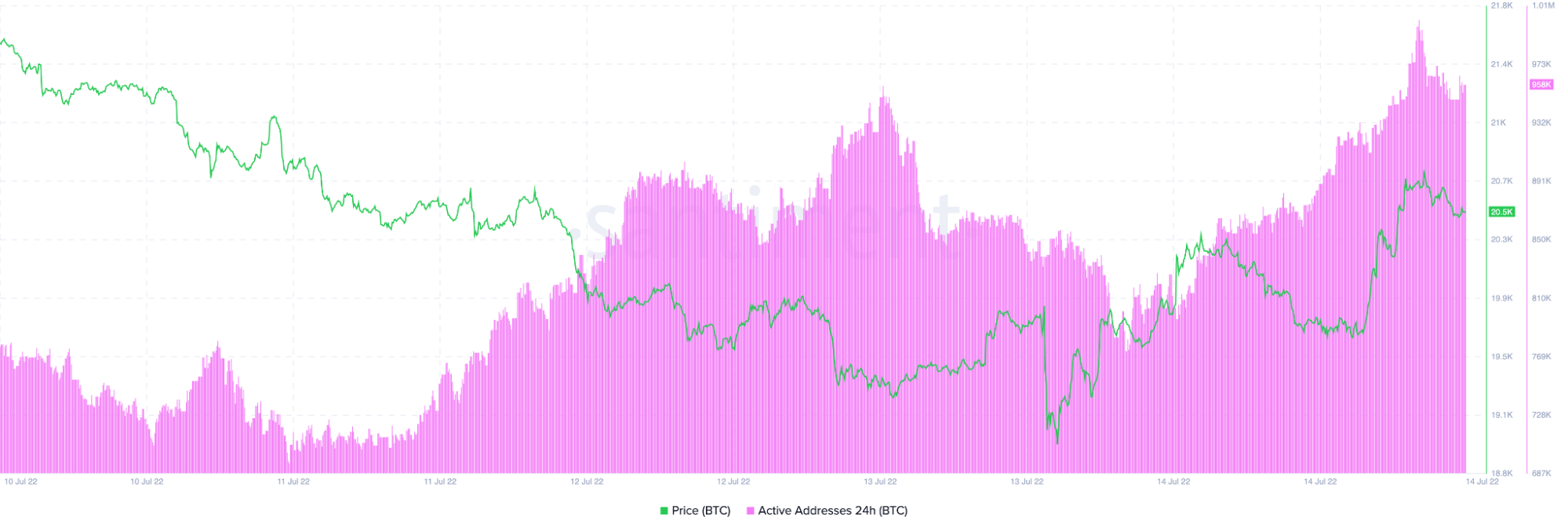

BTC energetic addresses have grown in the course of the previous 24 hours, says Santiment. The quantity was near 1,000,000 at press time, in comparison with 860,000 on July 14. This demonstrates that investor temper is shortly enhancing.

Source: Santiment

The quantity, which modified from 28.13 billion to 31.64 billion, is in a comparable situation. For Bitcoin maximalists, the rise in worth over the previous 24 hours on July 15 could also be an indication of reduction. In actuality, on the time of writing, Bitcoin’s market cap has elevated from $376 billion to $395 billion.

BTC market cap surges. Source: TradingView

In the meantime, Anthony Pompliano mentioned in his evaluation that the worth of bitcoin is declining resulting from rising inflation. It could also be correct, he continued, that it’s not a robust hedge in opposition to CPI.

Related Reading | Bitcoin Price Spends Four Weeks At 2017 Peak Prices, What Comes Next?

Featured picture from Pixabay, charts from TradingView.com and Santiment