Data reveals the Bitcoin funding charge has elevated to a comparatively excessive optimistic worth not too long ago, one thing that might result in a protracted squeeze out there.

Bitcoin Funding Rate Becomes Positive As Open Interest Rises Up

As identified by an analyst in a CryptoQuant post, the BTC funding charge has a optimistic worth for the time being.

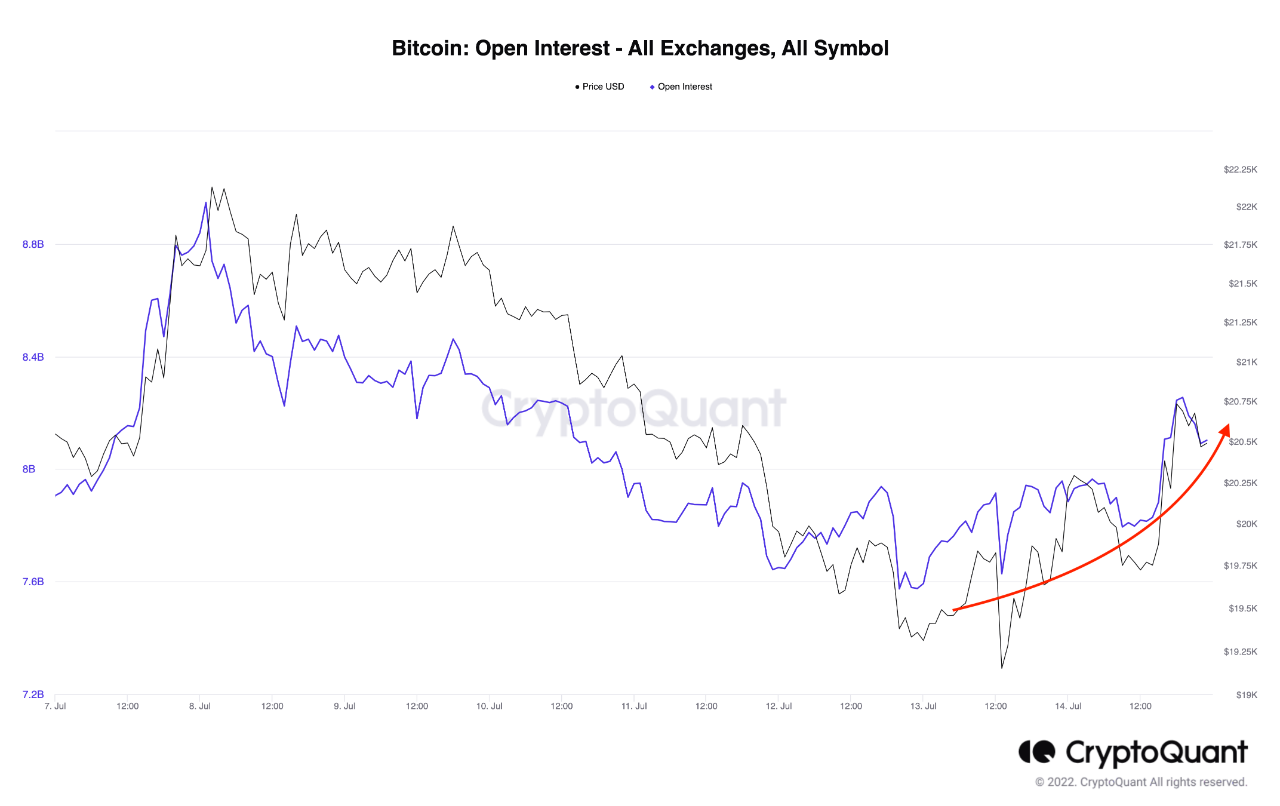

The “open interest” is an indicator that measures the overall quantity of positions at present open within the Bitcoin futures market.

When the worth of this metric is excessive, it means there may be a considerable amount of leverage concerned out there proper now. Excess leverage normally results in the crypto’s worth turning extra risky.

Related Reading | When Will The Extended Stretch Of Extreme Fear In Crypto End?

On the opposite hand, low values of the open curiosity can lead to lesser volatility within the BTC market as there isn’t a lot leverage concerned within the futures market.

Now, here’s a chart that reveals the development within the open curiosity over the previous week:

Looks just like the metric's worth has elevated not too long ago | Source: CryptoQuant

As you possibly can see within the above graph, the Bitcoin open curiosity has noticed an increase in current days. This may imply that the crypto could face greater volatility within the coming days.

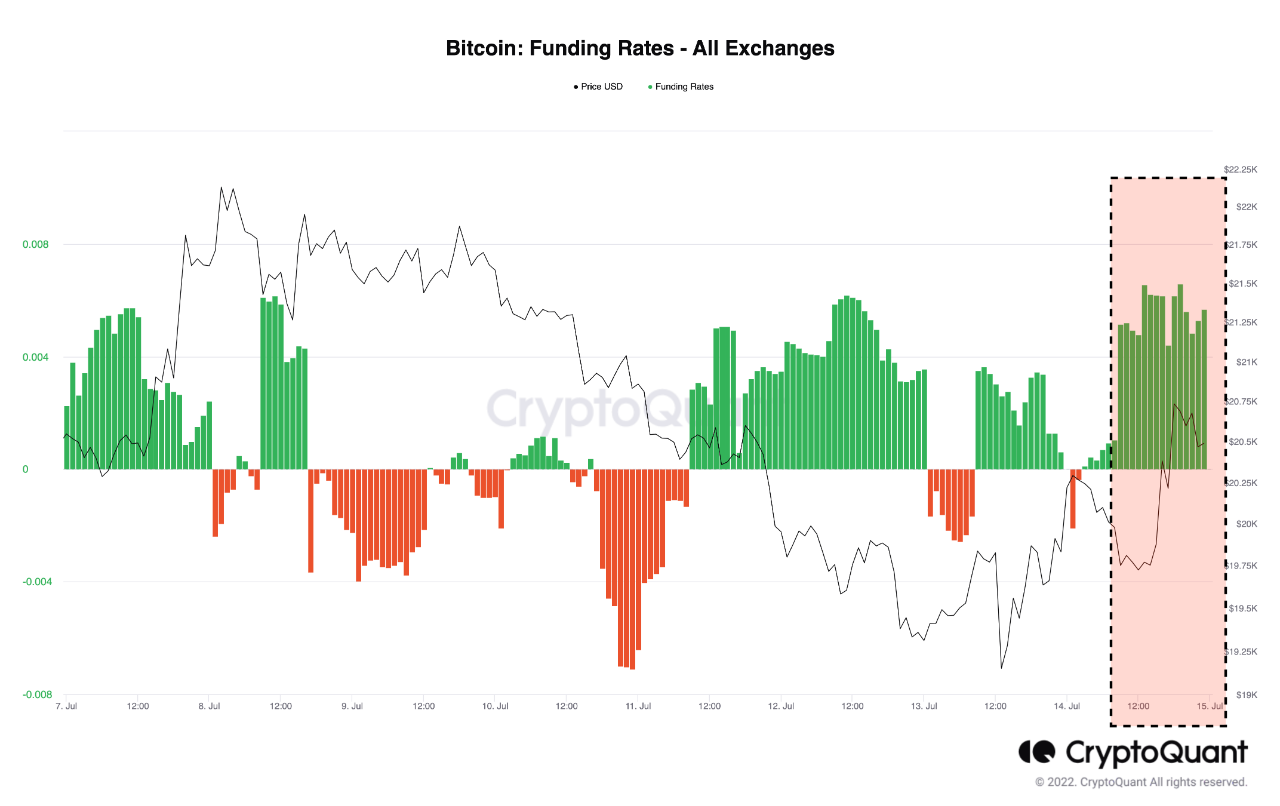

Another indicator, the “funding rate,” measures the periodic payment that merchants on derivatives exchanges pay one another to carry onto their positions. This metric tells us how the open curiosity is split between the lengthy and brief merchants for the time being.

Related Reading | Bitcoin Manage To Hold Its Own As Wall Street Open With Losses, Analysts Weigh In On Bottom

The under chart reveals how this indicator’s worth has modified through the previous seven days.

The worth of the indicator appears to have been inexperienced not too long ago | Source: CryptoQuant

From the graph, it’s obvious that the Bitcoin funding charge has a comparatively excessive optimistic worth at present. This implies that there are the next variety of longs current out there proper now.

Since lengthy merchants are paying a premium to maintain their positions (which is why the speed is optimistic), the general market sentiment is leaning in direction of bullish.

However, with the excessive open curiosity values, it’s attainable that any massive swing within the worth could cause what’s referred to as a “long squeeze,” which is an occasion the place mass liquidations of lengthy positions cascade collectively and push the value additional down.

BTC Price

At the time of writing, Bitcoin’s worth floats round $20.9k, down 2% within the final week. Over the previous month, the crypto has misplaced 5% in worth.

The worth of BTC has climbed up over the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com