The U.S. Consumer Price Index (CPI) for June jumped to 9.1%, in keeping with data launched by the Bureau of Labor Statistics in the present day, July 13. The rise in CPI began a liquidation chain throughout the crypto market, in addition to inventory markets.

In reality, worth pressures will power the Federal Reserve to go massive on the rate of interest hike later this month. The CME’s FedWatch software signifies the likelihood of a 100 bps rate of interest hike on the (*100*)’s assembly on July 27.

Crypto costs tumbled massively after the U.S. Bureau of Labor Statistics introduced a 9.1% CPI for the month of June. Bitcoin (BTC) and Ethereum (ETH) costs tumbled to $18,990 and $1019, respectively. This is the very best inflation seen within the U.S. within the final 40 years. The recession concern can be rising as that is the fourth-straight month of rising inflation.

The present situation confirms a 75 bps price hike by the (*100*) on July 27. However, the principle concern is an increase within the likelihood of a 100 bps rate of interest hike. The CME’s (*100*)Watch software signifies a forty five% likelihood of 75 bps and a 55% likelihood of 100 bps.

The crypto market, which is already below stress as a result of bearish circumstances and liquidity disaster, might tumble considerably because of the rising rates of interest. The rate of interest hike by central banks worldwide within the final months had dwindled traders’ curiosity in crypto, in addition to equities.

The cryptocurrencies have been intently monitoring shares for the previous few quarters. As traders have lowered their publicity to macroeconomic threat, they’ve offered off crypto together with equities.

A survey launched by Goldman Sachs on Wednesday revealed that 93% of small enterprise house owners assume the U.S. will enter a recession within the subsequent six months.

A pullback could also be seen from retail and institutional traders on account of a “mild recession this year,” says Bank of America economists.

Rise in Liquidations Amid Interest Rate Hike And Recession Fear

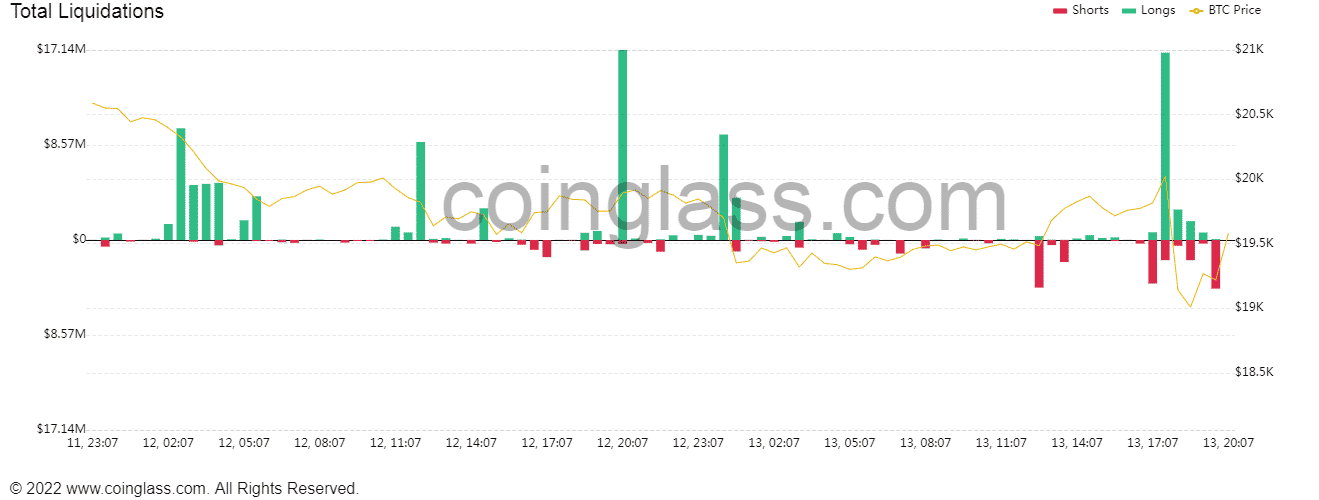

The international crypto market cap declines additional to $867.54 billion after the newest CPI report. The rise in costs throughout the crypto market is faux on account of brief promoting by merchants and institutional traders. Institutional traders had been piling into brief positions on BTC forward of the inflation knowledge.

The complete crypto liquidation jumps over $250 million, with Ethereum and Bitcoin witnessing 88 million and 87 million liquidated within the final 24 hours.

According to the MLIV Pulse survey, 60% of the Wall Street consultants surveyed assume BTC might fall to $10,000 on account of rising inflation.