Ethereum’s change from a proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS), through the much-awaited ETH 2.0 improve, isn’t right here but.

But because the platform slowly transitions, deposits into the staking contract on the Beacon Chain have risen repeatedly since November 2020. reached practically 13 million ETH.

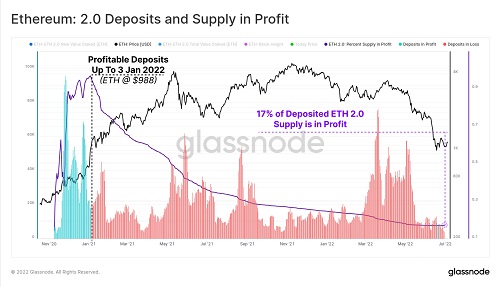

Most of the deposits occurred earlier than Ether’s worth rose to its all-time excessive above $4,800. However, profitability for these cash has fallen sharply amid the bear market, in response to analytics platform Glassnode.

Per a report the agency revealed on Wednesday, most stakers are “underwater” with solely 17% of the staked cash are in revenue at ETH/USD present ranges of simply above $1,100.

“Ethereum 2.0 stakers have deposited over 12.98M $ETH, with 62% of it flowing in before the Nov ATH. However, with $ETH prices collapsing over 78%, and coins unable to be withdrawn, only 17% of staked $ETH is now in profit.”

Chart displaying share of ETH 2.0 deposits in revenue.Source: Glassnode

Chart displaying share of ETH 2.0 deposits in revenue.Source: GlassnodeThe USD worth of the deposited ETH has additionally fallen sharply, down from $39.7 billion on the November peak. Currently, that worth is under $14 billion, reflecting a 65.2% decline.

No withdrawals but

The ETH 2.0 deposits account for nearly 11% of the cryptocurrency’s circulating provide.

Ethereum holders have frequently deposited their cash into the Beacon Chain contract as they give the impression of being to learn from the rewards of working a validator. To achieve this, a staker must deposit 32 ETH, with solo staking in addition to pool staking obtainable.

But there isn’t a withdrawal of staked ETH as but. All that holders who purchased and staked close to the ATH can do is watch because the bear market wipes out their token’s worth.

Notably, deposits into the ETH 2.0 contract have fallen in current months. During the bull market, every day volumes ranged from 500 to 1,000 in 32 ETH deposits.

That has dropped considerably, with weekly averages now at round 122 per day.