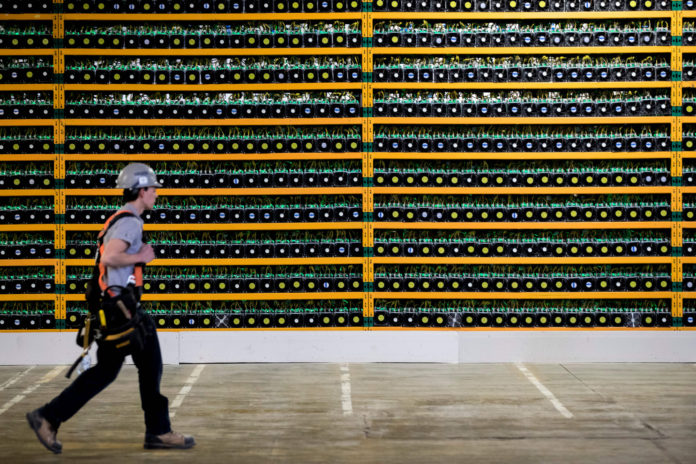

Bitcoin mining profitability has been dropping together with the market decline. The money stream from the mining rigs has grow to be more and more stunted over time, inflicting bitcoin miners to start promoting their holdings to cowl the price of their operations. But at the same time as this rages on, there’s a larger difficulty that might threaten the restoration that BTC has made to this point, which is the truth that bigger miners could also be pressured to liquidate their holdings.

Bitcoin Miners Can’t Meet Up

Usually, bitcoin miners are identified for holding the cash that they understand from their actions. Since miners should not shopping for the cash within the first place, it makes them the pure web sellers of bitcoin. However, their tendency to carry these cash has typically seen them having to dump their luggage onto struggling markets. So as a substitute of truly promoting in a bull, they have an inclination to carry till the bull market is over and with profitability down in a bear market, are pressured to promote cash to finance their operations.

Related Reading | Bitcoin Recovery Wades Off Celsius Liquidation, But For How Long?

The similar is the situation that’s at the moment enjoying out available in the market. With bitcoin greater than 70% down from its all-time excessive worth, miners are nowhere near as worthwhile as they have been again in November 2021. In the primary 4 months of 2022, it’s reported that public mining corporations have needed to offload about 30% of their BTC gotta from mining. This meant that the miners have been having to promote extra BTC than they have been producing within the month of May.

Given that the market in May was considerably higher than in June, it’s anticipated that the miners must ramp up promoting. This would probably see miners promoting all of their BTC manufacturing for the month alongside the BTC that they already held previous to 2022.

BTC miners promoting off holdings | Source: Arcane Research

Implications Of A Sell-Off

It is vital to notice that bitcoin miners are among the largest bitcoin whales within the area. This implies that their holdings have the potential of being a serious market mover when dumped on the similar time. These miners maintain as giant as 800,000 BTC collectively with public miners accounting for simply 46,000 BTC of that quantity.

What this implies is that if bitcoin miners are pushed to the wall the place it triggers a mass sell-off, the value of the digital asset would have a tough time holding up in opposition to it. The huge sell-side strain it will create would push the value additional down, probably being the occasion that may see it contact its eventual backside.

Declining costs forcing miners to promoting BTC | Source: BTCUSD on TradingView.com

The behaviors of the general public miners can typically assist level to if an enormous sell-off is imminent. These public corporations solely account for about 20% of all bitcoin mining hashrate but when they’re pressured to promote, then it’s probably that non-public miners are being pressured to promote.

Related Reading | Gold Proves To Be A Safe Haven Asset Amid Bitcoin Crash

Short-term restoration on the a part of bitcoin can push again this sell-off. However, it can solely be a short-lived reprieve as power prices are fixed and a few machines, specifically the Antminer S9, have now grow to be cash-flow damaging. To survive the bear market, miners would merely don’t have any alternative however to dump some BTC to climate the storm.

Featured picture from Newsweek, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional humorous tweet…