Bitcoin is again above $20,000 after seeing some reduction in the course of the weekend. The primary crypto by market cap dropped beneath its 2017 all-time excessive as promoting strain elevated pushed by the present macro-economic surroundings.

Related Reading | Bitcoin Derivatives Exchange Reserve Surges Up As BTC Continues To Plunge

At the time of writing, Bitcoin (BTC) trades at $20,500 with a 6% revenue within the final 24 hours. The final seven days report a distinct story with a 24% loss.

Former BitMEX CEO Arthur Hayes claims an institutional pressured vendor triggered the rise in promoting strain. An entity that was pressured to liquidate its positions as BTC’s value trended additional draw back.

Hayes believes that Canada’s Bitcoin Purpose Exchange Traded Fund (ETF) was probably chargeable for the draw back value motion. The funding car is settled by bodily BTC and, according to Purpose, when a shopper buys the ETF, they’re shopping for “real Bitcoin”.

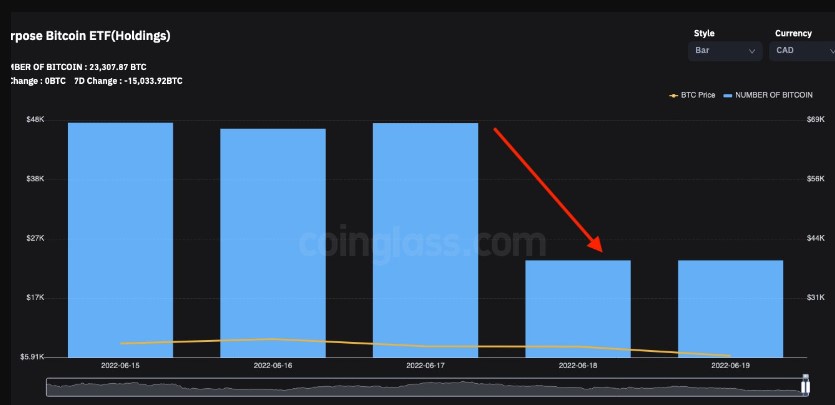

The former BitMEX CEO claimed he’s unfamiliar with this ETF’s redemption course of. However, the funding car seems to have dumped 24,500 BTC into the market, as seen beneath.

This represents nearly 50% of the ETF’s property, if the BTC was offered in a rush, it appears logical that Bitcoin misplaced help at round $20,000 and was pressured to commerce decrease with the remainder of the crypto market. Buyers confirmed up and absorbed the draw back value motion.

This enabled Bitcoin to reclaim the $20,000 space and confirmed that Bitcoin will get bough shortly beneath these ranges. Hayes stated the next concerning the situations that took BTC’s value to contemporary lows, and why it skilled reduction:

Over the weekend, whereas the fiat rails are closed, $BTC dropped to a low of $17,600 down nearly 20% from Friday on good quantity. Smells like a pressured vendor triggered a run-on stops. After the sellers dumped their luggage, the market shortly rallied on low quantity.

Why Bitcoin Could See More Pain

The preliminary response to the draw back strain was good, however as Hayes defined, it occurred throughout a low weekend with low quantity throughout trade platforms. The crypto market might see BTC’s value taking one other swing on the lows. The former CEO stated:

Given the poor state of threat administration by cryptocurrency lenders and over beneficiant lending phrases, count on extra pockets of pressured promoting of $BTC and $ETH because the market figures out who’s swimming bare.

Related Reading | TA: Bitcoin Recovery Stalls Near Key Juncture, Key Resistance Intact

As this construction, which contributes to spikes in promoting strain, stays intact bears might proceed pushing B’C’s value down. In the meantime, long-term gamers have a possibility to extend their holdings, Hayes concluded:

Is it over but … I don’t know. But for these expert knife catchers, there could but be further alternatives to purchase coin from those that should whack each bid regardless of the worth.