On-chain information exhibits the Bitcoin reserve of by-product exchanges has surged up not too long ago as the value of the crypto has continued to crash down.

Bitcoin Derivatives Exchange Reserve Observes Sharp Uptrend

As defined by an analyst in a CryptoQuant post, the crashing BTC value could also be forcing whales and long-term holders to open brief positions as a way to hedge their portfolios.

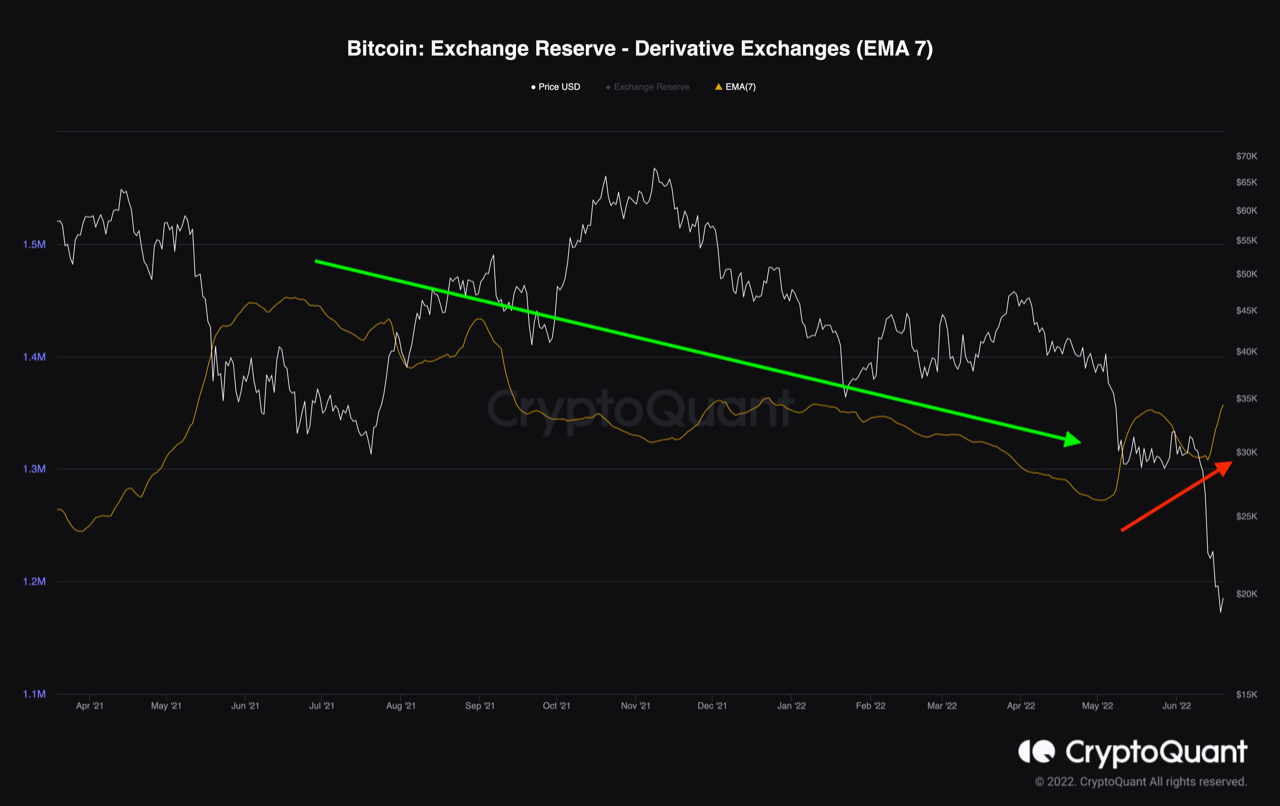

The “derivative exchange reserve” is an indicator that measures the overall quantity of Bitcoin at present current on wallets of all by-product exchanges.

When the worth of this metric goes up, it means cash are coming into into by-product exchanges proper now. Such a development might imply traders are opening leveraged positions in the intervening time, which may end up in greater volatility within the worth of the crypto.

On the opposite hand, a downtrend within the indicator implies traders are withdrawing their cash from these exchanges at present.

Now, here’s a chart that exhibits the development within the Bitcoin by-product alternate reserve over the previous 12 months:

The EMA 7 worth of the metric appears to have noticed some uptrend not too long ago | Source: CryptoQuant

As you may see within the above graph, the Bitcoin by-product alternate reserve had been heading down for fairly some time, till not too long ago when the indicator’s worth as soon as once more began rising up.

Recent information means that the crash within the coin’s value has pushed round 50% of the overall BTC provide into loss. Based on this, many long-term holders and whales are additionally sure to be underwater proper now.

Related Reading | Bitcoin Breaches $19K Level – Will Selloff Continue? What’s The Next Bottom?

The quant believes that the uplift within the by-product reserve is due to these long-term holders and whales panicking about their portfolios dropping worth.

These holders want to hedge their portfolios and scale back threat by opening brief positions on by-product exchanges.

The analyst factors out, nonetheless, that such aggressive shorting would create much more promoting strain, inflicting the value to see additional drawdown.

Related Reading | Bitcoin Long-Term Holders Now Own Nearly 80% Of Realized Cap

But one other chance additionally arises from this case, and that may an enormous brief squeeze. Quite a lot of demand and a sudden reversal within the value of Bitcoin might want to happen earlier than such an occasion can happen.

The quant thinks it might take extra time and additional decline within the worth of the crypto for the right situations to align for it.

BTC Price

At the time of writing, Bitcoin’s price floats round $19.3k, down 29% within the final seven days. Over the previous month, the crypto has misplaced 33% in worth.

Looks like the worth of BTC has rebounded again somewhat after a dip beneath $18k | Source: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com