On-chain knowledge reveals the Bitcoin trade whale ratio has remained at a excessive worth not too long ago, an indication that could possibly be bearish for the crypto’s worth.

Bitcoin Exchange Whale Ratio On Verge Of Entering “Very High Risk” Zone

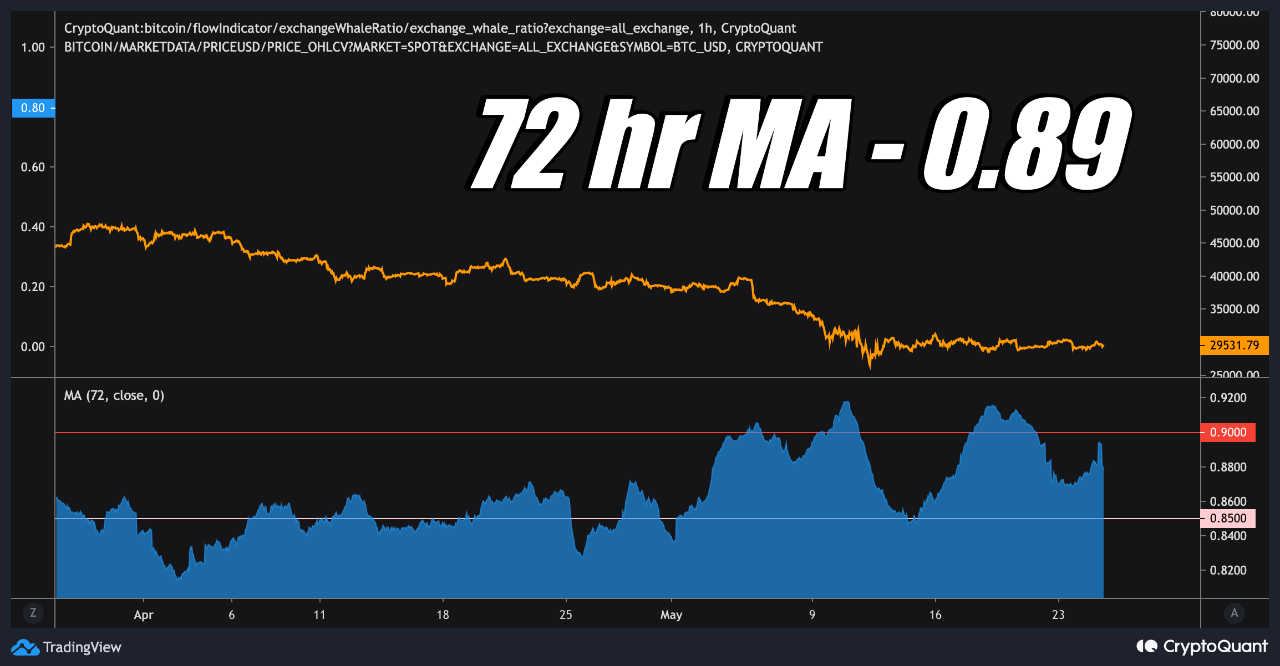

As defined by an analyst in a CryptoQuant post, the 72-hour MA whale ratio is close to 0.90, the very excessive threat zone.

The “exchange whale ratio” is an indicator that’s outlined because the sum of high ten inflows to exchanges divided by the whole inflows.

In easier phrases, this metric tells us what a part of the whole inflows are contributed by the ten largest transactions, which generally belong to the whales.

When the worth of this indicator is above 0.85, it means whales occupy a really massive share of trade inflows proper now.

As traders normally switch their Bitcoin to exchanges for promoting functions, such a pattern is usually a signal that whales are dumping for the time being.

The indicator’s worth normally stays above this threshold throughout BTC bear markets, or faux bull for mass dumping.

Related Reading | Bitcoin Trading Volume Plummets Down From Recent Top

On the opposite hand, values under the 0.85 mark normally signify that whale inflows are at present in a more healthy steadiness with the remainder of the market. The ratio’s worth normally stays on this area throughout bull runs.

Now, here’s a chart that reveals the pattern within the Bitcoin trade whale ratio (72-hour MA) over the previous couple of months:

It appears just like the indicator has been at a excessive worth not too long ago | Source: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin trade whale ratio has a price of about 0.89 proper now, above the 0.85 threshold.

According to the quant within the put up, values above 0.90 could also be thought-about the “very high risk” zone. So, the present worth of the indicator could be very near that.

Related Reading | Investors May Expect Downside For Bitcoin And Ethereum Market For The Next 3 Months

In this month thus far, the ratio’s worth has nearly at all times remained above the 0.85 line, with a few spikes above the 0.90 degree.

The analyst believes whales are lively proper now because of the FED May Meeting Minutes, and if the ratio stays excessive within the close to future, then it might spell hassle for Bitcoin.

BTC Price

At the time of writing, Bitcoin’s price floats round $28.8k, down 2% within the final seven days. Over the previous thirty days, the crypto has misplaced 30% in worth.

The under chart reveals the pattern within the worth of the coin over the past 5 days.

Seems like the worth of the coin has plunged down over the past couple of days | Source: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com