Now that the mud has settled from the spectacular Terra collapse, I believed it could be attention-grabbing to dive into the DeFi house and see how the shake-up has affected different protocols. DeFi surged to prominence in 2020, or in order for you to get down with the lingo, throughout a interval recognized as “DeFi Summer”.

Since then, it has cooled slightly bit – yields dropped throughout the house as the market grew to become slightly extra environment friendly, which is smart. Well, there was nonetheless a reasonably juicy yield obtainable on the Anchor protocol, truly – a salivating 20% – however I heard on the grapevine that it didn’t finish so effectively.

As the above graph from DefiLllama reveals, Anchor complete worth locked (TVL) plummeted from $18 billion to inside a rounding error of zero. If you hit “Play Timeline” within the prime left nook of the graph beneath, you will notice the TVL for the whole Terra blockchain, which till a few weeks in the past had a snug maintain on second, second to solely Ethereum. How the mighty have fallen.

Guess Whose Back, Back, Back, Back Again

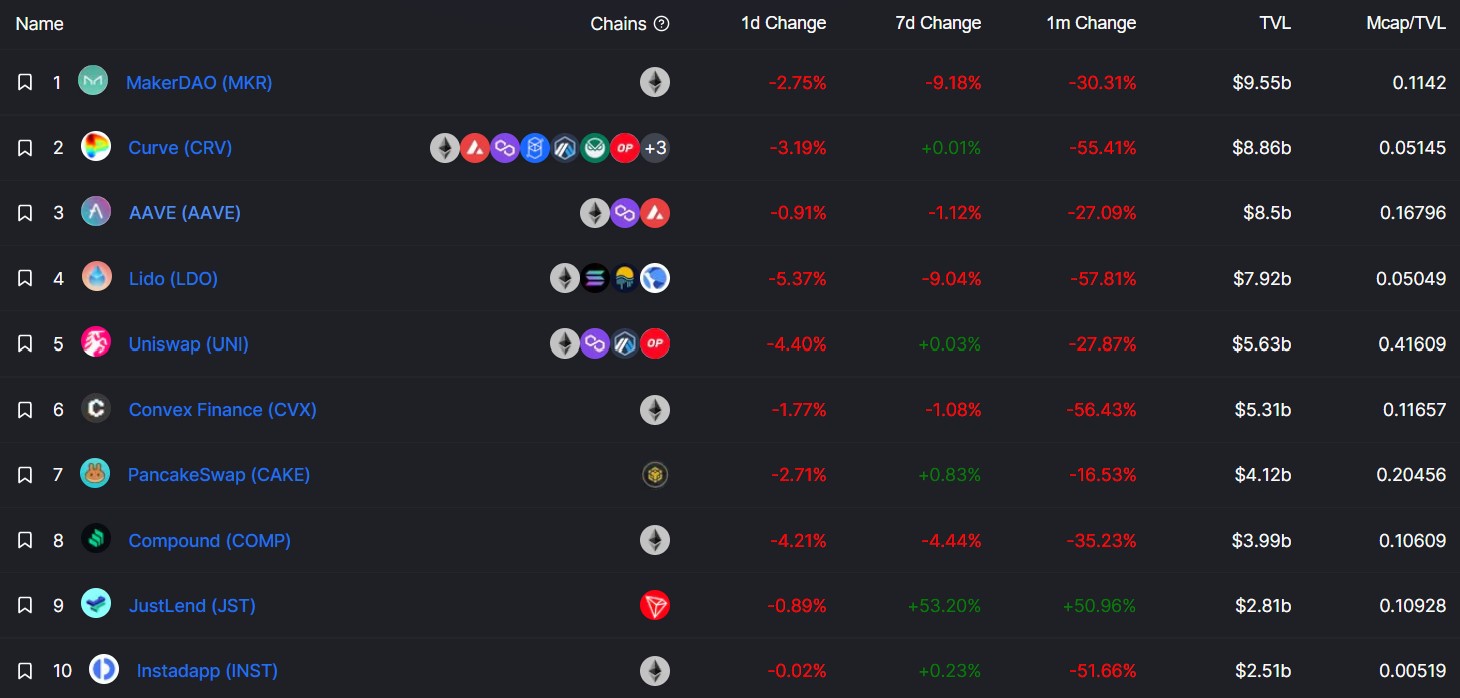

So how have the rankings shaken up? Well to reply Eminem’s query, it’s the suddenly-rather-smug trying DAI stablecoin that’s back, back, back, back once more. MakerDAO is King of the Hill as soon as extra, with $9.5 billion in TVL putting it as the number one protocol, following the curious case of Anchor’s vanishing $18 billion.

It’s a merciless however logical twist of irony, after all, as MakerDAO had launched the primary decentralised stablecoin to obtain real prominence– DAI. While my Editor Joe KB urged on our newly-launched CoinJournal podcast final week that Americans don’t do irony, I’m positive this wasn’t misplaced on anybody.

For the uninitiated, DAI shares that seductive high quality of decentralisation with the befallen TerraUSD. DAI advocates will likely be screaming as loud as they’ll, nevertheless, that there’s additionally one crucial distinction – DAI is collateralised.

To give a handy guide a rough clarification, DAI is created when customers borrow in opposition to locked collateral. Conversely, it’s destroyed when that mortgage is repaid, when the consumer concurrently regains entry to the locked collateral. It’s virtually nauseating how a lot sense it makes in comparison to TerraUSD, however nonetheless, it was dropping important market share to all issues Terra, with founder Do Kwon not pulling any punches in his conflict in opposition to this logical stablecoin.

By my hand $DAI will die.

— Do Kwon ???? (@stablekwon) March 23, 2022

Curve and Aave are the 2 protocols behind MakerDAO on this new-look prime three. Similarly, additionally they current as old-timers, maybe “less sexy” protocols than the admittedly dazzling, if inherently flawed, Anchor protocol was. The TVL on each is analogous at $8.9 billion and $8.5 billion respectively. I believed the CEO and founding father of Yield App, Tim Frost, had attention-grabbing ideas right here when he stated the beneath:

“It’s heartening to see Maker DAO, the unique decentralised stablecoin undertaking, return to the highest spot by way of complete worth locked (TVL) this week. According to knowledge from Defi Llama, Maker DAO – the house of US dollar-pegged stablecoin DAI – is posting a TVL of practically $10 billion as of Wednesday. While 30% down from the place it was final month, this marks a grand achievement for considered one of DeFi’s oldest initiatives and a heartening sign for the whole trade.

He went on to say that “these top-three DeFi survivors (MakerDAO, Curve and Aave) really do represent the cream of the crop, providing a snapshot of the industry’s evolution from its earliest days in 2014 to today. It also shows how important solid development, track record, and reputation are in this industry. These projects were developed during the bear markets of 2018”

Final Thoughts

Frost is true on the cash together with his feedback. And whereas general DeFi TVL has plummeted consistent with the latest market downturn, that was at all times going to be the case. It stays a extremely experimental space in what’s out of the blue an aggressively risk-off market. But these three huge canine, if I can use that scientific language, do boast the closest factor to a good observe document that one can discover within the trade of DeFi, which has solely been round since 2018.

There’s a parable right here, actually, and it’s seen time and time once more throughout all asset courses and markets. We’ve been via a interval of intoxicating growth, the place everybody and their grandmother has been ready to make money. I’m fairly positive my grandmother’s monkey even 3Xd his crypto portfolio through the bull run.

But with the cash printer slowing, charges mountaineering and a laundry record of different bull components that I fairly merely shouldn’t have the vitality to kind proper now, the demand has been sucked out of the financial system. A pure flush of all of the froth was badly wanted, and we’re smack bang in the course of a correction throughout the house.

Flash within the pans like Anchor simply grow to be the most recent story of bubble hysteria gone incorrect. If that is the dot-com bubble bursting, the established names like MakerDAO, Curve and Aave are finest positioned to be the Amazons and rise from the ashes, at any time when we do get back on observe. Sometimes much less attractive is an effective factor. At least that what I inform my mirror within the morning after a late evening spent observing crimson candles on my laptop display screen.