Data reveals the Bitcoin complete transaction charges have continued to be at traditionally low values regardless of a spike throughout LUNA’s collapse lately.

Bitcoin Transaction Fees Have Moved Sideways Since July 2021

As per the most recent weekly report from Glassnode, the whole transaction charges on the BTC community has been very low for nearly a yr now.

The “total transaction fees” is a measure of the sum of the charges that every person on the community is paying for each transaction on the Bitcoin blockchain.

Miners decide up transactions based mostly on which of them will likely be extra worthwhile to deal with in the mean time. Transactions hooked up with excessive charges are naturally picked up first.

During durations of excessive community demand (that’s, a excessive quantity of transactions happening), the mempool will get congested.

This means some transactions could also be caught for some time as miners take their time to get by means of the congested mempool.

Related Reading | Untethered: Top Stablecoin USDT Dominance Begins To Decline

So, in durations like these, customers who need their transfers prioritized begin paying a better price. More and extra customers be part of them and the typical transaction price shoots up.

When demand on the Bitcoin community is low, nevertheless, there isn’t such cutthroat competitors anymore, and costs naturally get decrease.

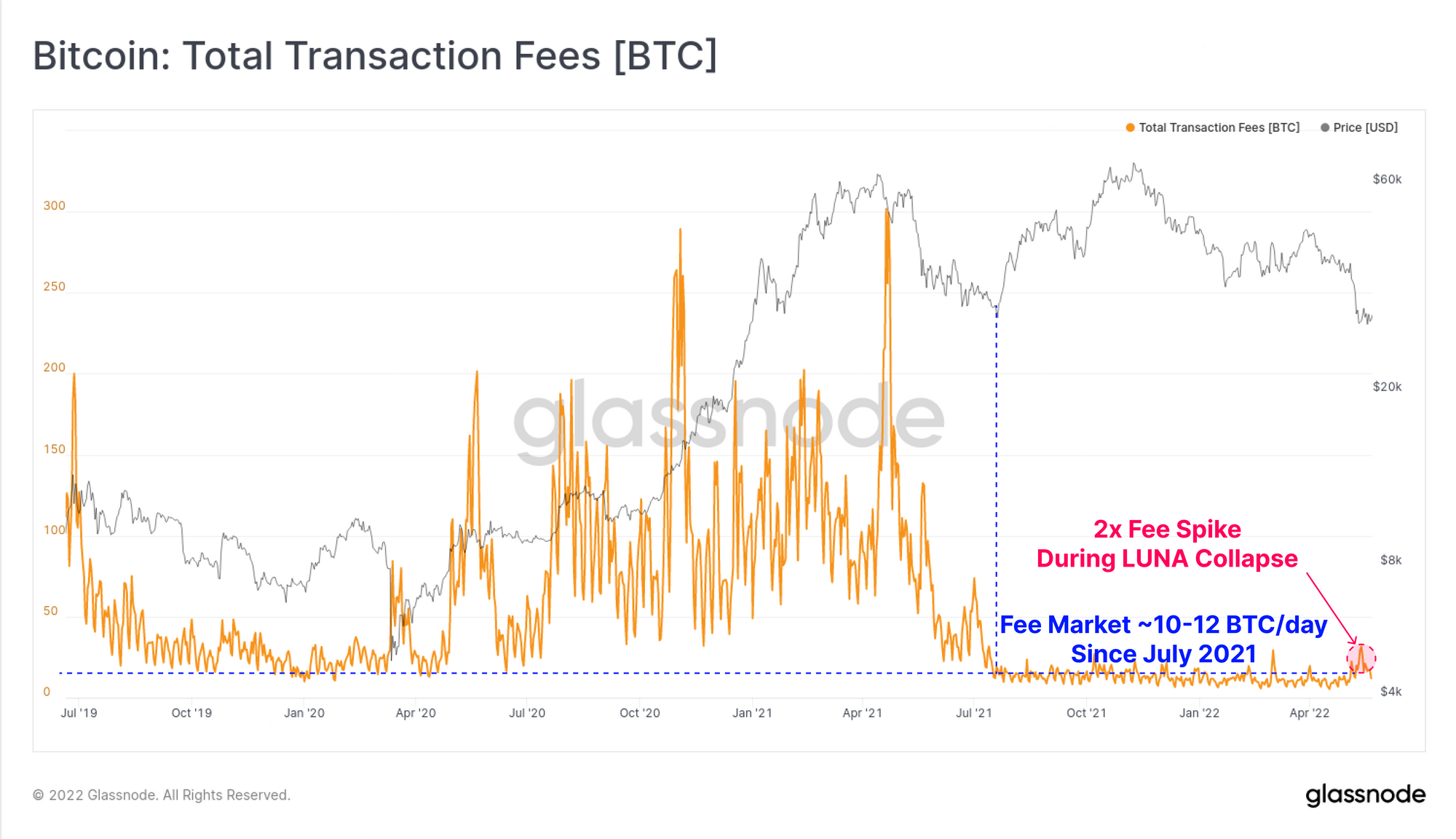

Now, here’s a chart that reveals the pattern within the complete transaction charges on the BTC blockchain throughout the previous few years:

Seems like the worth of the metric noticed a small spike lately | Source: Glassnode's The Week Onchain - Week 21, 2022

As you may see within the above graph, the whole Bitcoin transaction charges has been very low, simply round 10 to 12 BTC per day, for the reason that July of final yr.

The indicator’s worth did shoot up lately following the collapse of LUNA and UST, and the market chaos that ensued.

Related Reading | Stripe And Primer Go Lightning: New Bitcoin Payment Solutions Via OpenNode

This spike doubled the transaction charges, however regardless of this enhance, the charges nonetheless remained a lot decrease than what was seen throughout 2020 and first half of 2021.

An impact of this low transaction charges has been that Bitcoin miners’ revenue has additionally been fairly low in latest months.

At the second, it’s unclear when the charges could observe any revival. One factor is for positive, a excessive demand for blockspace will have to be there for the charges to see any vital motion.

BTC Price

At the time of writing, Bitcoin’s price floats round $29.1k, down 1% within the final seven days. The beneath chart reveals the pattern within the worth of BTC over the past 5 days.

Looks like the worth of BTC has sunk over the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, Glassnode.com