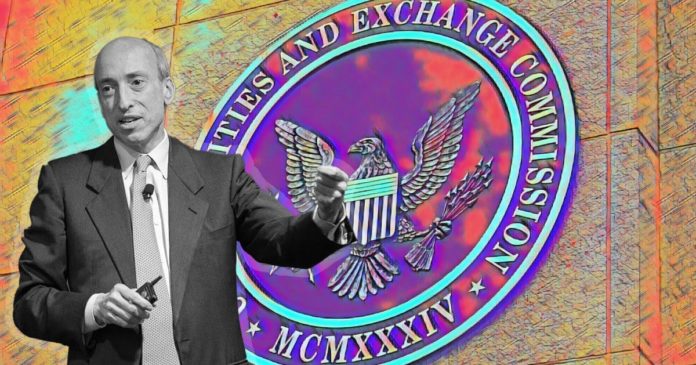

SEC chair Gary Gensler stated efforts are on to get a majority of the crypto preliminary coin choices registered, in coordination with the crypto exchanges. He was talking on the Congressional price range request questioning for FTC and SEC on Wednesday.

Gensler stated a majority of the coin choices come below the SEC’s securities law. The tokens might be introduced below regulatory framework by deploying the SEC’s enforcement instruments, he stated.

The SEC chair stated public from all communities is just not properly protected, responding to a query over black minorities having probably the most to lose from the speculative crypto trade.

On a broader regulatory motion of the volatility within the crypto market, Gensler stated the SEC is overseeing the issuance market that produced round 8,000 crypto tokens.

SEC’s Crypto Jurisdiction

Also, he stated there may be a really small variety of commodity tokens, together with Bitcoin, on which the Commodity Futures Trading Commission (CFTC) can have jurisdiction.

“Bitcoin is a commodity token and that could be a very large market value. But the SEC has jurisdiction over probably the best number of these tokens.”

According to the U.S. Commodity Exchange Act, digital currencies like Bitcoin are recognised as commodities. Reiterating the SEC’s place, Gensler acknowledged that the cryptocurrencies are extremely speculative and risky property. “Dare I say that the public (individual investors) are not protected.”

‘Speculative Crypto Marketplace’

In his opening statement, the SEC chair stated the extremely risky and speculative crypto market has mushroomed, attracting tens of thousands and thousands of American traders and merchants.

“In 2016, there were an estimated 644 crypto tokens on the worldwide market. Five years later, that number had gone up more than tenfold. The volatility in the crypto markets in recent weeks highlights the risks to the investing public.”

Gensler acknowledged further assets will strengthen the SEC’s litigation help, bolster the capabilities of the Crypto Assets and Cyber Unit. Besides, it’s going to assist examine the tens of hundreds of ideas, complaints, and referrals we obtain from the general public, he added.

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.