Buy the hearsay, promote the information.

The Ethereum Merge was accomplished with no hitch, however costs within the fast aftermath have disenchanted buyers. I dive in shortly right here to take a temperature test on all issues on-chain.

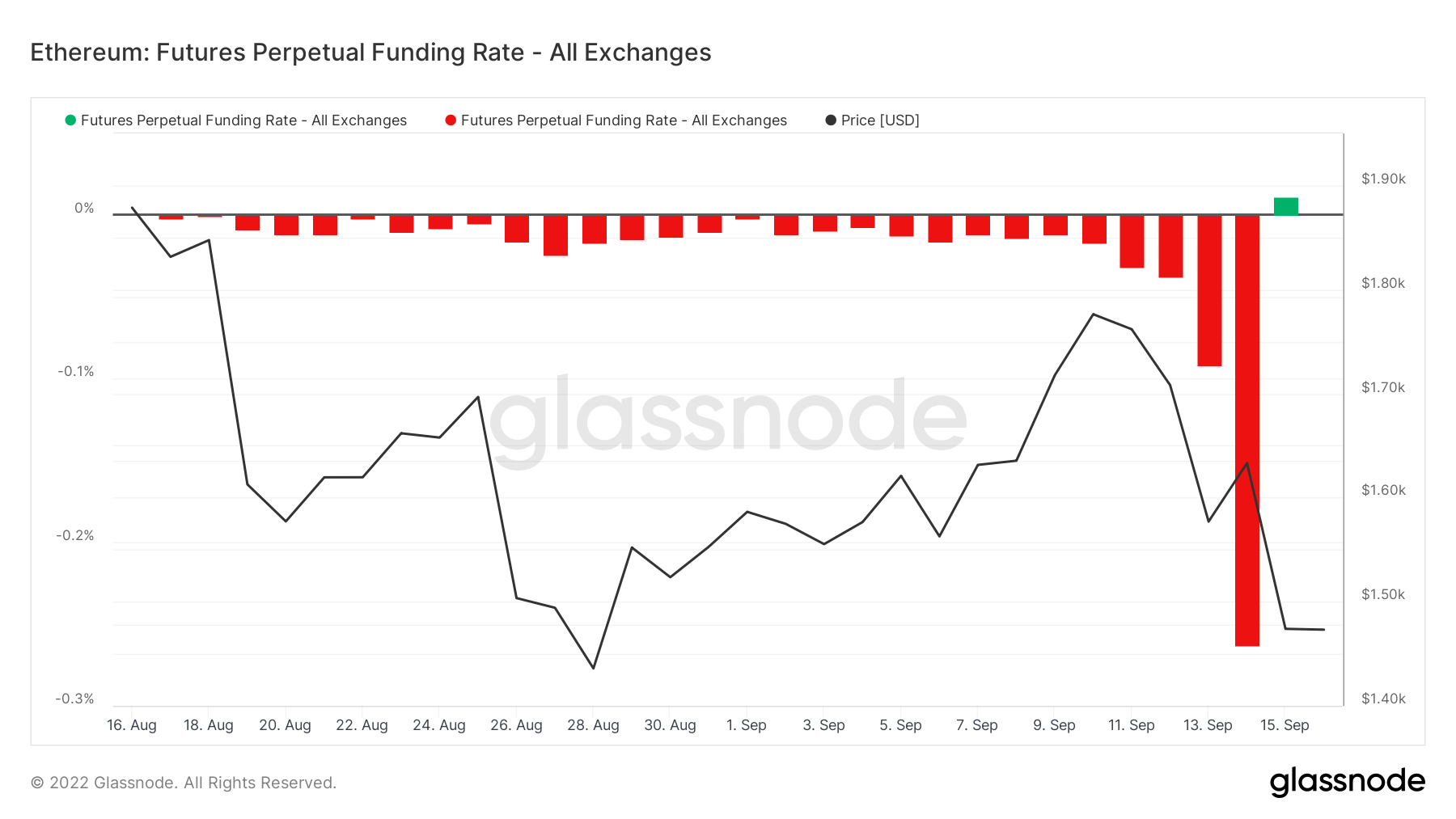

Funding fee turns optimistic

In the run-up to the Merge, funding charges on Ethereum hit all-time lows. This brought about headlines however was to be anticipated. With holders of Ethereum receiving an ETH PoW token, it meant buyers moved to lengthy spot ETH and brief futures in an effort to obtain the token whereas eradicating value publicity.

Given this was an obvious arbitrage alternative, the legal guidelines of straightforward market dynamics dictate that the funding fee has to come back all the way down to mirror the outsized variety of buyers shorting ETH futures into the Merge in an effort to lengthy spot and obtain the ETH PoW token.

Post-Merge, the all-time low funding charges have now reverted to regular ranges – and even turned barely optimistic. So, nothing to see right here and regular service resumed.

Why did Ethereum fall post-Merge?

Why did Ethereum fall post-Merge?

As I ate my breakfast Wednesday morning (toast and a croissant with honey), Ethereum accomplished its Merge – at block 15,337,393, to be exact.

The value of ETH traded at round $1,598 and jumped barely to $1,620, an increase of 1.4%. However, it then pulled again and as I write this over my breakfast on Friday morning (this time oats and blueberries) ETH is buying and selling at $1,470, 8% beneath the extent of the Merge.

And so, the Merge turned out to be a basic sell-the-news occasion. Given Bitcoin is barely buying and selling 2% beneath the extent it was at because the Merge accomplished, there does appear to be some underperformance from ETH.

Options additionally give a touch on the bearish sentiment. There was a volatility smile with a bearish divergence seen within the run-up to the ETH. This signifies that when the strike value was plotted towards implied volatility, there was higher implied volatility (of over 100%) at decrease strike costs – exhibiting merchants had been betting on a sell-the-news state of affairs.

Looking at choices open curiosity by strike value, there have been additionally extra places than calls – that means merchants had been betting on the worth falling somewhat than rising.

Federal Reserve will in the end dictate value

Of course, all this might be overshadowed by the important thing Federal Reserve assembly being held on September 20th and 21st, when the Fed is predicted to announce one other substantial fee hike following the disappointing inflation studying this week.

Nonetheless, it hammers house the purpose that just because there’s a massive occasion within the pipeline doesn’t imply the worth will rise. It’s a fully basic instance of a buy-the-rumour, sell-the-news occasion, one we see within the inventory market on a regular basis.

Having mentioned that, when it comes to Ethereum’s long-term future, the Merge is now previously and it glided by easily. It’s an enormous achievement and really bullish for Ethereum total. Jerome Powell and the financial system simply must cooperate now!

eToro

eToro is among the world’s main multi-asset buying and selling platforms providing among the lowest fee and payment charges within the trade. It’s social copy buying and selling options make it an amazing selection for these getting began.

Bitstamp

Bitstamp is a number one cryptocurrency trade which gives buying and selling in fiat currencies or standard cryptocurrencies.

Bitstamp is a completely regulated firm which gives customers an intuitive interface, a excessive diploma of safety in your digital belongings, glorious buyer help and a number of withdrawal strategies.

Why did Ethereum fall post-Merge?

Why did Ethereum fall post-Merge?