One of probably the most lined criticisms of Ethereum since its creation in 2015 has been its mammoth vitality utilization.

While not as heavy as Bitcoin, it nonetheless consumes 0.2% of the world’s electrical energy, and is liable for between 20% and 39% of cryptocurrency’s electrical energy consumption as a complete (Bitcoin claims between 60% and 70%).

Now – and going ahead – that vitality consumption has fallen 99.95% following the profitable completion of the Merge. It’s an unimaginable achievement.

What is the Ethereum PoW token?

Miners will thus have to discover one other coin to mine. However, some are clinging to hope {that a} fork of Ethereum will keep the Proof-of-Work validation consensus which is able to permit them to proceed to mine.

The PoW token will probably be obtained by way of airdrop to holders of Ethereum, with its value various over the previous couple of days fairly drastically. Peaking as excessive as $60, it presently trades at $18.

How does Ethereum mining work?

Ethereum miners have to date used highly effective computer systems often known as ASICs to validate transactions. With staking, that is now not vital, that means their livelihoods are in query. Many have swapped to different cryptos in order to proceed to mine, and the impact of this may be seen in the hash fee of these different cryptos.

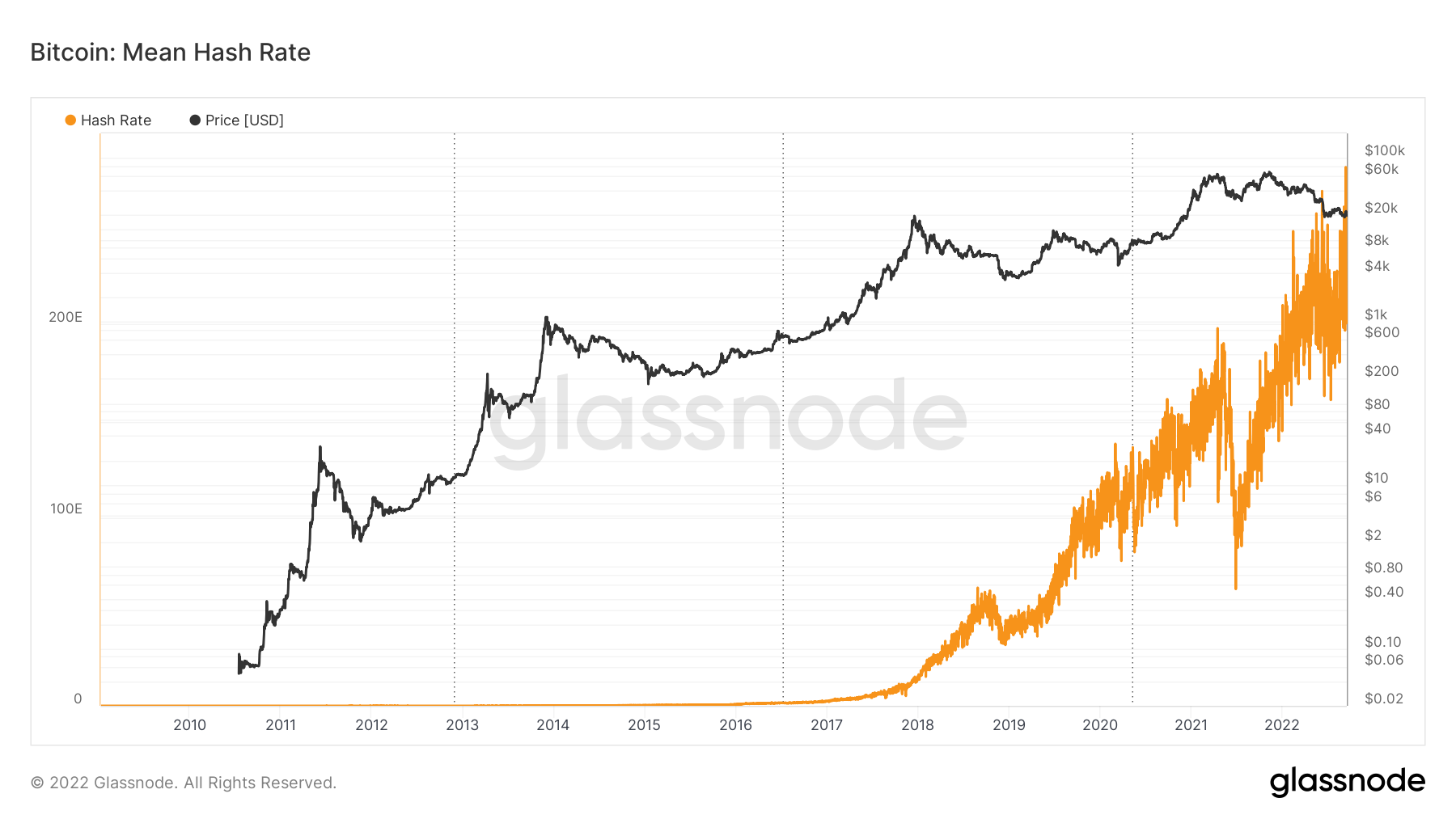

Hash fee is a measure of the computing energy on a community, and is a key safety indicator – the upper the hash fee, the upper the safety, as extra miners have to confirm transactions. For Bitcoin, the hash fee hit an all-time excessive final week.

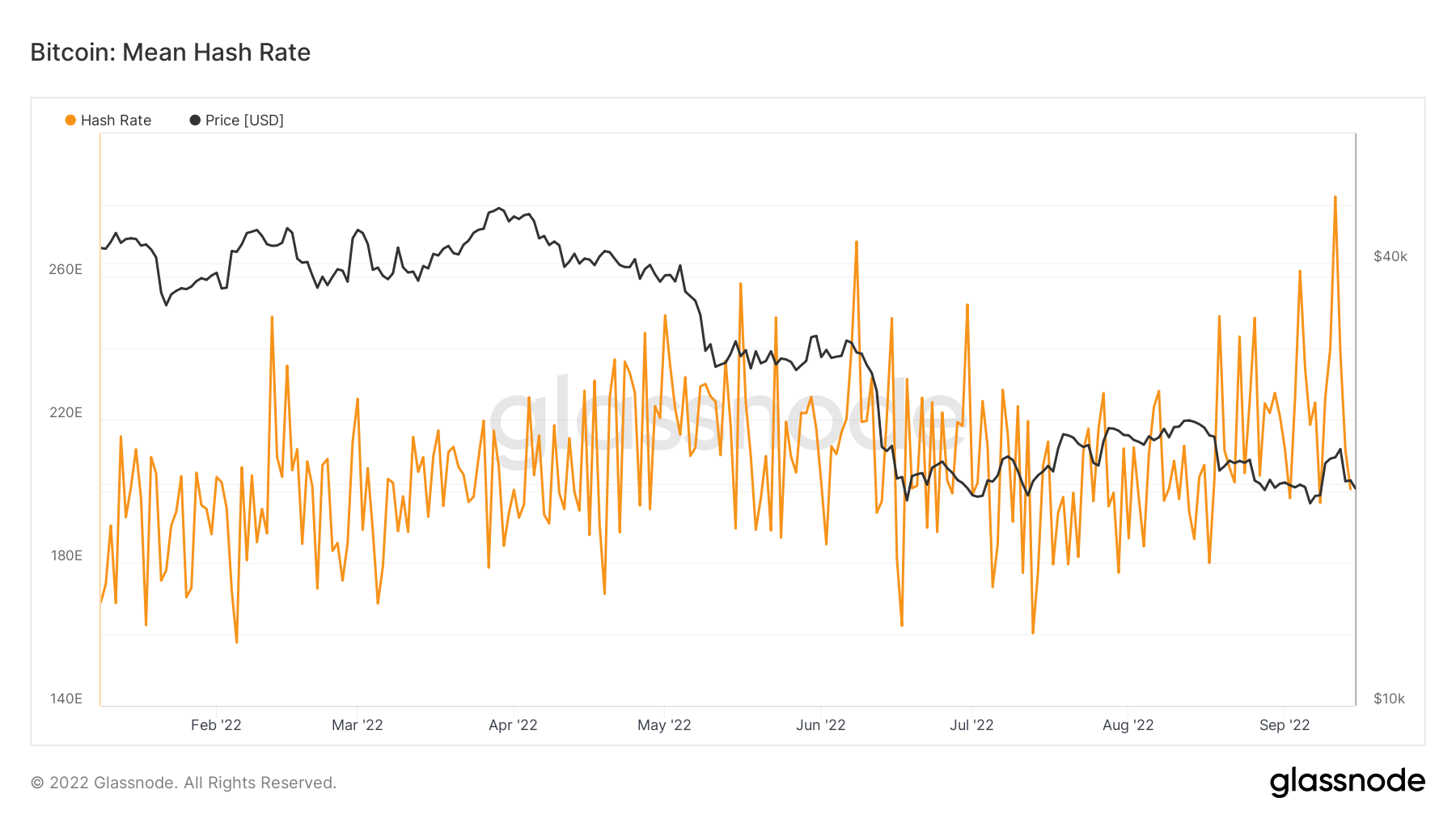

Let’s zoom in on this yr, which can be extra indicative.

This exhibits the hash fee opened the yr at round 170 EH/s, but is now north of 200 EH/s (and hit 280 EH/s earlier this week). This is regardless of the worth of Bitcoin plummeting from the mid $40K’s to beneath $20,000.

Ethereum Classic

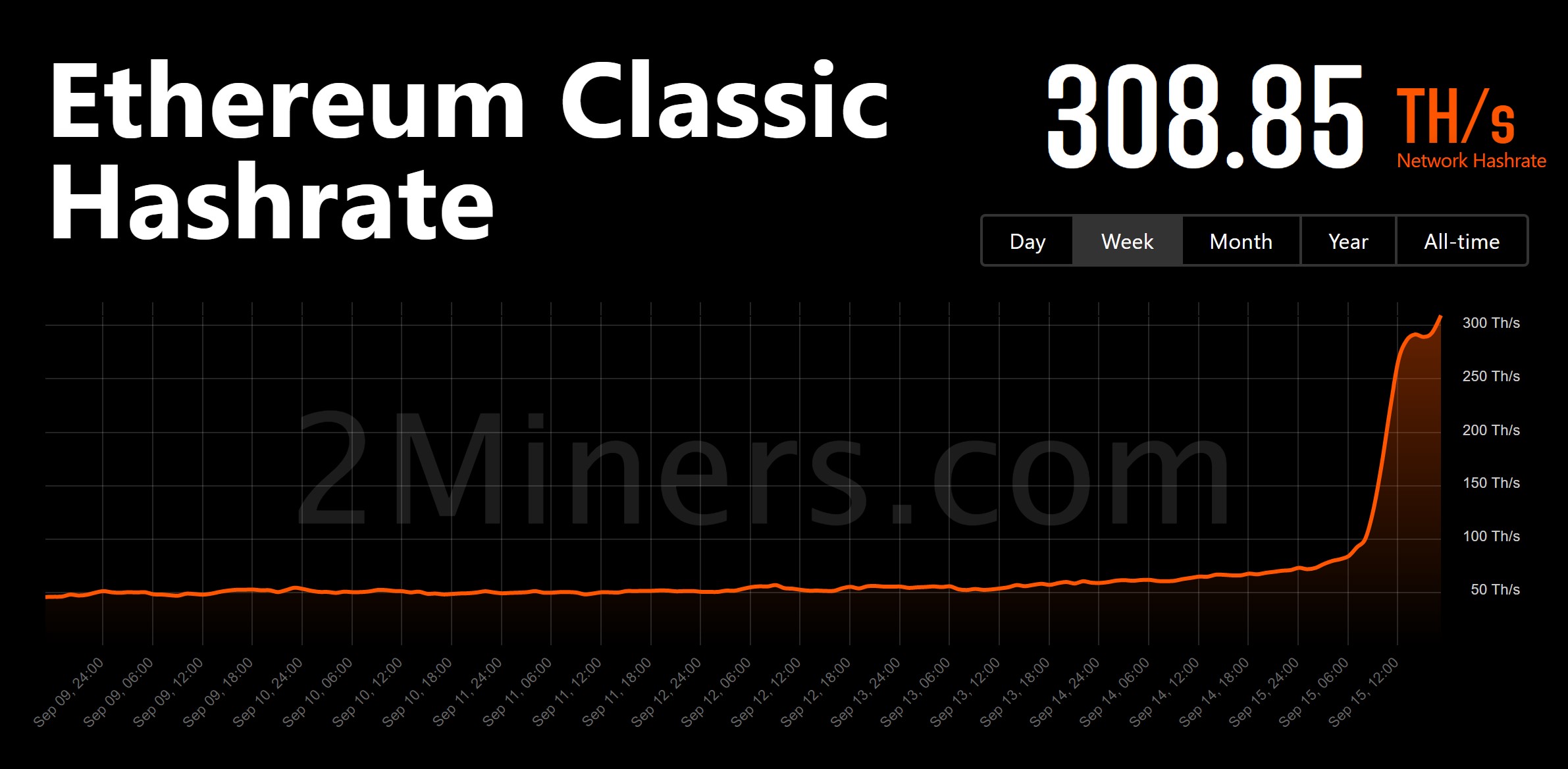

More curiously, nonetheless, is the uptick in hash fee seen on Ethereum Classic. This has been drastic, rising from round 50 TH/s final week to over 300 TH/s. This factors in the direction of Ethereum miners flipping over to the Classic variant with their gear – a a lot simpler shift than can be required to transfer to Bitcoin.

Indeed, different cash have seen upticks in hash fee as properly – Monero, Ravencoin, Ergo, to identify a number of.

Indeed, different cash have seen upticks in hash fee as properly – Monero, Ravencoin, Ergo, to identify a number of.

For the miners that haven’t flipped to alternate options, they are going to maintain out hope that the Ethereum PoW different takes maintain. Otherwise, they’ll be left with costly ASICs and no actual use case, now that Ethereum is Proof-of-Stake and now not producing miner income.