BQX and CRV have the potential for a rise in the direction of the closest resistance space, whereas HEDG has but to interrupt out above lengthy-time period resistance. AVAX is already at an all-time excessive following a parabolic help line, making its place probably the most precarious out of the 5 altcoins.

Biggest Altcoin Movers

During the week of Jan 11-18, the 5 altcoins that elevated probably the most had been:

- HedgeTrade (HEDG) – 275%

- Voyager Token (BQX) – 162%

- Curve Dao Token (CRV) – 154%

- IOST (IOST) – 147%

- Avalanche (AVAX) – 133%

HEDG

HEDG has been following a descending resistance line since reaching a excessive of $3.15 on June 4, 2020. HEDG has validated the road a number of instances up up to now, most not too long ago on Jan. 16, throughout final week’s upward motion.

Despite the numerous enhance, HEDG failed to interrupt out above this line, merely validating the $2.85 space as resistance as soon as extra. Currently, HEDG is again to buying and selling beneath this descending resistance line.

While technical indicators within the every day time-body are nonetheless bullish, the lengthy higher wick and failure to interrupt out is a powerful signal of promoting strain.

Therefore, it’s doable that HEDG drops to the 0.618 Fib retracement stage earlier than doubtlessly making one other breakout try.

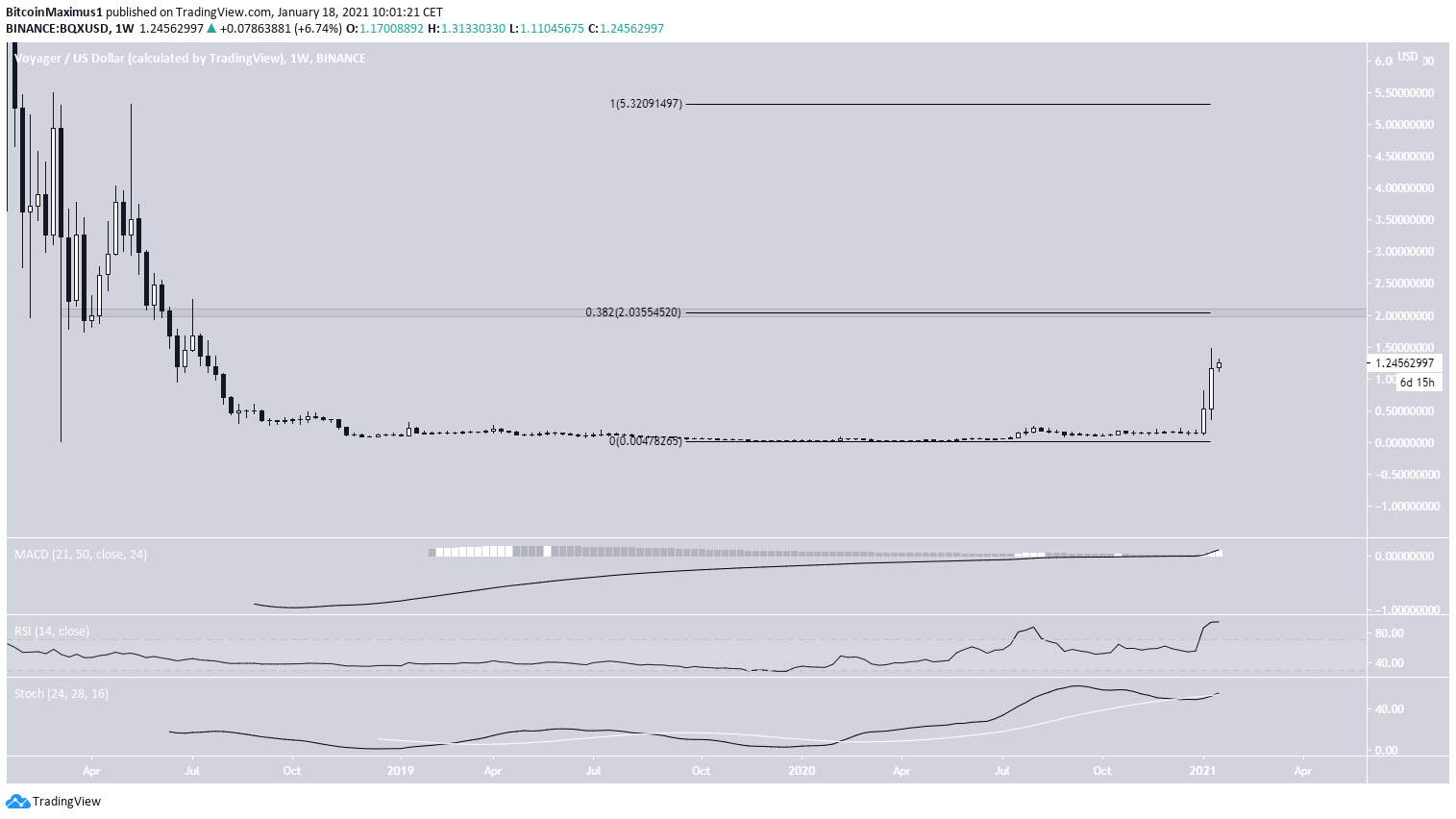

BQX

Beginning on Jan. 4, BQX has had an enormous run-up, growing by 933% within the course of.

Despite such a substantial upward transfer, there isn’t any weak spot in technical indicators but, regardless of all of them signaling that costs are within the overbought territory.

The weekly chart additionally suggests that there’s room for additional will increase. The closest resistance space is discovered at $2.03 (0.382 Fib retracement stage).

Weekly indicators are equally overbought however bullish, supporting the continuation of the upward motion.

CRV

CRV has been growing quickly since breaking out from a descending resistance line and validating it as help on Jan. 11.

Despite the parabolic fee of enhance, technical indicators are nonetheless bullish, although they’re in overbought territory.

The closest resistance space is discovered at $2.27 (0.382 Fib retracement stage). Similar to BQX, CRV is anticipated to succeed in this resistance.

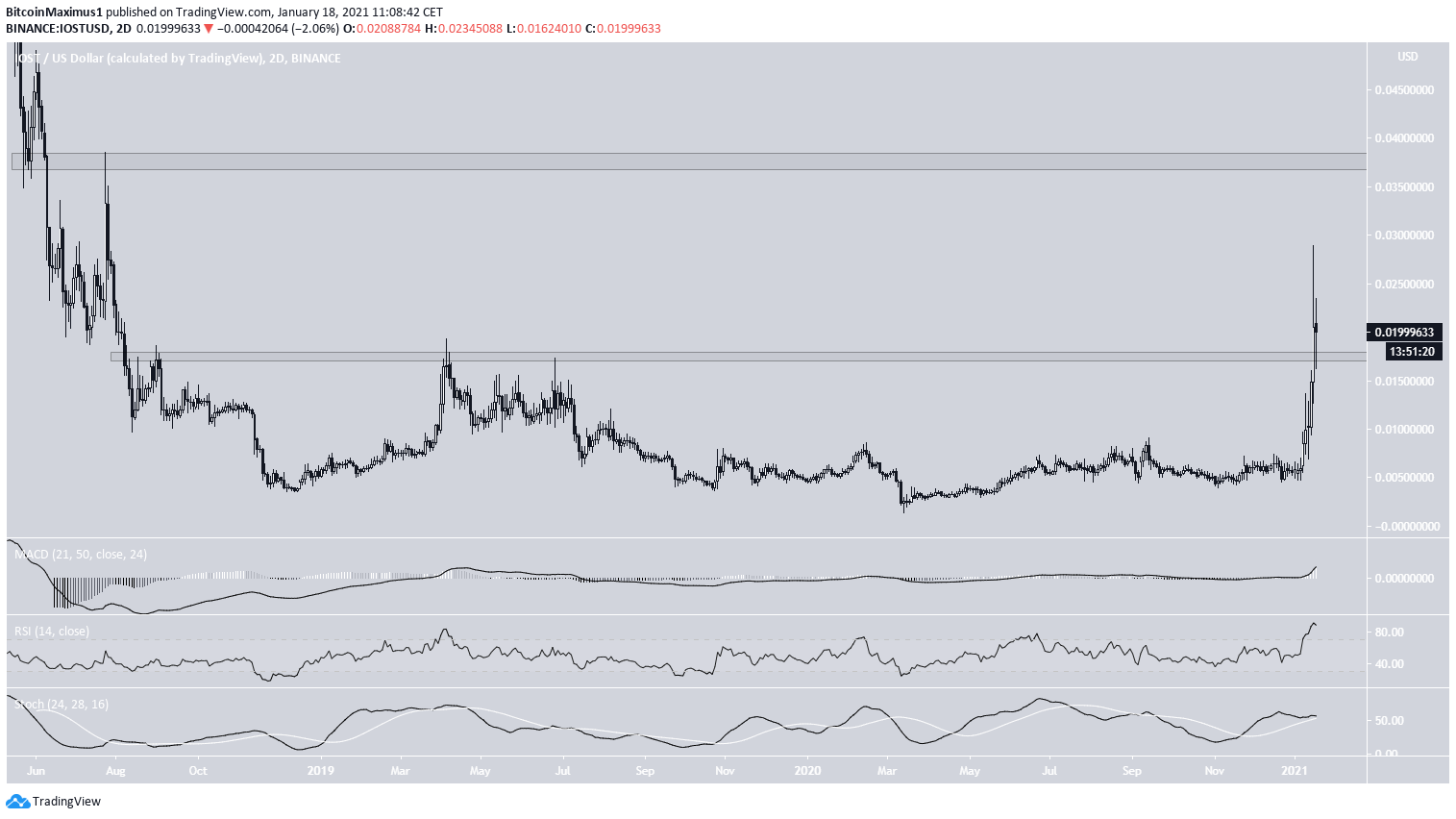

IOST

On Jan. 15, IOST reclaimed the $0.0175 space, which had beforehand acted as resistance for the reason that starting of 2018. IOST validated the realm as help after and has been growing since.

Technical indicators are nonetheless bullish, regardless of being overbought, supporting the continuation of the upward motion.

Therefore, IOST is anticipated to proceed growing in the direction of the closest resistance space at $0.037.

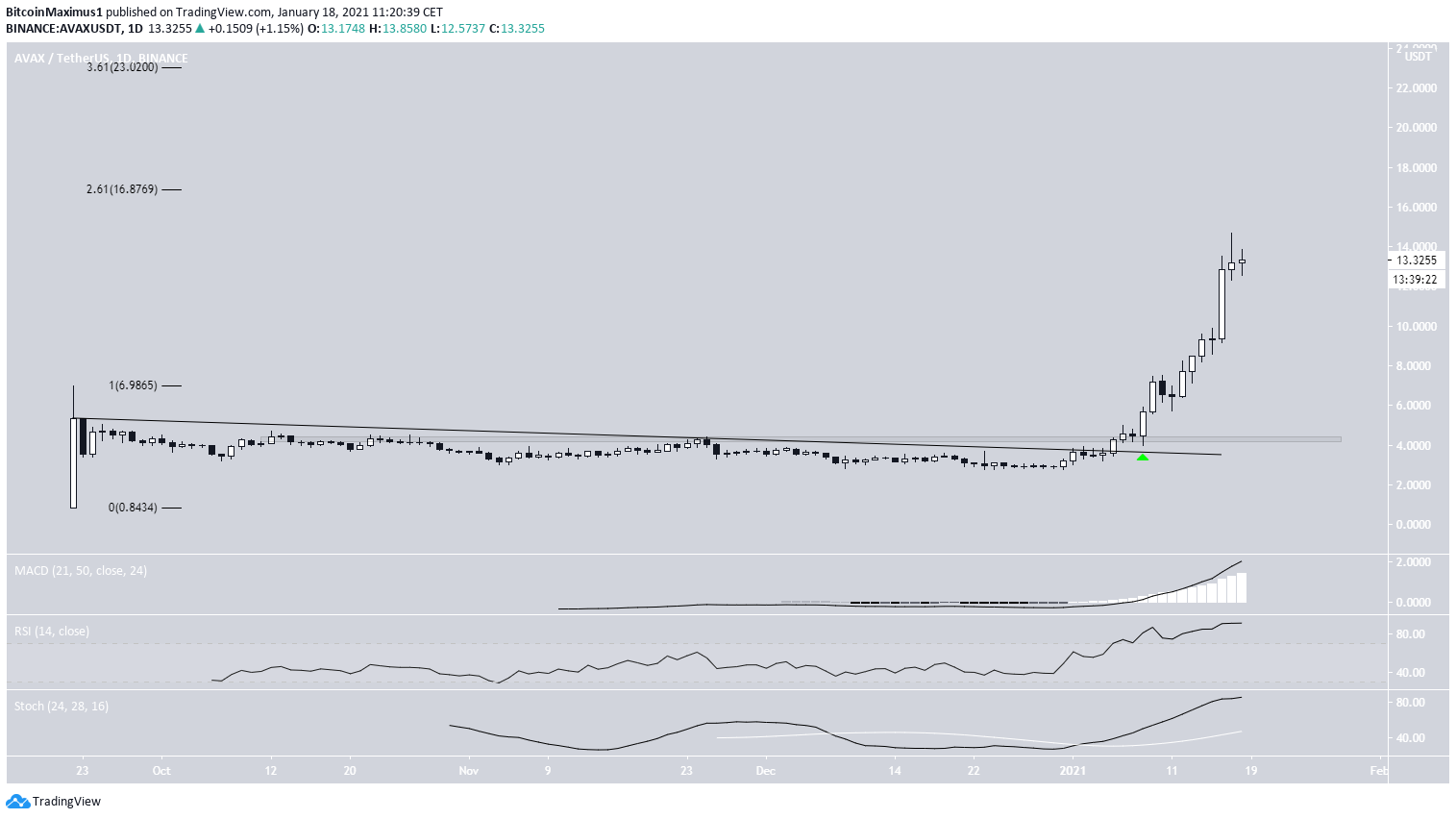

AVAX

AVAX has been growing quickly since breaking out from a descending resistance line and reclaiming a horizontal stage on Jan. 8. Since then, the speed of enhance has grow to be parabolic.

Due to the shortage of help beneath the present worth, the rally appears a bit unstable. Nevertheless, technical indicators are nonetheless bullish, supporting the continuation of the upward transfer.

Due to AVAX being at an all-time excessive, we have to use a Fib extension on the unique upward transfer with a purpose to decide the following resistance areas.

Doing so offers us the $16.87 and $23 ranges as potential resistance areas (2.61 and three.61 Fib extensions respectively).

For BeInCrypto’s newest Bitcoin (BTC) and altcoin analyses, click here!

Disclaimer: Altcoin buying and selling carries a excessive stage of danger and might not be appropriate for all buyers. The views expressed on this article don’t replicate these of BeInCrypto.