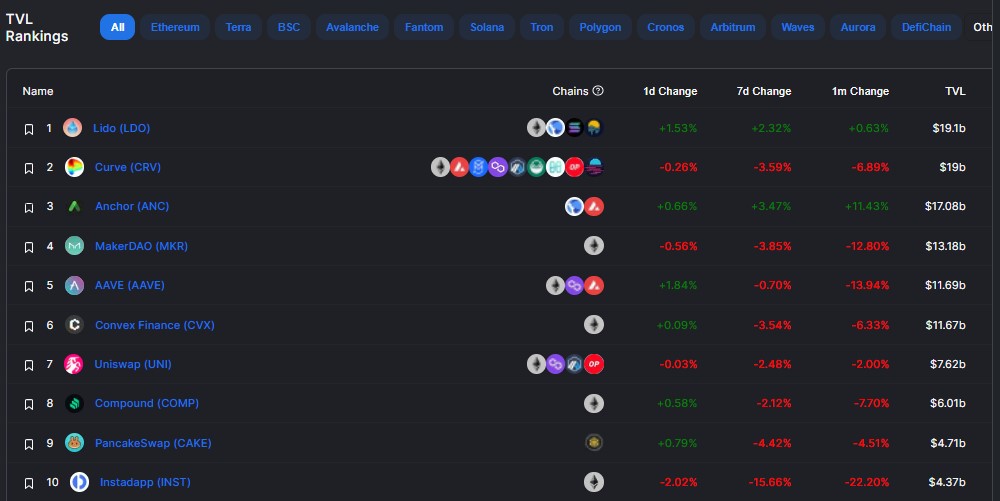

Summary:

- Lido Finance has surpassed Curve finance to grow to be the largest DeFi protocol in phrases of complete worth locked

- Approximately $19.1 billion is locked on Lido Finance in comparison with Curve’s $19 billion

- Lido Finance is offered on the blockchain networks of Ethereum, Solana, Terra, Kusama, and Polygon.

Earlier right now, Lido Finance turned the largest DeFi protocol in phrases of complete worth locked, edging out Curve Finance from the high spot in the course of. At the time of writing, the complete worth locked on Lido Finance stands at $19.1 billion in comparison with Curve’s $19 billion. Anchor comes in third with $17.08 billion, MakerDao fourth with $13.18 billion, and AAVE fifth with $11.69 billion in complete worth locked.

Lido Finance’s Rise in DeFi

Launched in December 2020, Lido Finance has grown to facilitate staking on the 5 networks of Ethereum, Terra, Solana, Kusama and Polygon. Furthermore, $11 billion value of belongings is staked on Ethereum 2.0; $7.142 billion on Terra; $288.722 million on Solana; $2.525 million on Kusama; and $16.175 million on Polygon.

Lido’s imaginative and prescient is ‘to build a staking solution that is fully permissionless and risk-free for the blockchain itself.’ The present roadmap of the undertaking contains adopting Distributed Validator know-how and creating further checks and balances on Lido’s governance. The latter contains straight empowering stETH holders to veto any selections that can be made on the protocol.

stETH is a liquidity token that customers get after they stake their Ethereum into the ETH 2.0 contract by means of Lido in a 1-to-1 ratio. stETH additionally permits its customers to take part in the total Ethereum DeFi ecosystem (Yearn, Curve, Maker, Aave) whereas nonetheless accruing ETH2.0 rewards earned from staking throughout Phase 0.

The workforce at Lido additional explains stETH as follows:

stETH accrues staking rewards no matter the place it’s acquired. This signifies that no matter whether or not you purchase stETH straight from staking by way of stake.lido.fi, buy stETH from 1inch or obtain it from a buddy, it is going to rebase each day to mirror Ethereum staking rewards.

This nullifies the downsides from staking into the Eth2 contract straight: illiquidity, immovability, inaccessibility. Instead of locking up your staked ETH, Lido permits you to put it to make use of so that you don’t want to decide on between Ethereum staking and DeFi participation.