Bitcoin is trending sideways into the lengthy U.S. weekend with the value of BTC compressing round $19,500 and $20,500. The assist across the decrease zone of this vary is perhaps examined because the primary cryptocurrency struggles to protect its present ranges.

At the time of writing, Bitcoin (BTC) trades at $19,900 with a 1.4% revenue over the previous 7 days and sideways value motion within the final 24 hours. BTC’s value is closely underperforming different cryptocurrencies as Ethereum (11%), Cardano (14%), and Polkadot (10%), recorded important income over the identical interval.

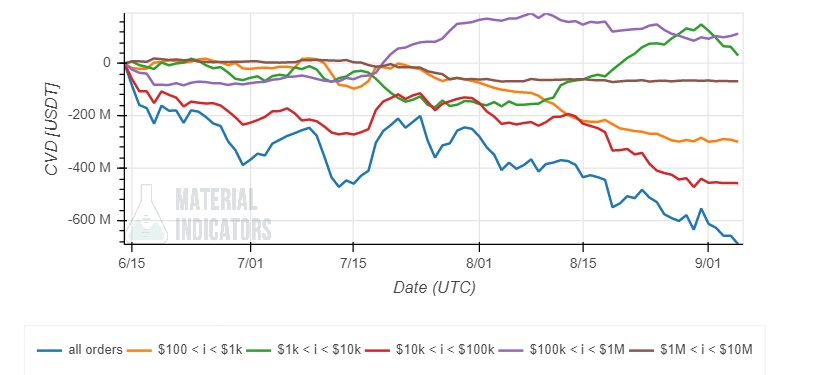

Data from Material Indicators hints at a possible native high for Bitcoin on low timeframes as ask (promote) liquidity will get thicker round its instant ranges. Selling orders have swelled over the previous week as Bitcoin trades sideways and may function as resistance stopping BTC to reclaim the world north of $20,000.

As seen within the chart under, as ask liquidity will increase, bid (purchase) orders fade round $19,500 contributing to the weakening of this key degree, on low timeframes. The subsequent instant assist is $19,000 which at present holds round $15 million in purchase orders.

The spike in ask liquidity correlates with a rise in promoting stress from small buyers to Bitcoin whales. As the value of Bitcoin trended to the upside in August, bigger gamers took benefit of the aid and “dumped” into the market.

Smaller buyers adopted, however with a slower response. Bitcoin whales have remained flat with bid orders of round $100,000 displaying a small uptick.

Additional information from a current Glassnode report coincides with Material Indicators, Bitcoin whales have been promoting their cash as the value of Bitcoin tendencies to the upside. This is part of a second distribution section expertise by the crypto market following a capitulation occasion. Glassnode noted:

Following months of accumulation, the market managed to rally above $24k, nevertheless as coated in WoC 34 and WoC 35, this chance for exit liquidity was taken by way of distribution, and revenue taking.

Can Bitcoin Reclaim $20,000 In The Short Term?

The key space of resistance is $24,000, as talked about above, and $24,500 as whales with over 10,000 BTC are utilizing this zone to “aggressively distribute coins into the range”, the report famous. Bulls should push above these ranges to stop additional draw back and presumably regain a number of the bullish momentum.

As a pseudonym customers have been noticing, that brief positions have been piling up as Bitcoin strikes round assist between $19,500. Over the previous week, the market has liquidated thousands and thousands from wiped-out shorts as BTC’s value tendencies nearer to $20,000.

This may present the market with sufficient ammunition for a brief squeeze above $20,000 and into the areas of crucial resistance.

It took solely a 2% pump for $200 mil in shorts on Binance to fold.

What in tarnation are these guys doing. pic.twitter.com/Zn4g6qvBpm

— Byzantine General (@ByzGeneral) September 5, 2022