On-chain knowledge suggests the Bitcoin Long-Term Holders are presently placing extra promoting stress available on the market than short-term holders.

Bitcoin Long-Term Holder SOPR Has Spiked Up In Recent Days

As defined by an analyst in a CryptoQuant post, Short-Term Holders and US traders haven’t offered as a lot currently as in the course of the begin of June.

The related indicator right here is the “Spent Output Profit Ratio” (SOPR), which tells us about whether or not traders within the Bitcoin market are promoting at a revenue or at a loss proper now.

When the worth of this metric is larger than 1, it means the common holder is transferring their cash at some revenue in the intervening time.

On the opposite hand, the indicator’s worth being lower than the edge implies the market as an entire is presently realizing some loss.

There are two well-liked classes of Bitcoin traders, the “Short-Term Holders” (STHs) and the “Long-Term Holders” (LTHs).

The former holder group consists of all these traders who’ve been holding their cash since lower than 155 days in the past, whereas the latter cohort is made up of the hodlers who’ve had their cash sitting nonetheless since greater than that.

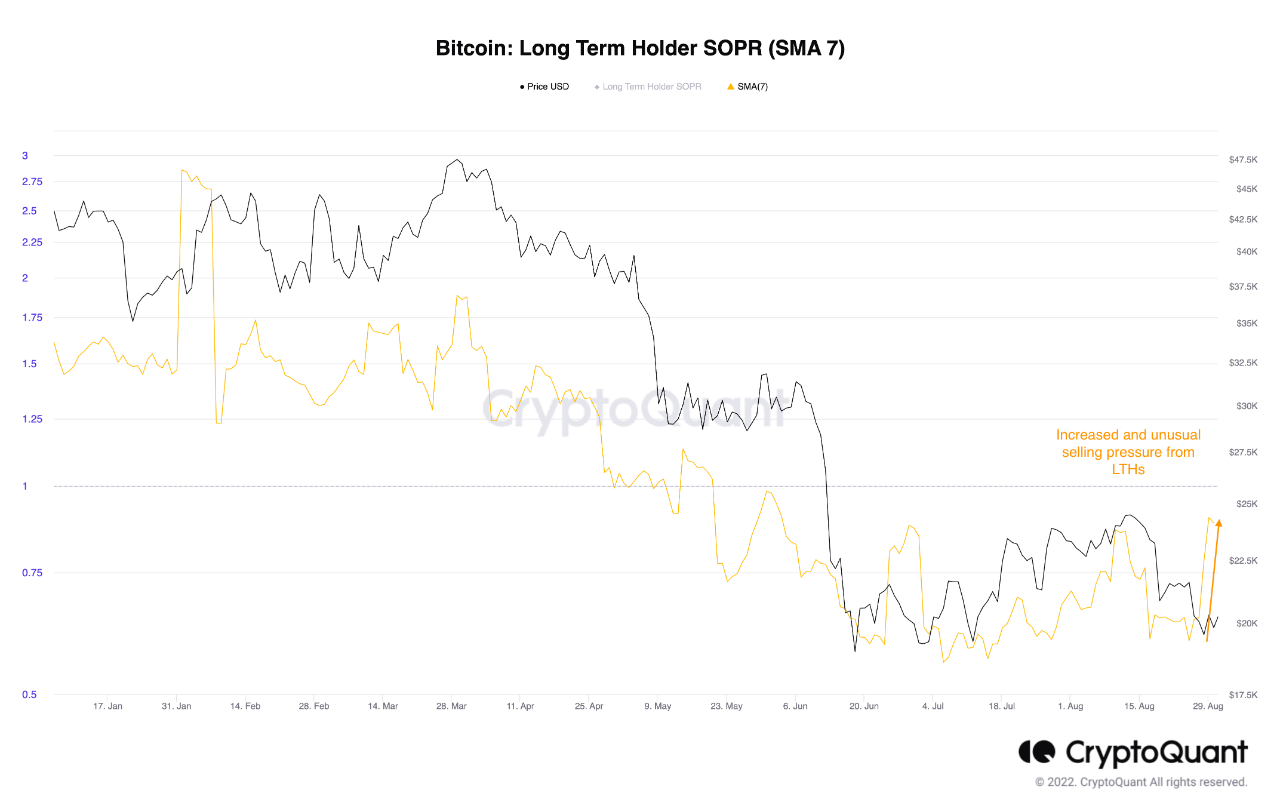

Now, here’s a chart that reveals the pattern within the Bitcoin SOPR particularly for the LTHs:

The 7-day transferring common worth of the metric appears to have risen in latest days | Source: CryptoQuant

As you may see within the above graph, the BTC LTH SOPR has spiked up lately whereas the value has gone down, suggesting that some older, extra worthwhile cash have simply been moved by this cohort.

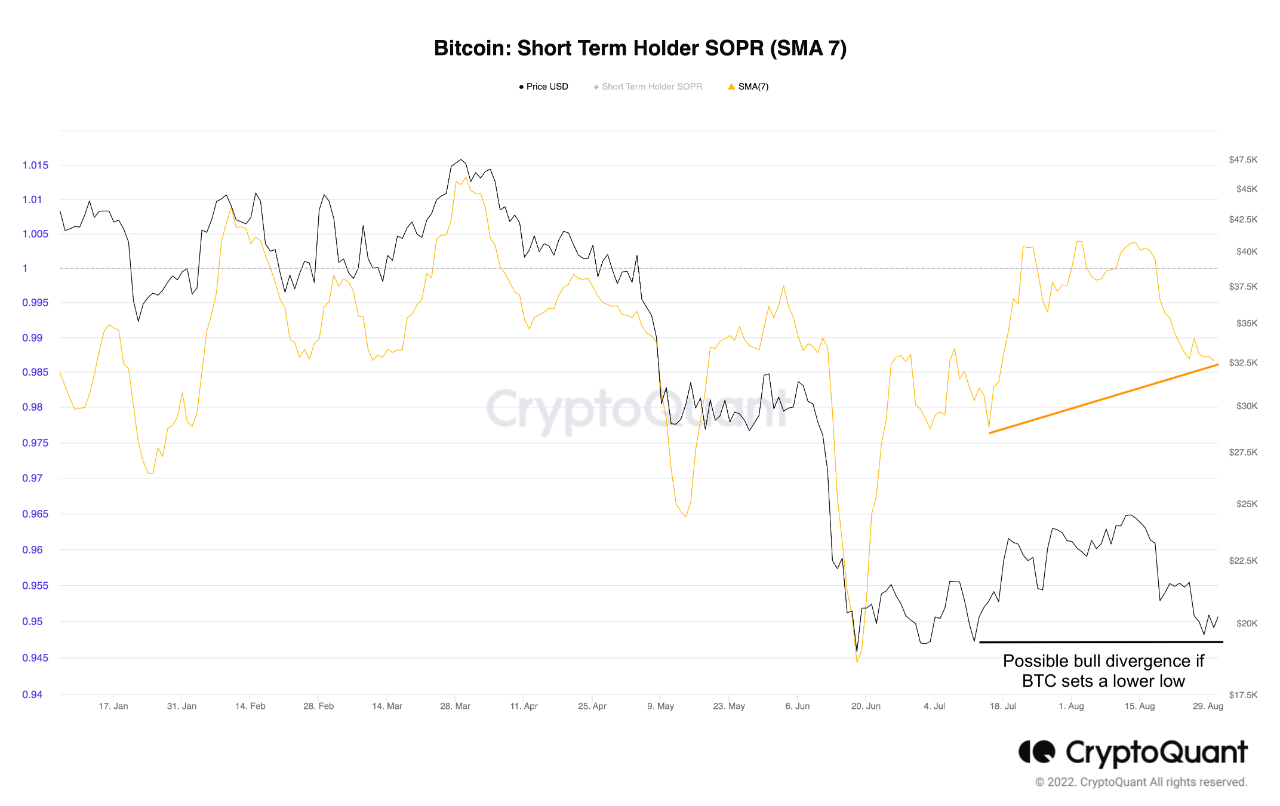

STH SOPR has, nevertheless, plunged down in the previous couple of days. The beneath chart shows this pattern.

Looks like the worth of the metric has seen some decline lately | Source: CryptoQuant

The distinction between the 2 SOPRs might imply there’s extra promoting stress coming from the LTHs as in comparison with the STHs.

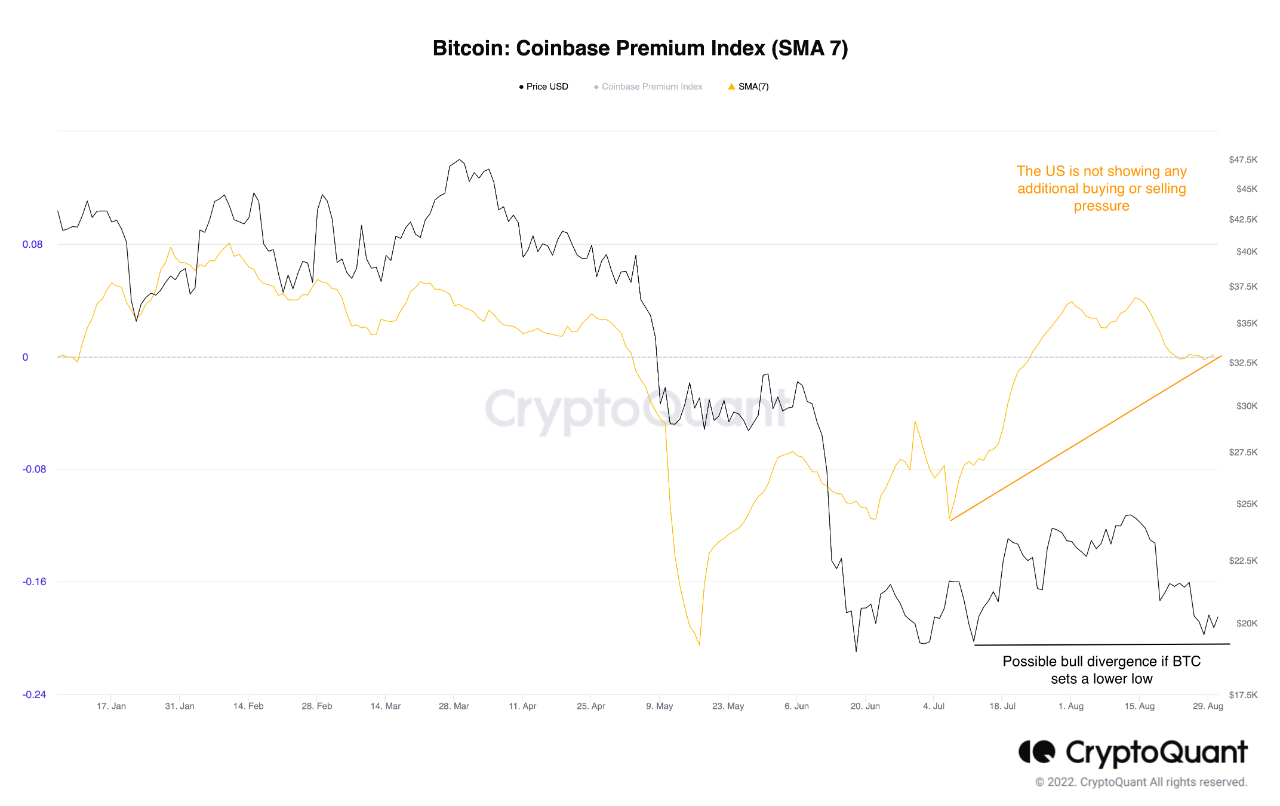

Lastly, the quant additionally talks in regards to the Bitcoin Coinbase Premium within the put up. This indicator measures the distinction between the value listed on Coinbase and that on Binance.

Since Coinbase is used extra closely by US traders, whereas Binance sees a extra international viewers, the Premium can inform us whether or not US traders are promoting or shopping for extra in comparison with the remainder of the world.

The metric has approached a impartial worth within the final week or so | Source: CryptoQuant

As the graph reveals, the Bitcoin Coinbase Premium has been round zero currently, indicating there isn’t any extraordinary promoting (or shopping for) stress coming from American traders proper now.

BTC Price

At the time of writing, Bitcoin’s value floats round $19.7k, down 8% prior to now week.

BTC continues sideways motion | Source: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com