Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Over the previous few weeks, the Bitcoin worth has maintained a considerably wholesome momentum, forging minor swing highs and lows in its bull run revival. Interestingly, this early-week upward motion has been corrected following the escalating battle between Israel and Iran.

All in all, the general constructive outlook for the premier cryptocurrency has remained, though it has been noticed to be in opposition to historic perspective. An on-chain analyst on social media platform X has delved into this unusual phenomenon within the BTC market and the doable causes behind it.

Bitcoin’s Historical Correlations With Macro Instruments

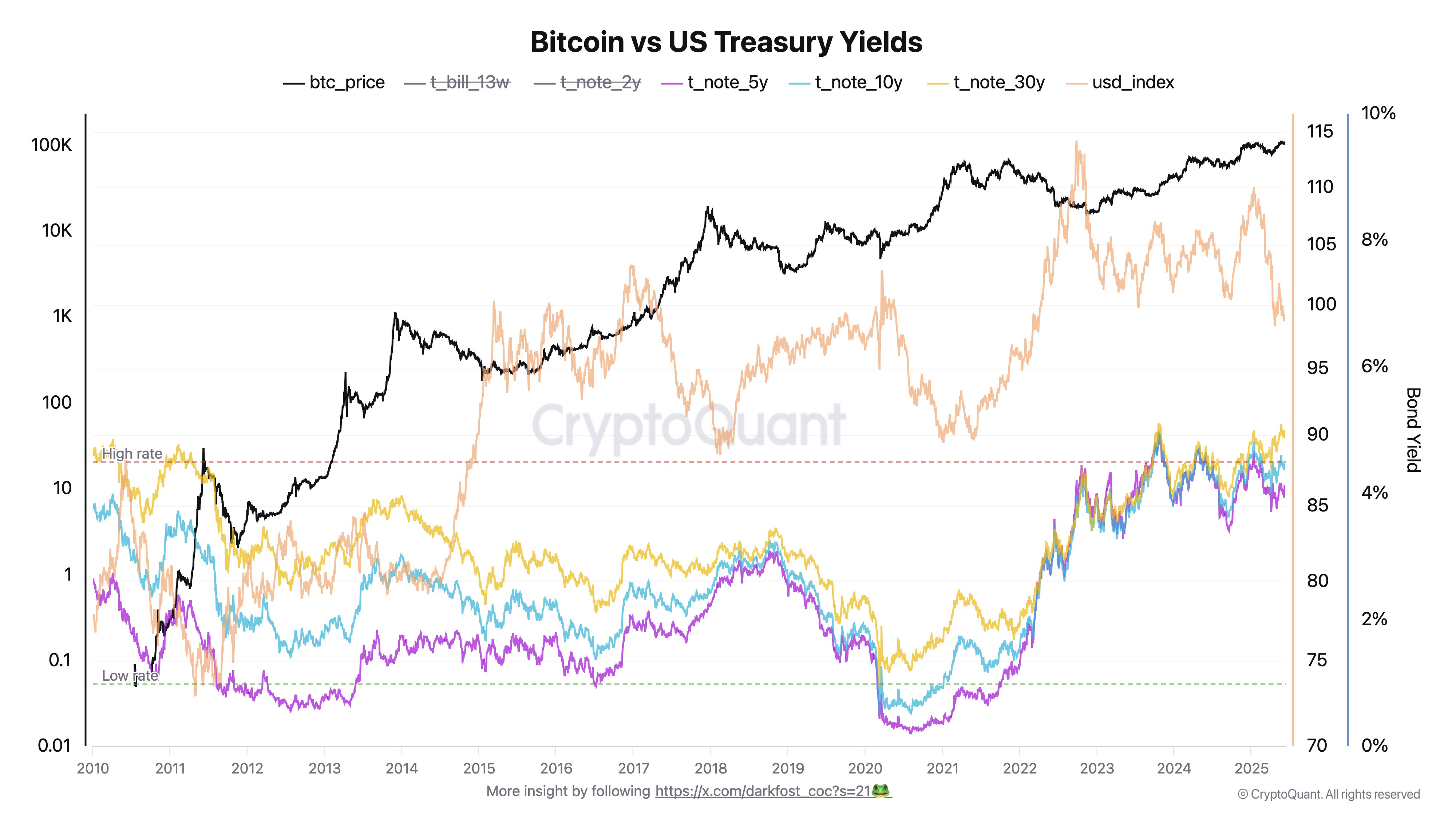

In a current submit on the X platform, an on-chain analyst with the pseudonym Darkfost broke down what, till not too long ago, was once standard expectations within the Bitcoin market relative to broader macroeconomics. The crypto pundit talked about that traders contemplate key indicators when making an attempt to decipher what institutional sentiments and the broader state of world liquidity could also be like.

Related Reading

The key indicators traders highlighted on this evaluation embody the US Dollar Index (DXY), which measures the worth of the US greenback in opposition to a basket of main foreign currency, and the US Treasury Yields, which mainly characterize the return traders earn on United States authorities bonds.

According to Darkfost, the above chart illustrates a well known macro precept: when each the DXY and bond yields are on the rise, capital tends to flee danger belongings (one among which is Bitcoin). As a outcome, the premier cryptocurrency turns into inclined to corrective actions.

According to the on-chain analyst, this precept is backed by historical trends, as bear markets in crypto have coincided with robust uptrends in each yields and the DXY.

On the opposite hand, when there’s a lack of momentum in DXY and yields, investor urge for food tends to shift in direction of danger. The cause for this, Darkfost defined, could possibly be expectations of Federal Reserve charge cuts, which gas bullish sentiment throughout crypto markets.

BTC Breaks Conventional Macro Logic

In the submit on X, Darkfost then went on to level out that the present BTC cycle has been uncommon. The on-line pundit reported that there was a decoupling between the Bitcoin worth and bond yields, which manifests as a seeming annulment of the standard macro ideas.

The analyst famous that the Bitcoin price continues to maintain its upward motion, regardless of yields reaching a few of their highest ranges in Bitcoin’s historical past. But this holds, he was positive to notice, when the DXY declines.

Related Reading

What this anomaly suggests, Darkfost inferred, is that Bitcoin has taken on a brand new position throughout the macro panorama, one which will increase its notion as a retailer of worth. To take it additional, which means that BTC, as of now, might react rather less conventionally to the macro forces believed to affect the crypto market.

As of this writing, the Bitcoin worth sits simply beneath $106,000, reflecting an nearly 2% soar previously 24 hours.

Featured picture from iStock, chart from TradingView