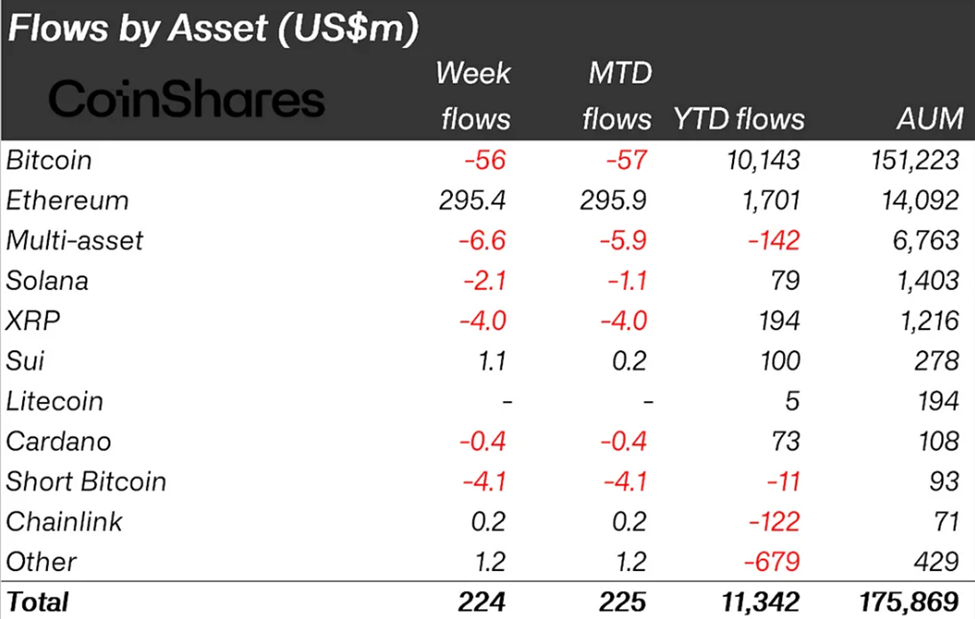

The newest CoinShares report reveals that crypto inflows soared to $224 million final week. Meanwhile, Ethereum (ETH) continues solidifying its place as a frontrunner in institutional sentiment.

The second-largest crypto by market cap continues to document constructive returns, with fortunes turning for the reason that Pectra Upgrade hit the mainnet on May 7.

Ethereum Records Strongest Inflow Streak Since US Elections

CoinShares’ newest report signifies that Ethereum posted $296.4 million in inflows final week, marking its strongest run for the reason that November US elections.

The inflows helped push complete weekly crypto inflows to $224 million, extending the continuing seven-week streak to $11 billion regardless of macroeconomic headwinds.

“Ethereum leads with US$296.4 million in inflows, its strongest run since the US election, now representing 10.5% of total AuM,” read an excerpt within the report.

CoinShares’s James Butterfill famous that the surge in demand for Ethereum comes regardless of a broader slowdown because of uncertainty across the US Federal Reserve (Fed) policy.

Meanwhile, Ethereum’s rise coincides with the community’s Pectra upgrade on May 7, which enhanced consumer expertise and smart contract effectivity.

Ethereum has repeatedly led crypto inflows within the weeks since, attracting $1.5 billion over seven consecutive weeks. BeInCrypto reported that Ethereum notched inflows of $785 million through the week after the improve and $286 million the following week, contributing majorly to its momentum.

Institutional demand can also be evident in Ethereum ETF (exchange-traded funds) flows. As BeInCrypto highlighted, Ethereum ETFs recorded a 15-day streak of inflows as of the final buying and selling session on June 6.

This displays rising confidence in ETH’s long-term potential following the Pectra improve and renewed ETF optimism within the US.

“Ethereum 2025 is 2016 on steroids. Same consolidation, same shakeout, same reversal pattern. Back then, ETH rewrote the charts. Now? We’ve got stronger base, more capital, and ETF momentum,” wrote analyst Merlijn the Trader.

Bitcoin Slips Again as Altcoins Remain Subdued Amid Macro Uncertainty

While Ethereum soared, Bitcoin recorded its second week of outflows, shedding $56.5 million as traders stay cautious.

“Bitcoin saw its second straight week of modest outflows totaling $56.5 million, as policy uncertainty kept investors on the sidelines…short-Bitcoin products also experienced a second week of outflows,” the CoinShares report added.

Altcoin exercise was largely subdued. Sui (SUI) noticed modest inflows of $1.1 million, whereas XRP recorded its third straight week of outflows totaling $6.6 million. This suggests sentiment stays combined outdoors Ethereum.

Despite the broader slowdown, Ethereum’s efficiency highlights a rising divergence between main digital property. Its ETF and institutional curiosity surge indicators that traders could also be positioning for Ethereum to outperform in a post-rate-hike atmosphere.

With Ethereum now representing 10.5% of complete digital asset AuM, the asset seems to be regaining its management standing within the eyes of establishments. Whether the development continues might rely on indicators from the Fed afterward Wednesday.

BeInCrypto information reveals Ethereum was buying and selling for $2,528, up 1.28% within the final 24 hours.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. However, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.