Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s bullish momentum has somewhat faded after reaching an all-time excessive of $111,000 on May 22, casting doubt on the sustainability of the rally. Bitcoin has pulled again barely after its record-setting push, and analysts are cut up on what this implies for its price action going forward.

Interestingly, not everyone is convinced the current all-time excessive displays real power. One of probably the most notable voices difficult that is licensed crypto professional Tony “The Bull” Severino, who warned that Bitcoin’s transfer will not be as strong because it appears to be like on the floor.

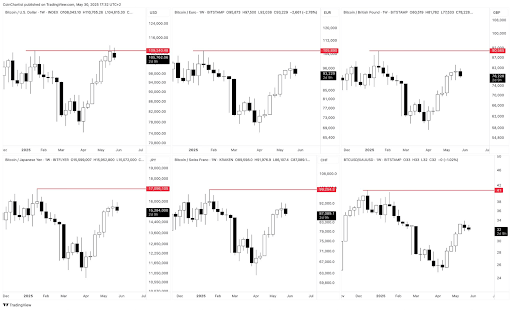

In his evaluation, Tony Severino argues that the breakout to $111,814 lacks the technical affirmation often related to a real bullish breakout. He famous that whereas BTCUSD did print a brand new excessive, different main buying and selling pairs didn’t comply with swimsuit.

Failed Breakout Indicates Weakness Rather Than Strength

Particularly, Bitcoin failed to succeed in a brand new all-time excessive in opposition to currencies such because the Euro, British Pound, Japanese Yen, and the Swiss Franc. The similar applies to BTC/XAU, Bitcoin’s value measured in opposition to gold, which presently lags far behind its former peak of 41 ounces per Bitcoin. At the time of writing, that pair continues to be hovering at 32 ounces, a big distinction that implies the upward momentum is isolated to the US Dollar.

Related Reading

This divergence leads Severino to argue that the transfer might be a byproduct of the USD’s weak point reasonably than Bitcoin’s power. A real bullish breakout, he says, would have been evident throughout a number of foreign money pairs and asset benchmarks. His skepticism is additional bolstered by the construction of the charts, as seen within the six comparative panels he shared on the social media platform X. Most of them present Bitcoin forming decrease highs or just failing to match the earlier all-time degree.

For occasion, Bitcoin priced in euros continues to be properly beneath its peak of €105,890, presently buying and selling round €93,229. Similarly, Bitcoin has didn’t breach the 17 million mark in opposition to the Japanese Yen and now sits at ¥15.28 million. The similar development is repeated within the Swiss Franc and British Pound pairings, with BTC / Swiss Franc failing to cross 99,254 and BTCGBP forming a decrease excessive at $78,228. These value actions make it troublesome to argue that Bitcoin is in a universally sturdy place, notably when measured in something apart from USD.

Caution With Next Monthly Candle Open

In conclusion, Tony Severino warns merchants and buyers to not be misled by the surface-level optimism that comes with a brand new all-time excessive in BTCUSD. A single breakout, particularly one missing affirmation from cross-pair power and basic indicators, doesn’t essentially sign the beginning of a brand new wave 5 or a sustained bullish development for the Bitcoin value.

Related Reading

According to him, the May month-to-month candle shut and the June month-to-month candle open will probably be essential in determining the next direction. If the present indecision tilts bearish, technicals may teeter again bearish towards a larger correction.

At the time of writing, Bitcoin is buying and selling at $104,850 after reaching a 24-hour low of $103,832. This is a quick restoration from its June open of $104,646.

Featured picture from Getty Images, chart from Tradingview.com