Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is holding robust above the $2,500 mark after a risky two-week stretch marked by heavy resistance and indecisive value motion. While bulls have efficiently defended key help ranges, ETH continues to wrestle towards the provision wall slightly below $2,800. The broader crypto market mirrors this sideways development, with Bitcoin and complete market cap additionally trapped inside tight ranges, limiting bullish momentum throughout the board.

Related Reading

Analysts are rising optimistic in regards to the potential for an altseason — however provided that Ethereum can convincingly reclaim the $3,000 degree. A decisive breakout above that mark would sign renewed power and sure spark a broader rally in altcoins, a lot of which have lagged behind in current weeks.

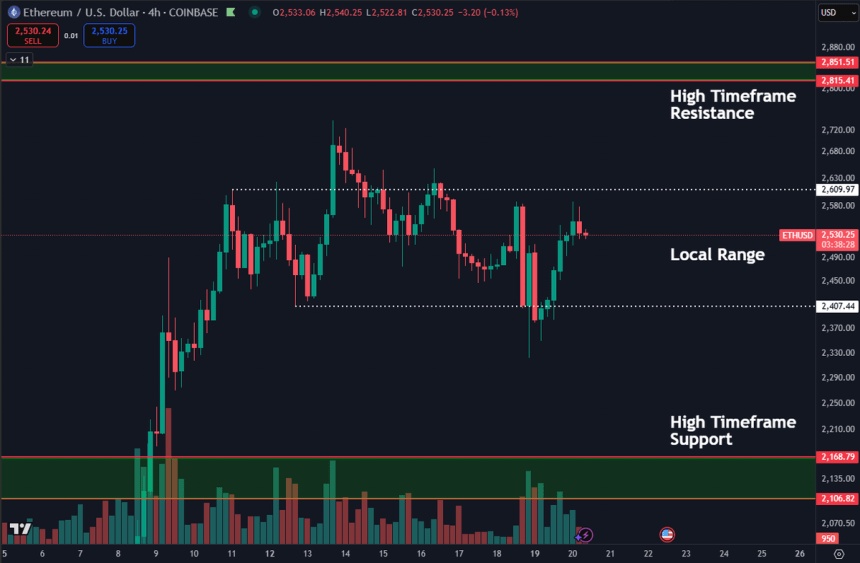

Top analyst Daan shared a technical breakdown, noting that Ethereum’s value motion has been risky over the previous two weeks. He emphasised that ETH is presently range-bound, very like BTC and the remainder of the crypto market. Until there’s a clear breakout from this native construction, merchants stay cautious.

Ethereum Bulls Hold Structure But Momentum Cools

Ethereum bulls gained traction earlier this month when the value surged above the $2,200 degree with ease, establishing a bullish construction for the primary time in weeks. Momentum accelerated shortly, with ETH breaking by way of $2,550 on Sunday earlier than retracing simply as quick into the $2,400 zone. The speedy up-and-down motion highlights the present uncertainty available in the market, the place traders stay cautious regardless of current power.

The Sunday pullback added weight to analyst warnings that Ethereum may face short-term promoting stress earlier than confirming the subsequent leg up. While many stay bullish on ETH’s medium-term trajectory, they acknowledge that momentum has cooled and the market is pausing to reassess.

Daan provided insights into Ethereum’s conduct, describing the value motion as “pretty messy” over the previous two weeks. He identified that ETH, like Bitcoin and the broader crypto market cap, is presently trapped in a decent vary. According to Daan, he’s “not looking to do much until we at least convincingly break out of this local range.”

The outlined vary sits between $2,100 (key help) and $2,800 (main resistance). If Ethereum holds above present ranges and pushes previous $2,800, it may set off a recent wave of bullish momentum. Until then, consolidation might persist.

Related Reading

ETH Consolidates Below Resistance As Bulls Hold The Line

Ethereum (ETH) is presently buying and selling at $2,539 after a risky week marked by robust bullish makes an attempt and rising resistance stress. The every day chart exhibits ETH trying to carry above the 200-day EMA ($2,440.71), which has now was a short-term help zone. Meanwhile, the 200-day SMA sits larger at $2,701.31, appearing as a key resistance degree Ethereum should overcome to substantiate a sustained rally.

After a pointy rally in early May that propelled ETH from below $2,000 to above $2,700, the value has entered a interval of consolidation. This pause comes after a number of failed makes an attempt to interrupt and maintain above the $2,700 resistance, just below the 200SMA. Volume has decreased, and the current value motion suggests a battle between bulls attempting to defend the $2,500 degree and bears urgent to cap upside strikes.

Related Reading

The bullish construction stays intact so long as ETH stays above the 200EMA and inside the $2,400–$2,600 vary. However, a failure to take care of present help may expose Ethereum to a deeper retracement towards $2,200. For bulls, reclaiming $2,700 is crucial to unlock the subsequent leg larger towards the psychological $3,000 degree. Until then, merchants ought to count on uneven value motion and tightening volatility.

Featured picture from Dall-E, chart from TradingView