Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

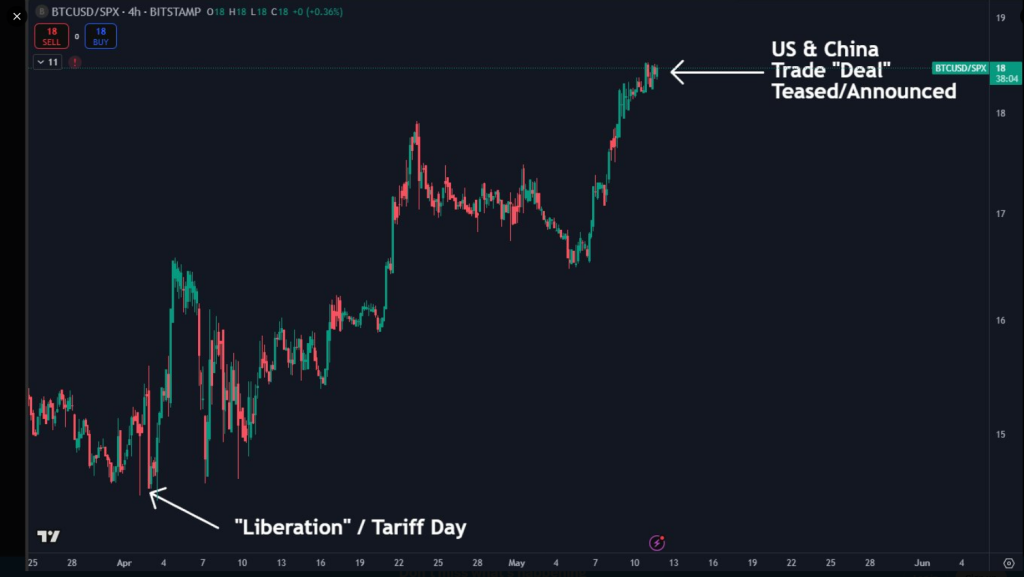

Bitcoin’s worth has surged some 25% since April 2, at the same time as the massive inventory indexes declined. The digital foreign money broke via $104,000 by May 12. Traditional markets such because the S&P 500 have been within the crimson concurrently. Based on market knowledge, Bitcoin’s resilience has stood out within the face of sell-offs and tariff negotiations.

Related Reading

Bitcoin Outpaces Stocks

According to stories, the S&P 500 declined virtually 1% throughout April, however Bitcoin rose. Other monetary markets skilled losses throughout the identical weeks. Bitcoin’s improve was made whereas merchants thought-about considerations over escalating tariffs.

The world’s most sought-after crypto asset was seen by some as a way to keep away from charges on overseas commerce. However, there isn’t any proof that any nation utilized crypto to keep away from tariffs.

Settlements Via Bitcoin

Based on examination by crypto knowledgeable Daan Crypto Trades, there was hypothesis that nations might convey commerce settlements to Bitcoin. The idea gained traction since BTC stood agency even when provide chains and markets have been in bother.

$BTC Has outperformed shares since “Liberation” / Tariff Day on the 2nd of April.

It held up extremely sturdy throughout a pointy unload on shares in April.

It then additionally proceeded to outperform because the markets bounced and tariffs have been applied.

Back then folks have been questioning… pic.twitter.com/gfvfH80TVP

— Daan Crypto Trades (@DaanCrypto) May 11, 2025

Nevertheless, specialists be aware that large on-chain transactions are on the market within the open. Regulators would catch any massive cross-border funds made in crypto. There has not been a reported case of governments turning to Bitcoin in an effort to sidestep duties.

Testing Key Resistance Levels

According to chart evaluation by Rose Premium Signals, Bitcoin is presently testing an important barrier at $105,000. If BTC breaks down there, it would retreat into the $100,000 zone. Some sample observers declare an Inverse Head & Shoulders configuration might develop.

💰 $BTC Market Update#Bitcoin is presently testing the Weekly Supply Zone round $105,000 👀

🧠 The more than likely state of affairs is a rejection from this stage, resulting in the formation of an Inverse Head & Shoulders sample — a setup that might create area for a mini #altseason 📈… pic.twitter.com/aLSPi5qhuq

— Rose Premium Signals 🌹 (@VipRoseTr) May 11, 2025

That sample requires two distinct shoulders and a decrease trough within the center. Currently, the swings have been unbalanced, muddying the picture. A rejection is perhaps adopted by a quick interval of altcoin accumulation earlier than Bitcoin takes off once more the place it left off.

Related Reading

Long-Term Outlook Stable

As per market observers, most traders will likely be seeking to buy dips if Bitcoin breaks resistance. They add that greater costs will put the limelight on pullbacks. Dips supplied entry factors throughout earlier rallies. But Bitcoin’s in depth runs persist for a number of months, not days.

Risks are nonetheless seen by merchants: potential fee will increase, laws on crypto, and contemporary tokens competing for consideration. Meanwhile, rising ETF flows and fortified wallets reassure others.

Based on accounts of US–China trade negotiations, any settlement would cut back some pressure. But there are drivers of Bitcoin’s worth which can be impartial of worldwide tariffs. Monetary actions, massive traders, and sentiment drive large strikes.

If BTC continues to outrun shares, it would solidify itself instead in international markets. In the meantime, merchants are ready for the subsequent route at these vital ranges close to $105,000.

Featured picture from Unsplash, chart from TradingView