Investors look like rising cautious in regards to the Bitcoin rally, with the BTC influx slowing down. The latest outflow within the US Spot Bitcoin ETF signifies a waning institutional curiosity, with many seeing it as a possible risk to the continuing rally.

Will Bitcoin Rally Continue Amid Slowing BTC Inflow?

The US Bitcoin ETF influx has slowed from its sturdy efficiency over the past eight days, Farside Investors data showed. From April 17-29, the BTC influx totaled $3.93 billion, which has helped in a powerful rally for the flagship crypto’s value, sending it to over $95K.

BlackRock BTC ETF Reigns Supreme

However, on April 30, the funding devices recorded a mixed outflow of $56.3 million. It’s value noting that BlackRock IBIT has nonetheless recorded an influx of $267 million on Thursday. Also, IBIT has consistently recorded inflows since April 14.

Meanwhile, the latest mixed outflow signifies that the institutional curiosity is fading, which could add stress on the crypto’s value. Besides, many are additionally questioning the potential of the Bitcoin rally forward.

Bitcoin Rally To Sustain? Here’s What To Watch Next

Despite the slowdown in BTC influx on Thursday, it seems that buyers are nonetheless placing their bets on the asset. It additionally signifies that the merchants are assured within the long-term potential of Bitcoin, betting on a seamless rally.

Notably, BTC value as we speak was up over 1.3% and traded over $96,000 throughout writing. However, within the early US hours, the worth dropped to $93,796 on Friday. Besides, the longer term open curiosity of the asset additionally rose by over 5%, reflecting the robust confidence of the merchants.

What Lies Ahead?

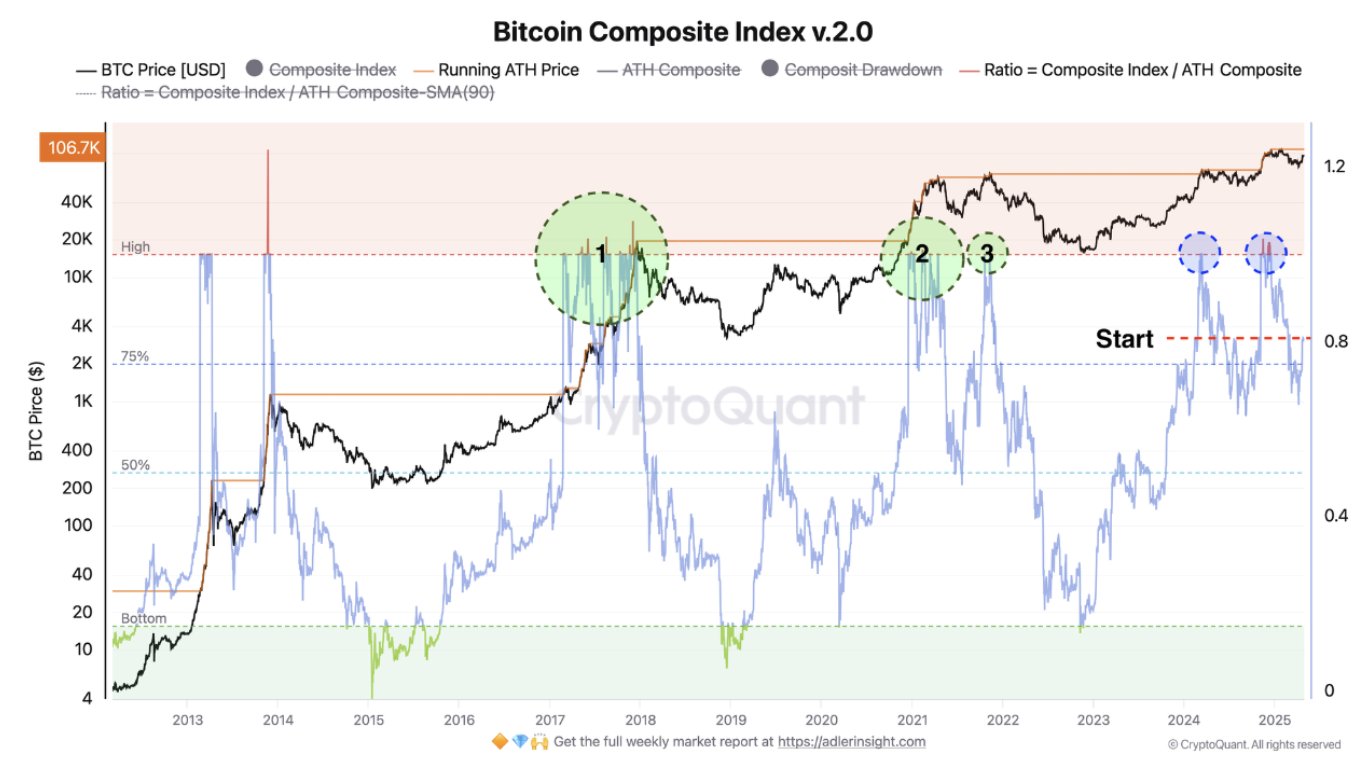

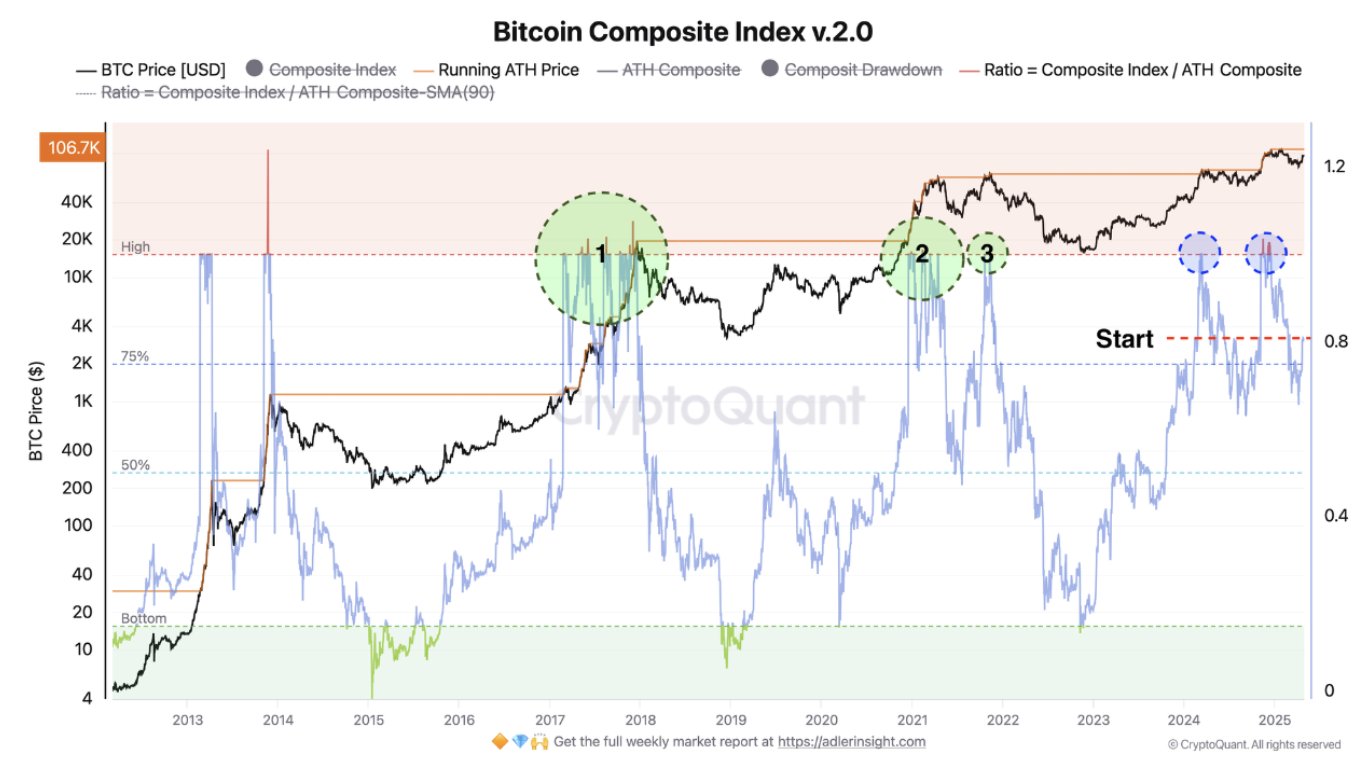

According to CryptoQuant analyst Axel Adler Jr, Bitcoin’s on-chain momentum is gaining steam, with three potential eventualities shaping its subsequent rally. The optimistic outlook predicts a value surge to $150-175K if the Ratio breaks above 1.0.

A base case situation suggests consolidation between $90-110K, whereas a pessimistic outlook warns of a correction to $70-85K. With the Ratio at the moment at 0.8, the subsequent six months can be essential in figuring out Bitcoin’s trajectory.

Meanwhile, a latest BTC price prediction additionally confirmed that the crypto is more likely to soar previous the $100K mark this month. Considering all these, it seems that the Bitcoin rally could proceed within the coming days, particularly if the ETF influx recovers to supply extra help to the bullish momentum.

Disclaimer: The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.