Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This week’s market restoration has seen Bitcoin (BTC) surge over 10% to retest a key barrier for the primary time in weeks. Amid this efficiency, some analysts recommend that the flagship crypto is about to restart its bullish rally, whereas others contemplate that holding key ranges will decide BTC’s subsequent step.

Related Reading

Bitcoin Reclaims Its ‘Ultimate’ Level To Break

Bitcoin has recovered from its early April sub-$80,000 correction after surging 11% up to now week. On Friday, the biggest crypto by market capitalization reclaimed the $85,000 barrier, which has served as a key barrier since late March.

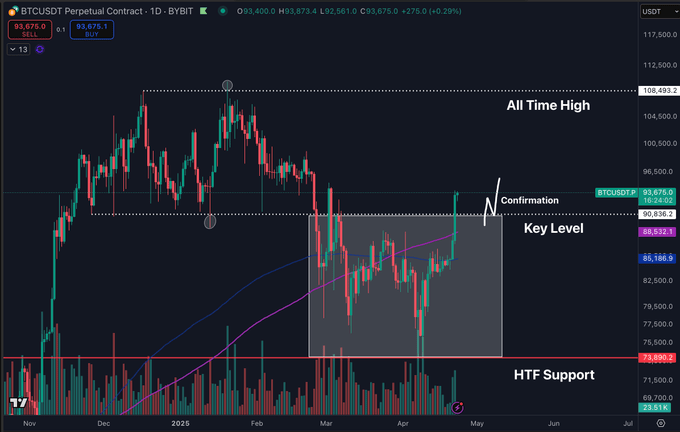

Since Friday, BTC has climbed a number of key ranges, breaking above the $90,000 resistance on Tuesday and holding it for the previous 24 hours. Analyst Daan Crypto Trades identified that Bitcoin has a “solid breakout back into the previous range and above the Daily 200MA/EMA.”

Notably, the cryptocurrency has been buying and selling inside a major space over the previous weeks, because it has been retesting its multi-month downtrend line and the Daily 200 Exponential Moving Average (EMA) and Moving Average (MA).

After the Thursday pump that kickstarted the continuing restoration, Bitcoin broke out of its four-month downtrend. The cryptocurrency bounced from the Daily 200EMA to shortly consolidate beneath the Daily 200MA earlier than breaking above this degree yesterday.

This despatched the cryptocurrency towards the bull’s “ultimate level to break,” the $90,000-$91,000 vary. However, the analyst prompt that Bitcoin should maintain holding that area to verify the breakout isn’t “just a liquidity grab to fall back down below.”

Moreover, he additionally acknowledged that BTC’s each day closes ought to keep above these ranges “ideally,” and that “some consolidation up here to regain fuel and attempt higher would be perfect” for a rally continuation.

Ali Martinez additionally highlighted BTC’s value efficiency, which is buying and selling close to its yearly opening of $93,500. The analyst asserted that this degree was a robust help all through the post-election breakout however famous that it “could now flip into key resistance” if it isn’t reclaimed.

Analysts Eye BTC’s Weekly Close

Crypto Jelle called the $93,500 resistance the bear’s “last line of defense,” stating that when BTC recovers that degree, “all bets are off.”

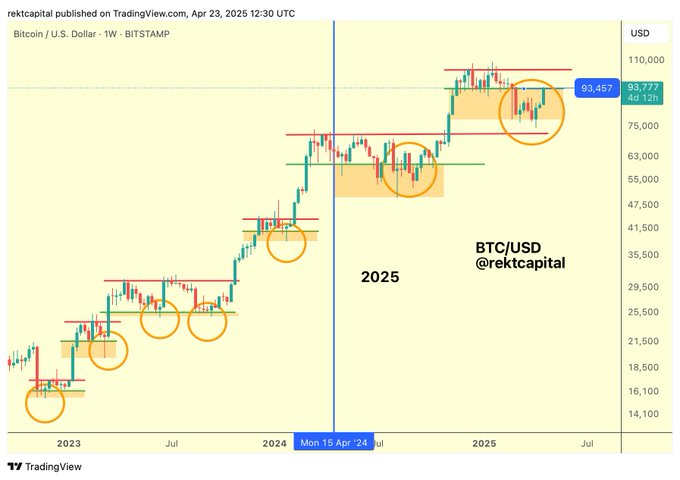

Meanwhile, Rekt Capital famous that Bitcoin has been “rallying in an effort to resynchronize with its former ReAccumulation Range and confirm the end of its first Price Discovery Correction.”

He highlighted that after yesterday’s efficiency, BTC is close to the top of its draw back deviation, affirming that the cryptocurrency must stabilize above the $93,500 degree.

To obtain this, Bitcoin wants a weekly shut above this important degree and reclaim it as a brand new help. He additionally highlighted that it’s repeating its mid-2021 value efficiency “fantastically well.”

Related Reading

The analyst beforehand explained that in 2021, Bitcoin consolidated between the 2 greatest bull market Exponential Moving Averages (EMAs), the 21-week and 50-week EMAs, earlier than breaking out from the triangular construction and resuming its rally.

Now, BTC is breaking out from the vary fashioned by the 2 Bull Market EMAs, which “wasn’t just anticipated back in mid-2021 as it was happening but also in this cycle as well.” Rekt Capital concluded {that a} Weekly Close above $87,000 “will position BTC for a confirmed breakout.”

As of this writing, Bitcoin trades at $93,459, an 8.2% surge within the month-to-month timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com