- Ethereum (ETH) value is displaying restoration after falling to a low of $1,415.

- Bullish patterns and DEX power sign a possible ETH value rebound.

- The upcoming Pectra replace might drive ETH to $2,140.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has endured a tricky quarter, with its value lately dipping to $1,415, reflecting a steep 61% drop from its December peak.

This important decline has solid Ethereum as a notable underperformer within the crypto market, sparking unease amongst buyers and analysts.

However, after hitting a low of $1,415, the value has proven indicators of restoration, climbing to round $1,623.42, hinting at a possible shift in momentum.

What induced the ETH value to drop this low?

The downturn in Ethereum’s value stems partly from inside issues, with David Hoffman, co-founder of Bankless, calling out the group’s management for alienating customers and builders.

Hoffman factors to hostile attitudes, like shaming the staking platform Lido Finance and criticizing sure merchants, which can have shaken confidence within the ecosystem.

Everyone is midcurving why ETH’s value efficiency has sucked

Ethereum management and tradition have alienated customers and builders by being hostile to its personal app layer.

We publicly exorcised @LidoFinance. We’ve shunned merchants and degens.

On a permissionless chain, we’ve tried…

— David Hoffman (@TrustlessState) April 12, 2025

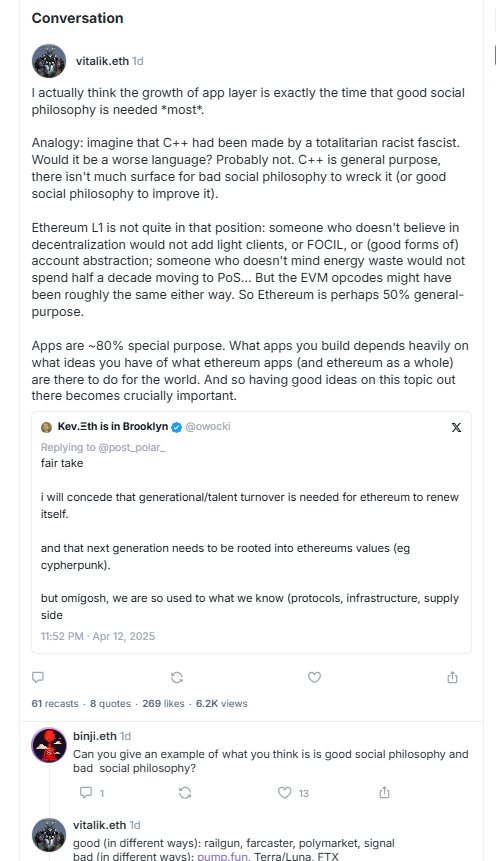

Ethereum Co-founder Vitalik Buterin, in an April 12 post on Warpcast, additionally emphasised the necessity for a robust social philosophy in Ethereum’s utility layer to information builders in constructing decentralized apps that align with its core values, citing initiatives like Railgun and Farcaster as optimistic examples.

Beyond inside strife, Ethereum’s Layer 1 infrastructure has struggled to maintain tempo with newer blockchains, including stress to its valuation.

External forces, reminiscent of market volatility triggered by President Trump’s tariff announcements, have additionally fueled sell-offs throughout cryptocurrencies, dragging Ethereum down additional.

Technical evaluation indicators a value rebound for Ethereum (ETH)

Despite the rocky 2025 begin, a number of components recommend that Ethereum could possibly be gearing up for a rebound, providing hope to these watching its trajectory.

Technical evaluation, nevertheless, paints a extra optimistic image, as chart patterns sign a potential reversal in Ethereum’s fortunes.

A falling wedge sample has emerged on each each day and weekly charts, nearing a confluence degree that always precedes a bullish breakout.

Should this sample play out, Ethereum (ETH) might climb to $2,140, a 35% bounce from its present value.

An inverse head-and-shoulders sample, one other bullish indicator, can be taking form on the one-day chart, strengthening the case for an upward transfer within the close to time period.

The RSI indicator additionally lately rebounded from the oversold area, signaling that the token could possibly be on a bullish rebound, which might final for some time.

The Market Value to Realized Value (MVRV) Z-score dipped to -0.832 earlier than rebounding to round 0.98 at press time, indicating Ethereum is buying and selling effectively beneath its historic common.

This metric implies that the cryptocurrency could also be a discount for buyers, doubtlessly sparking shopping for curiosity that might carry its value.

Historically, such undervaluation has typically preceded intervals of value appreciation, including weight to the bullish outlook.

Ethereum-based DEXs outpacing rivals

Ethereum’s decentralized change (DEX) community continues to exhibit resilience, offering another excuse for optimism.

Despite competitors from blockchains like Solana and Arbitrum, Ethereum’s DEXs processed over $17 billion in quantity prior to now week, outpacing rivals, according to data from DefiLlama.

This sustained exercise highlights Ethereum’s capacity to retain customers and liquidity, even with larger charges, reinforcing its foundational power.

Such strong efficiency suggests the community stays a cornerstone of the decentralized finance area, able to weathering aggressive pressures.

Valuation metrics additional bolster the argument that Ethereum is primed for a restoration, as its present value seems undervalued.

The upcoming Ethereum Pectra replace

Looking ahead, the Pectra update, slated for May 7, 2025, guarantees to improve Ethereum’s community, doubtlessly reversing a few of its latest setbacks.

This improve goals to deal with Layer 1 challenges, enhancing scalability and effectivity, which might restore religion amongst buyers and builders.

A profitable rollout would possibly function a catalyst, driving Ethereum’s value larger because the market anticipates a extra aggressive blockchain.

Scheduled enhancements like these sign Ethereum’s dedication to evolving, an element that might reignite enthusiasm.

The mixture of bullish technical patterns, a robust DEX ecosystem, undervaluation, and the promise of the Pectra replace builds a stable case for restoration.

Investors would do effectively to keep watch over resistance ranges and sentiment shifts, but the proof factors to Ethereum doubtlessly rising from its disappointing quarter.